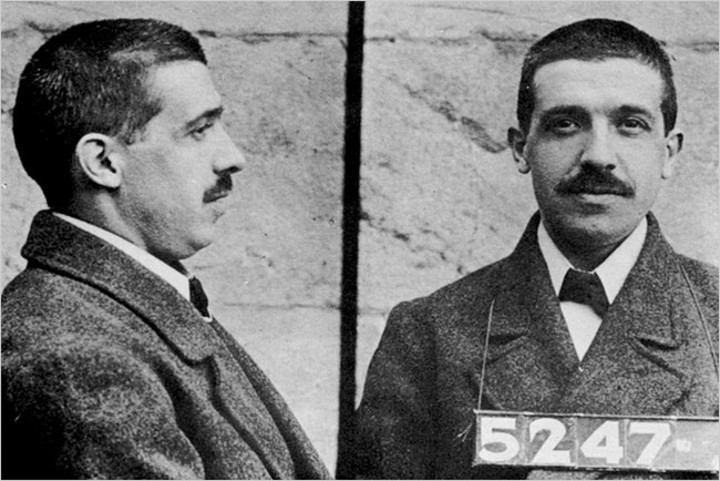

Carlo Ponzi

Before Madoff and Enrique Blaksley there was an Italian who invented a deception that is still going on: Carlo Ponzi.

He arrived in the United States with two and a half dollars in cash and one million in hopes.

In less than 20 years he would manage to equalize both accounts and soon after would weigh 200 times more bills than he had dreamed.

And all thanks to his great invention: the trick of stealing Peter to pay Paul, the one that allowed Bernard Madoff to take over 65 billion dollars from his Wall Street investment firm.

No one is very clear about where Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi was born, although the most accepted version indicates that he did it on March 3, 1882 in Lugo, in the Italian province of Ravenna, in a poor house from where they decided to send him to look for a future. New Continent before it turned 20 years old.

It would take a long time to return. In 1903 he disembarked from SS Vancouver in Boston, Massachusetts, with less than he had anticipated due to his bad luck in board games. He could barely lose a few hours before taking the first job that was put within reach, as a dishwasher in a restaurant. Despite his chronic allergy to work, at the time he managed to progress and become a waiter. However, what would soon be revealed as an obsession with easy money would end up betraying him: his boss would discover that he kept a percentage of the return of each client he attended.

A couple of other temporary jobs convinced him of the need to look for another scenario. In 1907 he moved to Montreal, Canada, and obtained a position in the bank created by a compatriot named Luigi Zarossi, the Zarossi Bank, in which he would meet with a revelation.

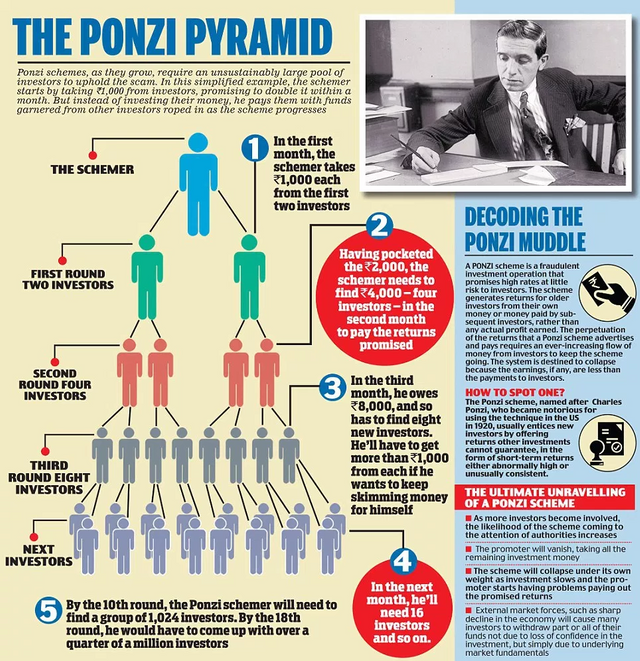

"Louis" Zarossi took deposits under the promise of returning them with 6% interest, double what the market offered. The only detail was that these interests were paid with the money provided by the new clients, mostly Italian immigrants, and that there was not really any investment, so there was no other possible ending other than a flight with the bulk of the capital obtained.

One day Zarossi escaped to Mexico, with the bag full and the family abandoned in poverty. For everyone it was a scandal, but for Carlo Ponzi it would be a revelation in the long term. In the short film he had been unemployed and penniless, so he made the decision to get the check book of a company that had an account in the bank and issue a check in his favor.

Much less skilled than Zarossi, Ponzi was discovered, arrested and sentenced to three years in prison. In 1911 he was released and returned to the United States, where he took too little time to dance again with crime: he joined a network of compatriots who trafficked illegal Italian immigrants to that country. They discovered him too soon and he was sentenced to two years in prison.

When he left prison, determined not to return to a cell but without much conviction to avoid it, he gave himself up to the always thorny path of feelings: he married Rosa Grecco, the daughter of a wealthy man. For a while he was able to live the life he dreamed of, to do nothing with a lot of money from another, but at the time he was faced with the dilemma of being expelled by his father-in-law or surrendering to the world of work.

It was work, but on its own terms. He asked his father-in-law for money to rent an office in the Niles building in Boston, he asked his father-in-law for more money for the furniture and he asked for more money to spread his idea of making a printed foreign trade guide.

The result was worse than bad. The companies pounced on their invitation to advertise their businesses in the directory, but only to escape quickly. The months passed without variants and the patience and funds of the father-in-law were exhausted.

The day in which everything would change, the owners of the furniture of the Ponzi office warned that they would go to remove them for lack of payment. Tired of resisting, before handing them in, the Italian went to check the few papers he had in the drawers of the desk when he found a letter sent by a company in Spain that sent him a postal coupon to cover the costs of a possible response through the mail.

It was the key

Ponzi looked at the coupon with disinterest until he realized he was hiding the key to his destiny. It was of the system known as the International Reply Coupon (International Reply Coupon, IRC), a kind of stamp that could be changed at any post office by the amount of stamps necessary to pay the sending of a response by letter. And these in turn could be exchanged for cash. But the curiosity was not in the system, but in the values of change: the coupon bought at 30 cents of a peseta in Spain was equivalent to 5 cents in the United States, which meant a gain of 10 percent for those who acquired it. in Europe and sell it in America.

The opportunity he had been looking for was there, in front of his eyes. Ponzi took the coupon and swapped it for money to confirm his calculations. He took the newspaper and reconfirmed that the coupons had a pre-agreed price on an international level. Then he knew that the only thing he needed to become a millionaire was investors who put the money to buy the cheapest coupons in one country and then sell them for a higher value in the other.

The rest he had: relatives in Italy - another country where vouchers were sold at an advantageous price for him - well predisposed to go out and buy the IRCs and send them to them; and a friend who worked on a transatlantic that linked that country with the United States, so he could take money and stamps from one place to another.

When everything was ready, in the absence of a clean last name Ponzi created a company to take charge of the business, the Securities Exchange Company, which went on sale to offer 10% profits within 90 days. The idea was to ask very little money from each investor, so that none would ask too many questions or make objections, and promise many benefits in a short time to make the temptation of the bet irresistible. The exotic of the business did the rest: the silver began to appear, at first in small quantities but from the hand of an enthusiastic mass of investors.

Ponzi fulfilled his promises with rigor. In February 1920, the first full month of work, the Securities Exchange Company obtained $ 5,000. The next month they were 30 thousand and sixty days later the income already amounted to more than 420 thousand.

And the advertising came, but the good, indispensable for these management yesterday and today. The Boston Post published a note on the phenomenon and the investor candidates began to queue at the door of the Ponzi building. The Police had to put together a special operation to order the ranks.

By July 1920, the firm's income was about 250 thousand dollars per day. And they were still increasing.

That's when the newspapers got serious. The Boston Post entrusted a finance expert with looking for the defect in Ponzi. The first thing the specialist discovered was an intriguing fact: the Italian was investing the money of others, but he did not risk a single penny of his own. That is, he did not seem to trust the wonders of the business he offered.

The second fact was more complicated: a simple account allowed him to realize to the specialist that, to respond to the investments of his clients, Ponzi needed to buy about 160 million postal coupons. But in the world only 27,000 had been issued.

Something did not close.

The newspaper published its investigation and a crowd gathered in front of the Ponzi offices, but not to invest their money but to claim the one already invested. The Italian, charismatic, delivered coffee and bills and managed to calm most. Immediately, he announced a lawsuit against the authors of the journalistic note and said that they criticized him because they did not understand his secret formula for business.

The advertising, now bad, left him reeling. Especially because it attracted the attention of the US Attorney General, who ordered an audit. Ponzi stopped taking new investments with the excuse of facing the expertise, but also stopped paying interest. The Boston Post discovered his criminal record, published it and everything went down.

It is estimated that by then the Italian had obtained about 20 million dollars, a figure equivalent to about 225 million today.

It would never be known at what point Ponzi stopped buying postage stamps and devoted himself directly to executing his pyramid scheme. Six banks went bankrupt for their maneuvers, which forced him to face a trial for postal fraud in which he was sentenced to five years in prison. He got out of prison at three and a half, but only to face 22 charges of larceny (fraud), in three new trials. Already without money, he could not afford a lawyer and bet everything to his personal charm. Even so, he was sentenced to nine years in prison, which he avoided during a time that he dedicated to committing a new scam by selling land in Florida that turned out to be swamps. He was discovered and tried to flee to Italy on a ship, but he was caught in New Orleans.

Only in 1934 could he leave prison. He got a job on an Italian airline and started working on the route to Brazil, but formal employment was not his thing. Rosa, his wife, had left him and he ended up living in Rio de Janeiro, where he died alone and poor on January 18, 1949.

That, the final solitaire, was the only chapter in the script of his scam that failed to perfect.

The Ponzi Piramid

Can you post the one for "D.B.Cooper"?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just found out my friend, the ponzi was already long, thank you for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit