Save As Much As Possible!

Consistently, it seems that conventional wisdom as promoted by ‘experts’ and The Government has failed society as a whole. Whether it is the realization that the food pyramid that has been promoted to us since childhood actually leads to terrible health or that marijuana was unjustly demonized by the media and schools, it is necessary that we start to consider how much credence these recommendations have. Personal Finance, especially conventional saving advice, is another great example of something that is pushed on the masses and generally never questioned. I suggest that all of us take a long hard look at the conventional wisdom of saving, and why the %20 savings guidance is a social construct that traps most employees into working 40 to 50 years before retirement.

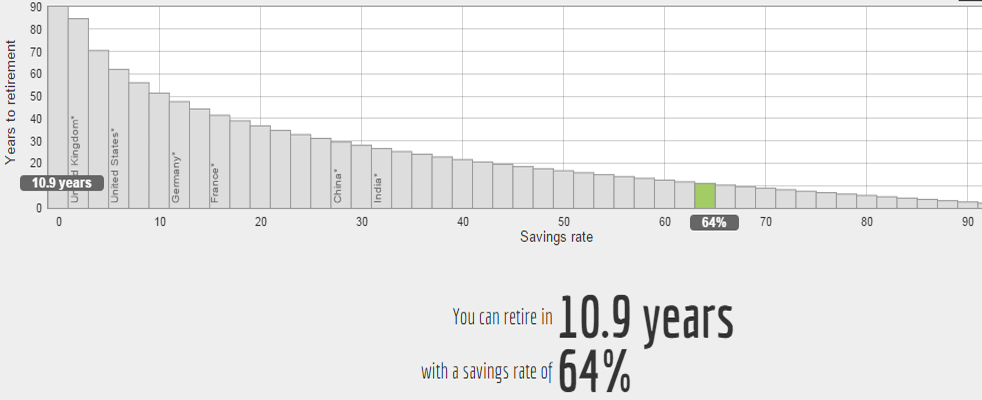

The standard rule of saving (at least the most popular one I found on Google) is the 50/30/20 rule, where %50 of your income is for fixed expenses, %30 for ‘discretionary spending’, and %20 for saving. This rule is spouted in countless articles (examples: 1, 2, 3, 4, 5) and is a perfect example of a personal finance cookie cutter advice that has lead society to accept a lifestyle of working in a career for the majority of their adult life. By simply changing my savings rate, the time required to reach my targeted goal of Financial Independence can be cut dramatically. In the below graph, you can see how saving %10-%20 will commit an employee to a 40-50 year career, but conversely, saving 64% will lead to retirement in 10.9 years.

pasted image 0Assumptions to this chart linked here from MrMoneyMustache.com

After I understood this basic concept, the most important thing I realized is that saving more of my income required drastic changes to my behavior and lifestyle. Some of these changes would turn out to be a huge sacrifice in my short-term ‘happiness’, but will absolutely pay off in the long-run. Firstly, before I drastically changed anything in my life, I asked myself the following questions:

“Will I be happy in life if I have to work 40 to 50 years working for someone else”?

No, I want to work on something I personally believe in, find enjoyment in and has to mean to me.

“When would I like to retire or be financially independent?”

As soon as possible, but I could settle with being financially independent in the next 10-15 years.

“What am I willing to sacrifice in order to increase my savings rates?”

Anything besides my health. Such as time, lifestyle changes, and unnecessary spending.

Of course, everyone’s specific situation will be very different from my own or any other person’s situation. However, if your answers are anything similar to mine, then you are in the right mindset in order to make the right moves to begin saving more. No matter how dire your specific situation may be, the first step is to understand why conventional saving is simply not enough to achieve any sort of financial freedom early in life. Once you are able to fully understand how important saving every penny is, you will be on the right path to achieve Financial Independence.

Frugality Is A Skill - Save As Much As You Can!

I realize that many people believe that they are in a situation in which they are unable to save. No matter what specific situation we are in, I absolutely believe that everyone has the opportunity to reduce expenses and marginally increase saving. Saving half of your income may seem impossible for some people, but is a savings goal worth aiming for. This high level of saving requires dramatic changes in consumer behavior in order to achieve any chance of creating long-term wealth. Saving money can be very similar to trying to achieve fitness goals, in the sense that both require an incredible amount of dedication to changing your life for the better.

Like any other discipline, saving money is a skill that everyone can build if they choose to. Another way to think about saving is to think about saving like working out. In order to live a healthier lifestyle and lose weight, we need to take the proper steps in order to succeed in our goals. You need to stretch to prevent injury, go to the gym regularly to get consistent gains and eat the proper foods in order to get the appropriate nutrition to fuel your muscle growth. The steps needed to be followed in order to increase savings are incredibly similar to the steps necessary to becoming healthier.

Like stretching before a workout, it is necessary to prepare for a lifestyle of high savings. Specifically, for me, this means cutting all fixed expenses wherever possible. ‘Going to the gym regularly’ translates to regularly monitoring how I spend my money on day by day basis. ‘Having a proper diet’ can be simply explained as doing the proper things with your savings. Such as portioning your savings into a 401k, ROTH IRA, Investment Funds, cash-equivalents or any other way to store money. Doing the ‘proper’ things with your savings also means not spending your savings, unless for dire emergency situations. Too often will people dip into their savings to go on a vacation, afford lifestyle choices (like a wedding or engagement ring), or purchase other expensive items.

If any of these 3 parts of working out, mentioned above, are neglected, the entire effect of the workout can have lower than expected results. The same can be said with saving money as a part of your income. If the proper steps are not taken to reduce fixed expenses, reduce ad-hoc consumption, and properly allocate your savings, it will be nearly impossible to save enough money to become wealthy.

As I began trying to save as much as I can, it became painfully obvious how difficult this is. I am striving to save %50 of my income as I find it to be a nice round number to aim for and will allow me to retire in about 20 years. In reality, most Americans do not even save the conventional %20 for retirement at 65 years old and rely on social security (or other methods) to see them through retirement. The social norm of spending more than you can afford is deeply embedded in all of us and requires a serious revelation to occur in order to fully understand the detriments associated with living above our means.

Saving money and cutting costs is one of the most impactful ways we can all start building wealth slowly. More importantly, saving money is the one thing we have a %100 control over in our daily lives. So before we make excuses based on limiting beliefs as to why it is impossible to save that much, we must first try to fully comprehend how critical a high savings rate is if we are to achieve early retirement or financial independence. Until this non-standard philosophy of saving as much as possible is drilled into our very being, we will all be stuck working for a corporation that we may or may not enjoy for the majority of our adult lives.

So, stop making excuses! And start saving now!

-Jack

P.S. You also have to invest your money at a certain point, but let's focus on saving first.

anything else is gambling though.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is a saying I've heard: save as much as you can until it "hurts"...this along with the old mantra "pay yourself first" are both good to keep in mind if saving is a high priority.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit