A lot of people go through life without knowing the language of money. What am I referring to when I say the language of money, you ask? There is no simple answer; there is a whole lot of things. It includes a lot of economic terms, like demand, supply, elasticity, competition, and product life cycle. At the same time, it includes lot of financial terms like revenue, dividends, and earnings.

The basis of "The Language of Money" series is to familiarize all of us with these terms as well as teach us important skills, like valuing a business and generating passive income - things which not a lot of teachers teach us in school or college.

There are 3 basic accounting statements - balance sheet, income statement, and cash flow statement.

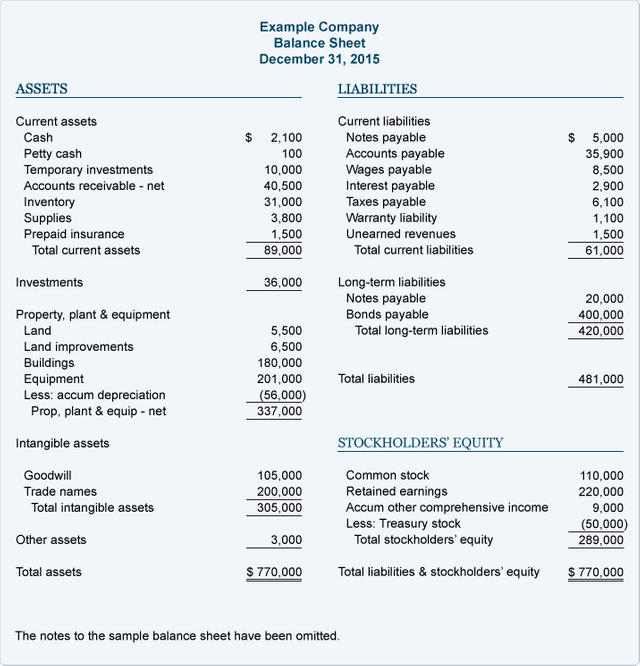

BALANCE SHEET

The balance sheet summarizes the assets owned by the firm/company, the value of such assets, and the mix of liabilities and equity used to fund them.

Putting simply, an asset is something that generates income for the company. A liability mean creditors' ownership of interest of assets, whereas equity means investors' ownership of interest of assets.

ASSETS = LIABILITIES+EQUITY

HOW DO WE VALUE THESE ASSETS?

1. Fixed and long term assets, such as land, buildings, and equipment:

Accountants usually begin with what they paid for the asset (original cost) and reduce the value for the aging of the asset (depreciation and amortization).

2. For short term assets - inventory (raw materials, goods), receivables (money owed to the company), and cash:

Accountants usually use updated or market value for these kind of assets.

WHAT DO THE OTHER TERMS IN THE BALANCE SHEET MEAN?

1. Intangible assets - You may have already guessed - these assets are not physical in nature. They may include copyrights, brand names, patents and goodwill. The most common intangible asset in accounting is goodwill.

a. Goodwill - When a company, A, acquires another company, B, the price it pays is allocated to the existing assets of the acquired company, B. Any excess paid in purchase price over book value is goodwill and is recorded as an asset.

2. Current liabilities - These include obligations that the company has due in the next accounting period, such as accounts payable and short-term borrowing. They are recorded at current market value.

3. Long-term debt - This includes bank loans and corporate bonds, and are generally recorded at face value at the time of issue.

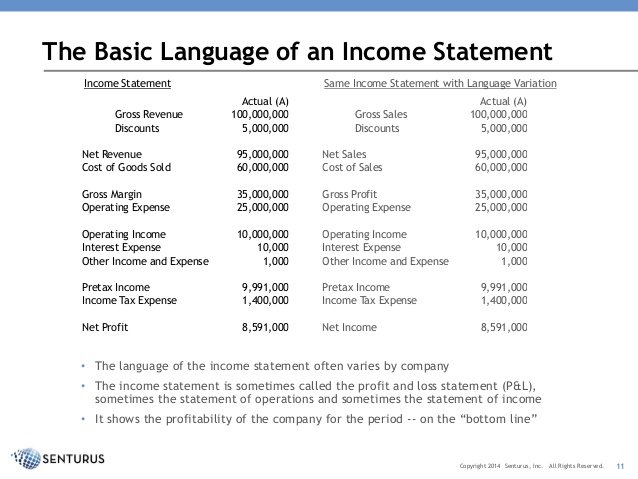

INCOME STATEMENT

WHAT DO TERMS IN THE INCOME STATEMENT MEAN?

1. Sales - Sales represent DIRECT sales to the public or distributors. This will NOT include income from franchisees because the income generated is not by direct sales to public or distributors.

2. Revenue - Revenue represents income streams from NON-DIRECT sources. This will include fees earned from franchisees or fees earned from membership dues.

EXAMPLE: If we take McDonald's as an example, the income generated by McDonald's from selling its products under company owned restaurants would be noted under sales. However, the income generated from franchisees would be revenue.

It is important to note, however, that these (sales and revenue) are becoming interchangeable terms nowadays, and companies often report both under revenue. As a result, in this article, total income will be referred to as revenue from now, instead of sales plus revenue.

3. Operating expenses - These are expenses which only provide benefits for the current period in theory. These could include the costs of materials and labor needed to create products sold in the current period.

4. Capital expenses - These are expected to generate benefits over multiple periods. They include cost of buying machinery and buildings.

5. Operating income - This is basically total income minus total operating expenses. It tells us how successfully a company executes its business plan to profitably sell its products.

Operating income = Total income - Operating expenses

6. Net income - Operating income minus net interest and taxes is referred to as net income.

Net income = Operating income - (Net interest + Taxes)

"THE 2 BOTTOMLINES"

7. Net margin - To measure profitability on a relative basis, we can use net margin. Net margin is net income divided by sales.

Net margin = Net income/Sales

8. EPS (Earnings per share) - If we divide net income by the the total diluted outstanding share count (total number of shares of the company), we get EPS or earnings per share.

EPS = Net Income/Total number of shares

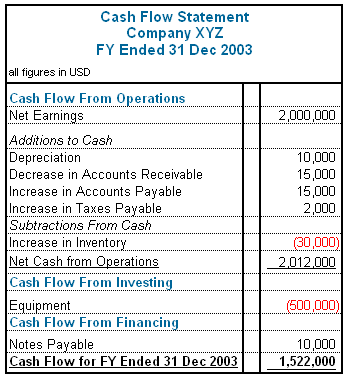

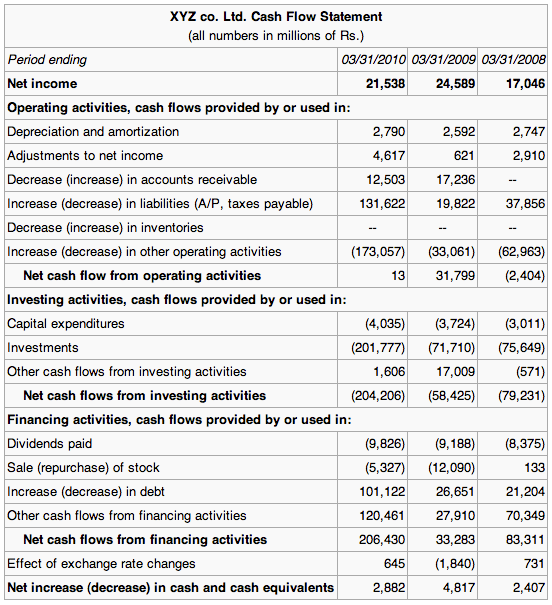

CASH FLOW STATEMENT

(X) - means cash outflow of $X.

(X) - means cash outflow of $X.

This is probably the easiest financial statement to analyze, and may even seem intuitive after going through the balance sheet and income statement. It tells us about a company's cash inflow and outflow.

When cash inflows are more than outflows, it is obviously good for a company. However, spending money on investing activities (outflow) could be necessary for the long term benefit of a company. A good operating cash-flow ratio and an acceptable proportion of investment-related financing are healthy signs.

1. Operating cash-flow ratio - This ratio tells us how well cash covers the CURRENT obligations of the company.

Operating cash-flow ratio = Cash flow from operations / Current Liabilities

I will be covering other terms like ROE, ROC, ROI and things like how to value a business in the next part.

Follow, comment, and upvote if you liked this. All comments will be upvoted, and all people who follow will be followed back.

Thanks,

Thank you for reminding me of my lost accounting skills. I have never really enjoyed accounting but atleast you have reminded me of my days as a student again. Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great tutorial. I have been looking for something like this. You've got my vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit