The Secrets to Successful Investing: A General Guide

Investing is a crucial pillar for building sustainable wealth and achieving future goals. Whether it's preparing for retirement, funding children's education, or realizing personal projects, investing wisely is essential. However, succeeding in this field is no easy task and requires a deep understanding and a well-thought-out strategy. This article explores the secrets of successful investing to help you maximize your gains while minimizing risks.

Understand the Basics of Investing

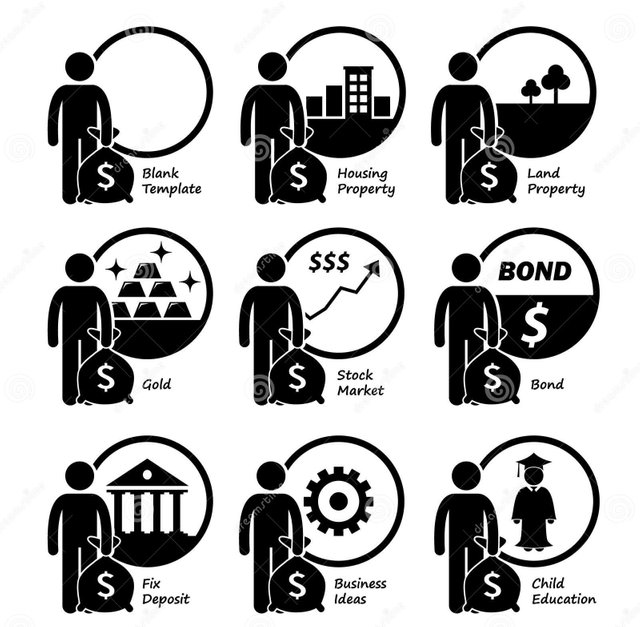

Before diving into the world of investing, it's essential to understand the basics. Investing involves using your capital to buy financial assets in the hope of making a profit. The main types of investments include stocks, bonds, real estate, mutual funds, and ETFs (exchange-traded funds). Each type of investment has different characteristics, risks, and potential returns.Set Clear Goals

Successful investing starts with setting clear goals. You need to know why you are investing. Is it to buy a house, for your retirement, or for your children's education? The clarity of your goals will influence your risk tolerance, time horizon, and the type of investments you choose. Well-defined goals will help you stay focused and measure your progress over time.Diversify Your Portfolio

Diversification is one of the fundamental principles of investing. It involves spreading your investments across different types of assets and sectors to reduce risk. By diversifying your portfolio, you can mitigate potential losses from one investment by offsetting them with gains from another. For example, if you invest only in stocks and the stock market crashes, you could suffer significant losses. However, by diversifying with bonds, real estate, or other assets, you can better protect your capital.

- Adopt a Long-Term Vision

Investing is often compared to a marathon rather than a sprint. Financial markets can be volatile in the short term, but they tend to grow over the long term. Adopting a long-term vision allows you to better manage market fluctuations and benefit from compounding, where reinvested gains generate additional gains. This requires patience and discipline, two essential qualities for any successful

investor.

Assess and Manage Risks

All investments carry risks, and it's crucial to assess and manage them effectively. Risk tolerance varies from person to person and depends on factors such as age, financial situation, and investment goals. A clear understanding of your risk tolerance will help you choose appropriate investments and develop a balanced investment strategy. Tools such as diversification, asset allocation, and active portfolio management can help manage risks.Educate Yourself and Stay Informed

Continuous education is essential for successful investing. Financial markets constantly evolve, and new technologies and trends can influence investment opportunities. Reading books, taking courses, and staying informed about financial news can help you make informed decisions. Successful investors take the time to understand the companies they invest in, as well as the macroeconomic factors that could affect their investments.

Avoid Emotions and Impulsive Reactions

Emotions can be the enemy of successful investing. Fear and greed can drive investors to make impulsive decisions, such as panic-selling during a market downturn or buying recklessly during a peak. It's crucial to remain rational and follow a well-defined investment strategy. Setting clear rules for your investments, such as profit-taking or loss thresholds, can help you maintain a disciplined approach.Seek Expert Advice

Finally, don't hesitate to seek help from professionals. A financial advisor can help you develop a personalized investment strategy, assess risks, and manage your portfolio. Experts have the knowledge and experience needed to navigate complex markets and can provide valuable advice to help you achieve your financial goals.

Conclusion

Succeeding in investing is a journey that requires time, education, and a well-thought-out strategy. By understanding the basics, setting clear goals, diversifying your portfolio, adopting a long-term vision, managing risks, continuously educating yourself, avoiding emotional reactions, and seeking expert advice, you can maximize your chances of success. Remember that investing is a powerful tool for building a solid financial future and achieving your life goals.

.