In this video, I talk with author and economic analyst John Sneisen about the importance of self sustainability and financial responsibility as the pension ponzis throughout the world start crumbling at their foundations.

The the UK Department For Work And Pensions announces that six million middle class workers are not saving enough for retirement. This is a big problem, but when compared to pensions throughout the world, it all fits into the script.

Pension funds are seeing massive shortfalls throughout the world and the reality is, the very entity that wants you in debt and poverty and benefits from such an occurrence is also the same entity behind the pension systems. The banking system and government. It's a massive ponzi scheme and keeps individuals dependent on that said system with some terribly risky bank rather then saving for themselves and being responsible with money.

People need to be self sustainable and financially responsible. People need to put money where they want to put money without the force of the state. Voluntary interactions is the true free market, not government coercion and force tell you you must save money here or there.

People under 30 are very unlikely to ever get their pension. So preparing themselves so they are comfortable later in life is very important.

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow!

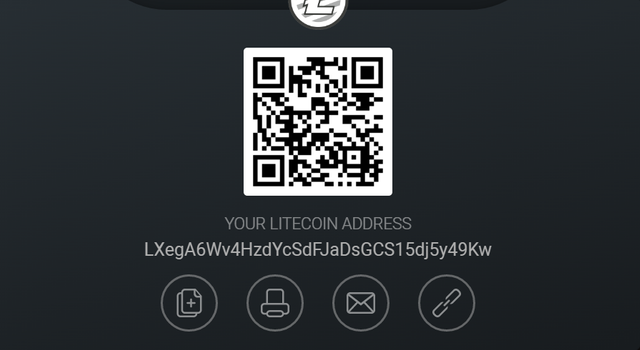

If you like what I do, you can donate to my Bitcoin, Dash or Litecoin addresses below! Especially as we are so heavily demonetized on YouTube as so-called "hate speech."

Bitcoin:

Dash:

Litecoin:

I keep telling my folks that pensions will probably cease to exist by the time they retire, or the pensions will pay so little when adjusted for inflation that it will be a pittance, but they are so indoctrinated with the currently system that they refuse to take seriously anything I say.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Real eyes realize real lies!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

truth

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Remember George Carlin? «And now they're coming for your social security money. They came for your retirement money. They want it back! »

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My advice: Follow the yellow brick road to Oz and seek the assistance of the Wizard.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @joshsigurdson, this post is the sixth most rewarded post (based on pending payouts) in the last 12 hours written by a Hero account holder (accounts that hold between 10 and 100 Mega Vests). The total number of posts by Hero account holders during this period was 426 and the total pending payments to posts in this category was $9201.63. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Scary!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That van down by the river is starting to look pretty good!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I get laughed at by bank employee questioning their deposit security and other issues. I switched to a credit union that don't do derivatives and have a different deposit insurance than banks. Hopefully less likely of a wipe out if things do go south.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I try telling people that it won't be there for them and they don't want to hear it. That's okay. The people I really care about listen to me :).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wooow this is really a huge problem that is facing the societies financially, and I believe investing in diverse businesses could save anyone who could practice it and commit to it, especially in digital currencies,, too many people got wealthy investing their money in cryptocurrencies.

Personally I invested a small amount of money $200 in digital currencies in the beggining of 2017 now it has been doubled 10 times,, I have now $2k which is a good thing imagine if I was financially able to start with $20k it would be $200k by today,

and I am not a professional trader,, but only investment put money in and let grow.

Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You said it brother. It may be even worse in the U.S. I was raised to believe that you better be saving for retirement by your 30's or earlier. Yet so many people I know refuse to even put 1% into a 401k because they just can't afford it. Their monthly Spotify, Netflix, Vaping, etc. habits are just too important ;)

I'm hoping my crypto investments play out long term, but I'm also investing traditionally!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great info. I am on a medical pension and this is a really scary thought. Luckily I saved enough maybe just enough to make it, Thanks again

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, just ask the clapping soccer moms.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Most people think that they should work work work and then save up until they think they have enough money to last them until they die... I think that's the scariest thing to think about in life.

But why can't we have little "mini" retirements throughout your life? I like the idea of just not working for a solid few years here and there during your life. It'd be way better to do it while you're young and you can enjoy it.

It's a shame that people think the norm is mandatory

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pretty funny. You should have been awake the day they promised you all that crap and put stars in your eyes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Find a career or projects that you love working on and you will find you don't even want that much vacation time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's cuz we're normies. ; )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well the idea is right but they have to pay off those that theirs are due. Nice post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We need to prepare for the worst through Crypto.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cryptos are a great way to save, but its too risky at its current stage to be widely accepted. Truth is, its impossible to grow your wealth, while its safe.

Social security is theft, taxation is theft, inflation is theft. They are just doing the same thing with fancy names.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downer.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The rules are rapidly changing when it comes to finances @joshsigurdson

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ne bileyim

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing this post with us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As I see it - the main "problem" is that people live longer - so if X money was divided by Y years they have to live, now its "x/(y+some more) and it just isn't enough any more - one option could be putting more money to the pension each month. the question is - can we rise it by a reasonable amount that will leave the person with enough for his years before pension? years in which he wants not only to scrap a living but to enjoy - go to restaurants, vacations etc...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The good thing is that the whole corporate resort / condo / isolated retirement bullshit will die. People will really on groups/friends - cohabitate - share economy ... almost commune style at times to survive / it will bring people closer and refocus priorities. The whole western corpo culture of retire golf courses and travel to tahiti shit will be gone... it's all non-sustainable and stupid anyways... people will be less isolated and more integrated with real human culture / peace

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Honestly, I hope the pensions all fail. Its outrageous that government employees, who are arguably incompetent and work for the government as they are unemployable in the real world, receive a monthly check after they EARLY retire. Meanwhile, hardworking folks can't retire, can't even conceive of retiring, have only what they have saved......As it should be

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

pls translate for me im turk

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Might want to keep onto that change a bit more ;)))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Time to do a video on infinite banking. Let's get people out of traditional banking.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Totally agree, the pension system is just outdated and proven not working over and over again... I think blockchain will drastically change this, allowing people safe enough money for the "retirement" time...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with the idea that many of us will never see our pensions. I do pay in to a pension myself (and just turned 30) I am hopeful that I will see it when I am older. However, I have prepped myself with other investments to make sure that I have enough when I retire if I don't receive the pension. Now if I do get it, i'll be super comfy when I am older!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been a fan for a while. keep up the good work :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pensions are pretty much down to union workers now, and government employees.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The whole welfare state will go bust, not just the pensions while governments will confiscate more and more to return less and less until w end up paying a lot for nothing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Quite interesting and educative content. Good one.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post dear,,,, I think everybody should try to save their money for secured their future life.. Even pensioner person also should save few amount of money every month to safe their future life....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Guys - thanks for another great video!

John briefly mentioned infinite banking. I'd be really keen to hear this concept explained in detail. Do you think you might be able to create a post/video explaining it and how one can get started?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Employer: Say "insert favored pronoun here", I want you to work for me. Tell ya what, I'll pay you a substandard non-living wage for oh, say, 30 maybe 40 years, during which time you'll work for me as hard and as long as I want. Then, if I haven't fired you for some, any or no reason at all between then and now, my company will promise to pay you 300% of the total of your wages during that 40 years of labor in small increments until you die.

You: Ok. when do I start?

Me to employer: Uhm....wft? are you nuts? Yea right. You actually talked people into this gig? They actually said yes to that??! wow!

My answer to employer: Naw, if you want me to work for ya, you'll pay me what i'm worth every day and i'll quit when the job is done. Take it or leave it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In the UK pensions just seem totally unsustainable in their current state. There our largest portion of spending costing even more than the NHS. People are living longer and the qualification to receive pensions seems to be declining. When pensions were introduced in 1910 you had to live to 70 to receive it, with the average lifespan being 55 years. In the current paradigm you have to live to 68, when the average lifespan is 80. It just seems unrealistic to think we can have the average person living off the state for 12 years at the end of their life.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All these years my family and acquaintances have been telling me what a loser I am because I never bought a house and never contributed to a retirement plan. Ha ha. We're all gonna be in the same retirement poorhouse.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Everyone should take responsibility for their own retirement as best they can. You cannot count on anyone else to do it for you. Live below your means and save/invest all your extra money. That is the only way to be sure you have what you need to retire.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With this population explosion for my generation use of pension funds is a dream

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit