Warning:

If you are thinking of investing or borrowing with Prosper.com, don’t, run away. They have turned into a loan shark total scam company. I’ve been investing with Prosper.com since 2011. They were the first P2P banking company and made a big disruption to the banking industry when they first appeared. They scared the banking industry so much that they tried to shut them down in 2008, but Prosper won their case in the Supreme Court and were back in business a year later. This was before Bitcoin was on anyone’s radar so the banks had to crush this better way for people to invest.

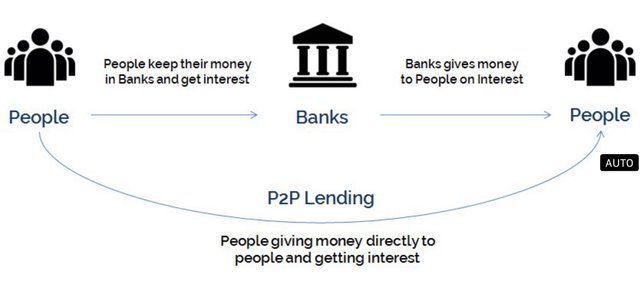

How P2P Lending Works:

Banks and P2P lenders both rely on credit history to determine who’s eligible for loans. Banks are pretty picky and are quick to deny people loans, but P2P works like BitTorrent. Rather than lending $10,000 to one borrower from a single source, P2P breaks that $10,000 loan into 400, $25 micro loans that several lenders can agree to lend. For the borrowers who get rejected by traditional banks it can be good because P2P banks can still lend out funds (at extremely high rates) as long as enough people agree to lend them $25. For lenders it is good because they only risk $25 a time diversifying their investments and can get up to 30% ROI.

Going Downhill:

Prosper used to be a great way to make passive income. Their interface was clear and easy to use and then it slowly got worse over the years. Lenders used to have the option of clicking on CLASSIC VIEW, but now you will see this cute little rocket telling you that it’s gone.

P2P lending is still a great idea, but it needs to be done on a public blockchain to avoid horrible companies like Prosper. I don’t know why they became so bad, but they must be going bankrupt or something. If you call them, they will be very polite, but will lie about your funds or when they will arrive. Many borrowers have complained that they make it hard to pay off loans early. If lenders stop reinvesting their gains, they will put the account on hold and freeze your cash only to make false promises about when the money will arrive.

I can only guess to what went wrong. Maybe Wall Street thought that since they can’t crush them through the courts that they should infiltrate them or buy them out and make it a horrible experience so no one ever uses P2P again. It really doesn’t matter what went wrong, just avoid Prosper.com altogether. I know there are some crypto P2P lending platforms, but nothing as big as Prosper yet. If they model it after Prosper’s original model and make all loans publicly viewable on their blockchain, it will work fine.

I honestly don’t care if this post makes one cent. I just hope it shows up on Google searches so people can avoid this now dishonest scam of a loan shark company.