I have invested in 50+ Start-Ups in the past 24 months.

Following will be the lesson’s I’ve learned…

With access to early stage investments on the rise worldwide, I thought I would share my experience after investing in over 50 start-up in the past 24 months. Crowdfunding and Syndicate based investments have opened up a market that, until 5 years ago, was completely closed to retail investors. Title III Crowdfunding the US is about to shake up the market even further, opening up this type of investment to all citizens (not just high net worth individuals) for the first time.

This has opened up a world of opportunity to retail investors, however it does come at a cost… VERY High Risk. This type of investment should thus, be approached with some trepidation and large amounts of research.

First of all, for anyone that is interested, I thought I would share with you most of my portfolio. If anyone has any questions regarding these investment don’t hesitate to contact me..

My Portfolio

Houseology.com, Curious Brew, Tossed, Vrumi, Den Automation, Oppo Brothers, LandBay, CommuterClub, Tandem, Bank, Beeline Navigation, Pronto, Crowdcube, Redchurch Brewery, Ethos, 1Rebel, Crowdfunder.co.uk, Alquity (Investment Fund Manager), Brewdog, Stockflare.com, MonetaFlex, Pavegen, Workable, Lick (Fro-Yo), Theidleman.com, HUMM Music, Meet Memory, Rateragent.co.uk, Facewatch, Emoov, Clippings.com, Woolandthegang.com, Growing Underground, Street Steam, Gripit (Plaster Board Fixings), Mondo Bank, Simply Cook, Witt Energy, Hybrid Air Vehicle, Rise Art, go Henry, Opun, Zap and Go, Axol Bio Science, NowWeComply, Syndicate Room, GrowthDeck, Dabbl (Stock Broker)..

I have certainly made mistakes on the way, and would pass on some of the investments I have made, if I were offered them today. Following will be some rules that I have developed to filter out the 'bad apples', in an attempt to give myself the best possible shot of success. I believe these rules can be applied boardly to your investment strategy, and give you a quick and easy filter that will leave you with a less overwhelming choice of investments.

Only Invest what you can Afford to Lose

Seems obvious, but many investor don’t realise the level of risk involved in startup investing. I would suggest you never exceed an investment sum you can't afford to totally lose. From research and experience, I would suggest that 7 out of 10 startups will fail in spectacular fashion, and then out of the other 3, who knows... This ties in nicely with the next step.

Diversification - Don't put all your Eggs in one basket..

I believe this to be key. In order to get the odds of success in your favour, I believe building up a portfolio to minimum of 10 investments is important. This ties in nicely to the $ sum you should be investing in any given investment. Make sure you can carry on investing that sum 10 times over. Spreading your risk like this gives you more of a chance to hit a 'hero' some point..

Invest in what you know!

First things first, would you be a customer, or do you know someone who would be? This concept has been coined many times by illustrious investors like Warren Buffet and Peter Lynch. This is an important consideration as, how can you assess a company in great detail if you don’t know anyone that would use their products or services. If your not excited about their offering (or don't know anyone who would be), then your not the right person to invest. Also, many prospective companies offer investor rewards in the form of free product. If you were to be a customer of this company, this is a great way to de-risk an investment (The Brewery investments have given me on average 50% of my investment back in product rewards...).

Industry Activity

- Is the industry growing? (Craft Beer)

- Is their larger player buying up smaller players? (Technology - Google - Nest)

- Is the industry ripe for disruption? (Banking)

- Is the regulatory environment good for new players? (Crowdfunding)

Could it be a 10 bagger...

This is a very risk form of investment, and thus the potential returns need to be high. I work on the premise that, if I pick my investments well, and go through the process, 1 in 10 will hit their projection and succeed (maybe 2-3 will give me a good return, and the rest will fail for total loss. In turn, I look for a viable case that I can get a 10x return on capital with every company I invest in. Then, If 1 in 10 hit their projections, I have the other 9 for free, and some of these should give me returns..

This company raised at a £10m valuation with a revolutionary product that had only been launched a year earlier into small retail outlets. With a forecast of £8m Net Profit in 3 Year, such a company could sell for 10-15x Net Profit if they were to hit their numbers over the following 3 years. This would be a sale price of £80m-£120m. If you believe this company to have a reasonable chance of hitting it's projects, it passes this test.

Strong Management is Key!

I would rather invest in good management with a good idea, than bad management with an AMAZING idea. Bad management kill anything in their wake, but great management can make the most average idea succeed. Almost all of the greatest companies in the world were not first to market, they just executed better than everyone else..

How big is the market opportunity

Try your utmost to visualise how big the market opportunity is. Products with broad appeal and strong use case will generally have to spend less to reach their potential customers. Talk to friends and family to gauge for who would be a customer, and what critiques they have of the concept.

Look for companies with strong corporate values

Apple success has not been down to innovation or being first, it's been down to the strong corporate values they hold, mostly based around simplicity and access. This is summed up nicely in a TED talk by Simon Sinek which I recommend is worth a view.

http://www.ted.com/talks/simon_sinek_how_great_leaders_inspire_action

Growth is key

Try to find companies that can demonstrate high levels of growth, with minimal capital investment. Theory being, when they complete a large fundraising round, that money will put 'fuel on the fire'..

Cash burn and Runway

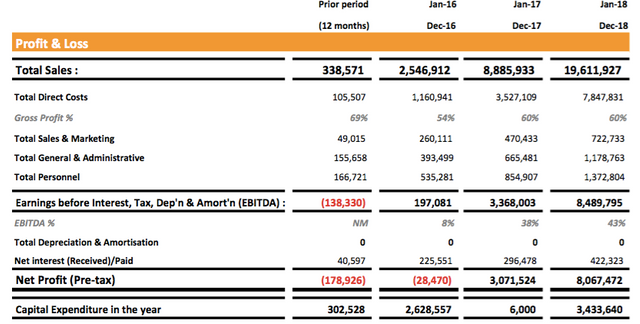

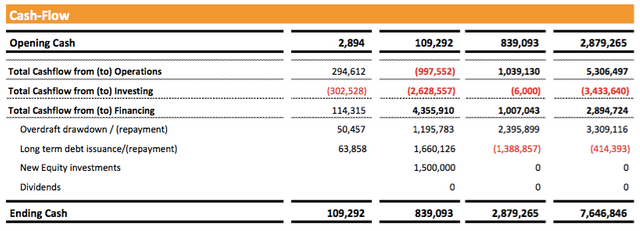

How much Cash is the company currently 'Burning' and how much 'Runway' does the current raise give the company (time between this fundraising and the next). The example I have above shows the last year in the left hand column, moving forward a year into the future as you move to the right. We can see here that the company Cash Burn next year is forecast to be £997,552 from operational activities, and £2,628,557 from investment activity (plant, machinery, assets etc). It also shows that the company will require further financing to the tune of £4,355,910 (which is broken down below) in order to carry on operating at the same level. There is no hard and fast rule here, just judgement as to whether you believe this to be a likely achievement for this company next year...

Don’t worry about the one’s you miss. Don't get EMOTIONAL!!!

FOMO (Fear of missing out) is one of the worst character traits an investor (I certainly have FOMO, but I'm trying my best to combat it). Get comfortable passing on successful companies. If the risk reward doesn't add up, then in the long run you will not make money, however successful a few companies you pass on become.

Summary

I look to satisfy all of these key terms before investing. Although much of this is subjective, it has worked nicely for me to filter down a larger amount of investments on offer, to a more manageable few to delve more deeply into. This also allows me to take emotion of out the equation, which is an important thing to do. If you have any question, I would be happy to chat to anyone interested..

Thank you for your post. Couple of questions (if you don't mind):

Always interested in sharing experience with investments!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @grazyeight I don't mind at all..

Ditto on the sharing experiences.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's interesting to put Steemit through these tests;

a. Is the industry growing? Yes

b. Is their larger player buying up smaller players? Yes, but doesn't apply

c. Is the industry ripe for disruption? Yes

d. Is the regulatory environment good for new players? Decentralised Blockchain Application are not under any regulation, nor will they ever be...

ZERO RISK!!!

I'm in!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Which platforms did you use to source deal flow?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @robreardon6. I use Crowdcube, Seedrs, Syndicate Room, GrowthDeck, Angel.co, and I'm also a member of a few private syndicates.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Best of luck! Happy to connect if you're interested in US real estate. Am w/ a small commercial RE platform. @hisnameisolllie

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @robreardon6 I will certainly bear that in mind, and will be sure to check in on your posts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From all of those platforms which one would you say to be your favorite?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@becerra18 On a basis of valuations and investor rights, I would say Syndicate Room is the best platform. They offer to same deal and rights as the lead investors. The other platforms seem to inflate valuations aggressively and often have minimums around £25,000 to get A Shareholders rights...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking the time to share what you know. I really appreciate the knowledge :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@becerra18 My pleasure. I will will posting more along these lines in the coming weeks...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Concise and clear, thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Quite a few boxes i need to tick before my investment, but good read. Thanks

W

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@warrensteem Thanks for your post. I am by no means an expert, but I've learn so much by doing rather than reading a book. Happy to share.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm in the same boat. A long road ahead. Thanks for such a concise article. Looking forward to reading more of your posts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@condra My Pleasure. Let me know if there is anything in particular that you would like me to include in my next post, and I will get that done.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your post!

Unfortunately really low quality material on the steemit

With pleasure has read.

You are a private investor or a collective?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@delord Thanks for your reply. Great to hear from you.

I am a private investor, however do invest as a collective with a few syndicates from time to time.

The quality of material is slowly evolving (getting better) but it will take some time for the platform to stop looking so inward and branch out IMO.

The quality was much worse just a few weeks ago. I have seen a big improvement. Still, completely agree, big room for improvement.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I enjoyed reading it. Personaly i am new in this game, have only 6months experience in crypto trading and also investing in ICO's (initial coin offering).

I had both good and bad investments, but i feel as if you want total financial freedom and dont have money (like me). Invest everything you can afford now and let the future take care of you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@crypto-fan Thanks for you reply. I have made many rubbish ICO investments, but luckily as you know the good one's can easily be 4x 5x return, more than making up for the bad ones...

'Invest everything you can afford now and let the future take care of you.'

Couldn't agree more...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit