In this video, I talk with author and economic analyst John Sneisen about the historical prosperity of gold and silver in a dollar crash scenario as we approach the inevitable end of another fiat currency.

Gold and silver are not meant to be investments, though they have been treated that way in recent days. They are meant to be wealth insurance. So while you can gain value out of them, it's meant to maintain value in the event of a currency crash.

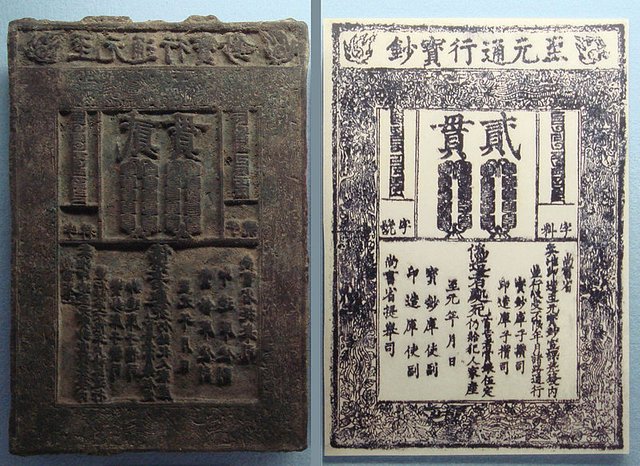

All fiat currencies eventually revert to their true value of zero. They always have, they always will going back to 1024 AD in China.

One of the first fiat currencies used under the Sung Dynasty.

While we cannot put a date on the crash due to fundamentals being off the table as the currency is so incredibly manipulated, we know it has to happen. Historically, gold and silver have prevailed in dollar crashes. Going back to the Sung Dynasty in China as they printed worthless paper IOUs, gold has been great security for those holding it.

Gold and silver have been vastly manipulated in recent years. In 1933 when gold was confiscated under FDR in the United States, the gold was used to fund the creation of the Exchange Stabilization Fund which manipulates gold prices. Later, remaining gold was used to fund the creation of the IMF.

Since 2012 especially, we have been in an artificial bear market for gold and silver as banks such as Deutsche Bank and HSBC vastly manipulate the price while we also see incredible outflows and inflows of ETFs in order for investors to attempt to make money off of the precious metals.

However, this creates a beach ball effect. When the currency goes down we will see the banks go down. When the banks go down, gold and silver having been held down and undervalued for so long gaining pressure like a beach ball under water will bounce and show itself once again to be a historical store of wealth.

Looking at hyperinflation throughout history, gold and silver have held up. Whether it be the Weimar Republic, Zimbabwe, Croatia or any of the other hundreds of fiat crashes throughout history.

That doesn't mean that a gold standard is the answer as once again that entails centralization. Creation of more IOU notes than there are gold reserves and again that means dependency on banks and government.

Of course gold and silver should be teamed with diversification in other great competitive currencies. There shouldn't be ONE main legal tender currency. Cryptocurrencies with good fundamentals have great potential as well. In the end, the market should decide. You, the market. If stores want to trade goats for goods and services, they can. But they likely will not. They will likely conform to using that which is most popular and easy. Gold, silver and cryptocurrencies.

And with that, as so many mention, you cannot eat gold. No, that's why you must learn to be self sufficient as well. Food, water, shelter, defense, sound monies.

Let's learn how to insure wealth. Be educated. Be over prepared if anything, rather than underprepared.

Responsibility is the hallmark of freedom itself.

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow!

If you like what I do, you can donate to my Bitcoin, Litecoin or EOS addresses below! :)

Bitcoin:

Litecoin:

EOS:

indeed very very unusual motivation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really interesting and nice article, we should now invest in crypto instead of gold and silver...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @joshsigurdson

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wah very complicated, if all that can happen. let alone the value of money is getting down

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit