Hello Steemers

Heres a short introduction into the world of silver investments for anyone who’s been hearing a lot about silver recently and become intrigued. Im going to skip a lot of the facts about silver and focus mainly on the various different ways you can get exposure to the white metal. I’m not here to advocate buying silver at this point, but to talk more about HOW and WHAT to buy.

From personal experience, investing in silver can seem a little overwhelming to someone new to the market. Theres so many different ways to gain exposure to silver it can lead many people into potential danger later on down the line if they dont fully understand their own needs properly and the market itself. The key to success in your investment is to choose a method and an investment that is RIGHT FOR YOU. To do this you need to first understand your own needs and then learn about what is on offer so you can potentially meet those needs.

To answer this you first need to answer the following questions?

Are you a quick profit type of person?

Are you saving for the long haul?

Do you believe that holding precious metal as insurance against social collapse is worth it?

How long before you will likely want or need that cash again?

There is an old saying that if you dont hold it you dont own it, so some people will sware the only way to invest is to own the physical metal itself. This is great but this does carry risks of theft and loss and selling could become an issue for some people. An exit strategy is something you need to think about now before you begin to part with your cash.

So you are still keen and want to know whats on offer?

ETFs. (electronic trade funds)

One of the easiest ways and most popular ways for people to get exposure to silver is through an ETF. If you are trader orientated and have a 'money to play with' for profits fund then probably the best way to go is somewhere like www.bullionvault.com where the silver is stored in an allocated ETF. You can buy and sell at the click of a button however and when ever you like. This gives the investor freedom and can be worth it for alot of people even though you dont get to see or hold the metal itself.

Miners.

Mining stocks can give staggering returns sometimes 10x the profits from the metal itself with certain companies. The mining sector has been in a crushing bear cycle for the last 4 years and recently bargain hunters have been stepping in to buy up assets for pennies on the dollar. Many old players that have been in the precious metals space for decades have all said that they have never seen anything this bad in thier lifetime. The thing about miners is you really need to spend time delving into the company right down to every last penny on there balance sheet to know if they are likely to survive any shock to the silver price. Stocks like any stocks carry large risks.

Bullion bars

Bullion bars are commonly available in sizes ranging from 100g up to 1kg and 5kg. This for me was the first thing that springs to mind when buying silver and can seem attractive as they offer the cheapest way in to silver for a large buyer to get as many ounces as possible for the money. This is great but in my opinion it can also trap new investors if the market heads south. Unless you can get these types of bars at spot price or very close then they are not worth buying IMO. Having said that some of the most desirable bars are from an old company called Engelhard which if you can find any of those for a good buy price then i would recommend those. When it comes to bullion bars you will only get spot price when it comes to sell. The silver is silver mentality is very much at play here.

Coins

This is the real area i really wanted to cover because coins are in my opinion the best way to go for anyone wanting to invest in silver regardless of needs. There are a range of coins available from mints all across the world and some of these are really beautiful, but most importantly they appreciate well on the secondary market with collectors. Some of the coins will appreciate on a yearly basis REGARDLESS of the silver price and this for me is the golden secret to success with silver.

Knowing your coins

Junk silver - Old circulated money from back in the day that has 50 percent silver content. These will be the coins that you might want/need if a doomsday scenario plays out. Most of the time they can be picked up at close to spot price unless there is a shortage. The downside is your also stacking 50 percent dead weight, which believe me can be a problem.

Generic rounds - These typically make up the American silver eagle, Austrian philharmonics and Canadian Maples. Well known coins that go for spot price or there abouts. The good thing about these is that when it comes to selling, you won’t have any problem off loading them. Millions and millions of each of these coins are sold to investors globally every year.

Numismatics - Proof coins, professionally graded coins, very low mintages, and very old rare coins. This is where things get really serious and you better have the white gloves on. Some of the prices these coins can fetch is truly staggering but be warned that value is in the eye of the beholder. So in a SHTF scenario i doubt very much your precious proof coins will be worth anything other than melt value.

Semi-Numismatics - Coins with a limited mintage but not really rare enough to be classed as numismatics.

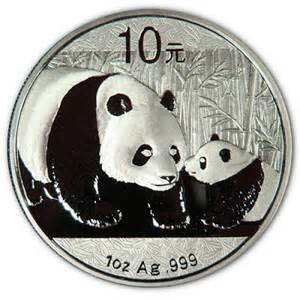

This is where things get interesting, the biggest winners without doubt for me are the semi numismatics particularly the Chinese Silver Panda. Ever year the design is different and every year the coins are sold out with the previous years coin already selling at a hefty premium in the secondary market. A few years down the line and you will have coins that are worth twice the spot price as long as you look after them and can find the right buyer.

The Australian lunar series is another winning coin in the secondary market. Again a different design each year is made based on the Chinese lunar calendar and every year the 1oz coins sell out fast at the Mint.

In my opinion these two coins, the lunar series and the panda should make up the majority of your stack. It doesn’t seem like the best way to go at the time as you pay a small premium for them compared to say an American Eagle but 2 or 3 years down the line, the lunar coin or panda will be worth 2 or 3 times the American Eagle if the general market trend remains.

Some of the other coins id also recommend buying but to a lesser extent would be the

Australian Kookaburras and Koalas

Mexican Libertads

UK Britannias and lunar series

Each of these coins appreciate on the secondary market year on year but are not quite as popular as the pandas and lunar series. ETFs and mining stocks dont guarantee success by any means but i believe that buying coins and buying the right coins every year should give you a nice savings fund in the future that won’t pain you no matter when/if you need to sell.

Please note this is meant as a guide not investment advice. Please do your own due diligence when investing.

How are you, hero?

Do you agree that we always support each other?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jphamer1 I want to submit a proposal to you.

I want to ask for support from you in my posts. so this way I will share the results of my posts with 50% for me and 50% for you. There are many advantages that you get, first you get curation of the second upvote you get the results of sharing my posts sbd and steem. if within 1 day I make a post and you support 100% then with a sound calculation of 200k power will come out 15.67 x 5 posts = 78.35 $ so 50% of the results of the post will go to you. if you agree with my proposal to you an investor. Please let me know so I can make a post and work with you. thank you @jphamer1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bookmark, crosspost to banking and finance community

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit