In this video, I talk with author and economic analyst John Sneisen about the recent meeting in Davos for the World Economic Forum where globalist world leaders, bankers, economists and business leaders are meeting to discuss the economic transformation of the world and in their eyes, the necessity for people to bend over to a massive financial global order.

Everyone from Modi and Trudeau to Merkel and Christine Lagarde are calling for more global unity which is code for global governance. Financial elite like Kenneth Rogoff (author of 'The Curse of Cash', an economic adviser to the Federal Reserve and member of the CFR) and Jes Staley (CEO of Barclays) are concerned about complacent markets not unlike 2006, something we at WAM have been talking about for quite some time, but what's shockingly absurd but not at all surprising coming from these men is their hope for a cashless society which would literally repeat the problems on a centralized digital scale, forcing everyone in servitude to the banks via legal tender laws.

As Staley said,

"We’ve got very little capacity in the capital markets to deal with a real move in interest rates.”

Well much like Sweden who lowered interest rates into negative territory and went cashless for the most part, a similar brush with financial ruin may come upon our doorsteps as well. The Federal Reserve is desperately attempting to raise interest rates so they can drop them out when the inevitable crash occurs. However, from 2008 to 2012, interest rates were dropped 5.5%. The drop out would be much higher this time around and there's no room for it about zero. We will see negative interest rates. So where do you think the monetary system would go? Cashless.

Just as Nobel Laureate Joseph Stiglitz demanded in Davos last year...

The problem is, the impact of the world reserve currency crashing would be so enormous that there's a good chance the whole system world wide would go down and people would rise up, so for that reason it appears that the financial elite are desperately trying to push the cashless system forward BEFORE the crash.

We are not talking about decentralized Bitcoin. We're talking about a legal tender currency likely routed through the SDR at the IMF which is based in debt, out of control circulation, centrally planned and teamed with bail in regimes restricting individuals from taking their non-existent money out of the bank. Look at it this way, if youre money's in the bank, it's not your's, it's the bank's. If your money's always going through the bank via legal tender laws and digital transactions, it's never your money. It's always the bank's. You are therefor in perfect servitude to the banking system.

Looking at the US M0 chart, it's clear there's already a move being made. With the power shift to China and India, there's even more evidence that this trojan horse will soon consume us. That's why we must learn to be self sustainable, financially responsible and educate ourselves and those around us. It's imperative to our very monetary survival. It's imperative to our very freedoms.

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow!

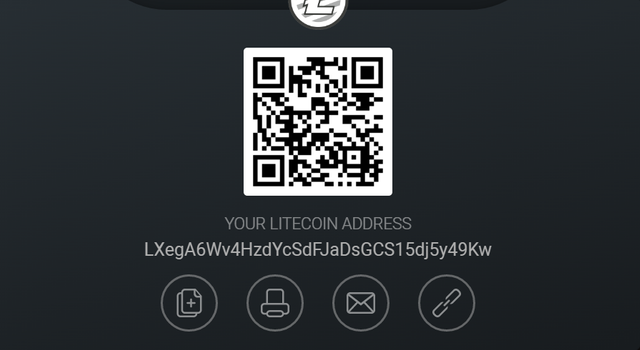

If you like what I do, you can donate to my Bitcoin, Litecoin or EOS addresses below as I'm demonetized by YouTube!

Bitcoin:

Litecoin:

EOS:

I am not an expert, but there is little doubt in my mind that a digital currency will be established. The question for me is, if a purposeful created financial crash could not accomplish 2 things in one stroke: A huge transfer of wealth like we had in all the other crashes PLUS the willingness of the people to adopt the "secure" version of (not decentralized) but government issued cryptocurrency...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent thoughts. They get two birds with one stone.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well what you suggest is actually better for the unprepared people. If there is still cash out there people would be hurt less by the crash.

I mean negative interest rate is just a nice name to say all your purchasing power in banks will have to take a haircut. But wait that would cause bank runs.... lets force cashless down the sheeple's throat.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The "cashless" society will come, but it will be decentralized and will be the downfall of the corrupt central banks and their monopoly on currency!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good post keep it up dear @joshsigurdson

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Up Crytocurrencies

Down Corrupt-Control-Over-Banking-System

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

informative post.thanks a lot for sharing

please keep on...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good friend video you have ..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks you so much for your valuable post sharing... I appreciate your video news, i wait your next post. best of luck my dear friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post. I largely avoid television and chose a few select articles of interest on yahoo, so post's like this are excellent!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very refreshing thoughts. All of us who are collecting crypto coins, at some point in our life, convinced that this is the way forward. I think it is a matter of time for the people in the power of corridor realised (probably they have but looking for ways how they could profit from it) how they could profit from it and jump on the bandwagon.

Thank you for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pathetic "rules"

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit