Summary

Low Valuation.

Best of Breed, Compared to Peers.

High Growth Complex, Refreshing Dividend.

Lam Research, along with the majority of the chip sector (not named AMD) has gotten obliterated in recent weeks. Lam Research traded as high as 176.21 in the past month and is currently down to 153.99 at the time of this publication. The case of Lam Research is not unique. When you take a look at the charts of Micron, a 2017 Wall street darling, it traded as high as 52.76 on the one month chart and is currently trading at 43.93 at the time of writing. That is dismal performance to say the least, however I spur investors to take a longer-term view with Lam Research, and the chip sector, and to buy the dip of Lam Research.

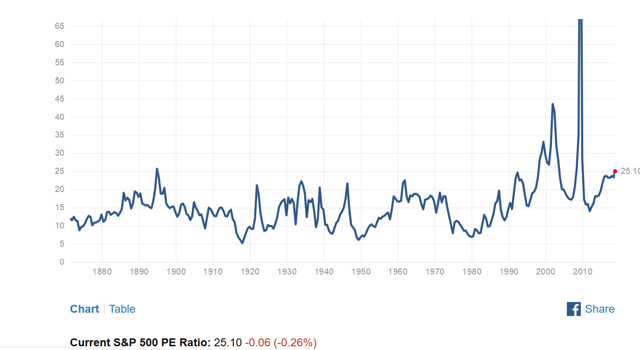

I have a couple bullish thesis’s when it comes to Lam Research, however one of the most compelling is its current cheap valuation when compared to the broader market, as well as the chip sector. When examining LRCX’s price to earnings ratio it currently sits at 11.51 according to Street.com. When you compare this to its peers, they trade at 49.67, a wild premium to LRCX. Furthermore, when you compare the price to earnings of LRCX to the broader market the story doesn’t change. The market (S&P500) is currently holding a P/E ratio of 25.10 according to multpl.com (see below figure). However, price to earnings can be slightly misleading especially when you take into the high growth capabilities of the chips.

SP 500 P/E

A much more reliable metric when comparing companies with higher growth compared to the broader market is the Price to Earnings/Growth metric. When you take a look at the chip sector which has a P/E/Growth number of 2.39, it is quite alarming as an overvalued state ranges from 1 to 2 depending on which analyst you poll. Generally speaking, I like to subscribe to the camp which believes anything over 2 (P/E/Growth) is rather worrisome, considering the broader markets “fair value.” When looking at LRCX which carries a Price to Earnings/Growth metric of .69 it is trading a large discount compared to its peers. This remains true by virtually every metric one can look at in comparison to other popular chip names. Price/Projected Earnings LRCX 8.30, peers 20.32. Price/Book LRCX 3.65, peers 6.85. Price to Sales LRCX 2.17, peers 5.79. Price to Cash Flow LRCX 9.05, peers 17.31. And finally, Sales growth which I believe is one of the more important metrics along with P/E/Growth as sales growth shows that LRCX is continuing to gain market share and outpacing the competition. LRCX has a sales growth number of 32.88 juxtaposed to its peers of 19.17. All of these metrics are according to TD Ameritrade.

LRCX has a strong place in any portfolio, when examining their 2.87% annual dividend yield it can make for an attractive addition to any portfolio, due to its high growth complex, coupled with its guaranteed yield. This is compared to the broader chip sector with the majority of companies not paying a dividend (AMD, CRUS, MU, AMBA). While a 2.87% annual yield is nothing to write home about, it shows commitment to shareholders while maintaining the cyclical, but high growth complex which is a staple of this industry.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in LRCX over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it.

Hello,

Welcome to Steemit.

In order to confirm your authorship of the content, please make a mention about Steemit or add a hyperlink to Steemit in your seekingalpha's blog profile:

https://seekingalpha.com/user/48599540/instablogs

You can remove this mention from your website, once we confirm the authorship.

Thank you.

More Info: Introducing Identity/Content Verification Reporting & Lookup

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://seekingalpha.com/instablog/48599540-jtaubs/5213518-lam-research-corp-buy-dip

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!cheetah ban

Failed Authorship Verification.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, I have banned @jtaubs8.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit