I'm sure many of you have made a lot from Ethereum/Bitcoin/Other Cryptocurrencies, some of us may have made enough to start thinking about some larger investments such as property, land and tangible assets.

This article is all about how to find the best asset for your investment and how to maximize (juice the S@#% out of) the profit of said asset. For this Article I will be analyzing the property market, but the rules and work done here can be applied to any asset you wish to invest in and or purchase.

1. Ratios and Simplification

This is the whole corner stone of my article, so first I want to explain why I use ratios, what they tell us about the intrinsic value of our asset and how two ratios compare against one another.

ROI Ratio

ROI Ratios I define as the ratio of the income the asset produces divided by the expenditure that we must spend in order to maintain/keep said asset. This is basically what accountants do with an income sheet, comparing the revenue against expenditure for profit, but rather than using deductions we divide because it's much cleaner to compare that way and we can define a simple cut-off point of point of

Income/Expenditure = 1

As the global minimum for ROI Ratio (So we exclude any asset where Income/Expenditure < 1)

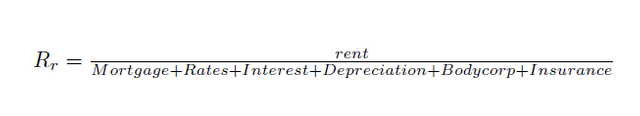

So for our example of property, a good example of a ROI Ratio would be: Rent / (Mortgage payment + Rates + Insurance + Interest + Depreciation [How much repair do we need to do] + Body Corporate Fees [Apartments] )

Okay so now we have established what our ROI Ratio is, we must move on to our next ratio

Total Asset Ratio

Our Total Asset Ratio or TAR is what I use to compare two assets with different price points and different ROI (For example we have two properties, one more expensive than the other with two prices and different rates, body corp fees, rent, etc), this TAR will allow us to directly compare these two assets to see which one is more suitable.

Our TAR is very easy to calculate

TAR = ROI Ratio / Total Asset Price

So for our property example, this would be : TAR(House) = ROIRatio(House)/ (House Price)

What the TAR measures is: Say we have two properties, one has a ROI of 2 (That is the income is twice the expenditure) which has a price of $400,000. The other property has an ROI of 2.5 which is higher than the first, However this property costs $800,000, obviously the first property is a better buy as we could buy two of these for a total ROI of 4 for the price of the 2.5 ROI Property, and this is what we calculate with our TAR.

TAR (Property 1) = 2 / 400,000 = 0.000005

TAR (Property 2) = 2.5 / 800,000 = 0.000003125

We can immediately see that TAR(Property 1) > TAR(Property 2), and therefore we opt to purchase Property 1.

The simplification is in the use of ratios, by using these ratios we can quickly and easily compare assets across the board of different values, income and expenses, and we can even automate this process in Matlab or the programming language of your choice! (We will leave this for another article). We Purchase the Asset with the LARGER TAR value to maximize our profit.

2. Mortgage/Loan distribution

This is actually where the math gets a little bit 'Interesting', so you may be wondering: "Okay so I have $x, and I want to take out a mortgage/loan but what should the distribution be between my capital and the mortgage/loan, basically how much should I take out as a mortgage/loan to purchase my asset?"

Most people will probably tell you to "take out as much as possible, put the minimum on deposit and the rest on mortgage", I will tell you why this is a BAD Idea, first of all regardless of contracts and the suchlike, banks are great, until they're not (we've had 2-3 depressions over the past 100 years all caused by banks) so being reliant on the bank for 90% of your asset is a bad idea especially when they can call in the debt and sell it in a pinch.

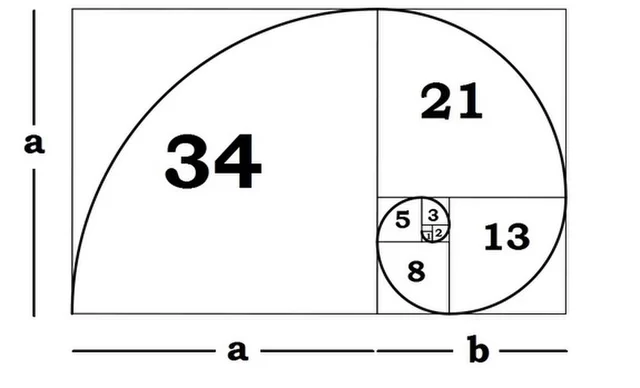

If any of you are familiar with elliptics / elliptical integrals then I'm sure you've heard of the "Golden Ratio", this is (1+sqrt(5)) / 2

this works out to be about 1.618..... I work within 10% of the golden ratio rounded to 2s.f. for the maximum and minimum capital outlay. So my minimum outlay would be 72% Mortgage and 28% Capital and my maximum would be 52% Mortgage and 48% Capital, and here is why:

Two quantities are in the golden ratio if their ratio is the same as the ratio of their sum to the larger of the two quantities that is if : (a + b) / b = a/b, here our a = Mortgage and b = Capital, we want (a+b)/b = a/b, if we take Mortgage = 62% and Capital 38% then we have approximately the golden ratio, what this 'golden ratio' means for our investment is that we have the perfect distribution in terms of repayment of the mortgage, with enough capital left to purchase several other properties (if 38% used we can still purchase approximately 2 more), this means we can maximize our ROI across several assets, whilst also being fairly secure from bank problems and if you get caught in a pinch financially.

3. Conclusion

Using the Aforementioned ratios and other quantitative factors we can accurately compare the intrinsic value of two assets and discover which one to purchase for maximum profit return over time. We also took a look at mortgage/loan distribution should you need it (I think it is wise/necessary for property) to find the perfect distribution for capital retention but also overcoming market climate factors (bank) and using the golden ratio to approximate the mortgage to part of an ellipse for efficient and effective mortgage repayment structure.

This article was slightly mathematically involved and I wish they actually had proper mathematical symbols here (I tried putting some Latex stuff but apparently they do not have that plugin for markdown latex), I just hope I didn't bore you guys to death too much :P as I wrote this article as I was giving the same sort of advice to people over multiple comments and thought it'd make a nice article.

Thanks for the article. Do you have any opinions on near future trend for the real estate industry (market)? Do you see THE REAL CRASH coming, as some have been giving that warning?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It really depends on location, property markets differ across countries of course... There could be a crash or there might not be, unfortunately CDOs are a thing again called "Bespoke Traunch Opportunities" which means we could have a similar collapse like '08. However, the thing about smart investing (especially in property and such like) is to protect yourself against these 'collapses' and also to start thinking big picture and long term, if you buy a property with 28% Capital / 72% Mortgage and say its value is 400k, this means you invest 112k with 288k Mortgage. Now if you rent this property (Rent usually does not decrease with a collapse of housing market it usually increases), we use the rent to pay off the mortgage, and say we break even in 5 years, also suppose that in this time the market has crashed and our house is now only worth 65% of the value purchased at which means its now worth 260k, You might say "Holy shit this has decreased and I have lost money!", No, definitely not, you just have to think big picture, you started off with 112k and in 5 years this investment is now worth 260k, that is just over 2.32x return on investment over 5 years which is pretty damn good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Plus continuous future income (residuals if you will) from rent. Wow!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly! Pretty amazing isn't it? :P That's why I'm highly vested in property

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanx, I really never looked at it this close.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No worries mate :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow! very good article, i been study about investment of rental property myself, few things i had learn is that there are landlord friendly states and tenant friendly states. i think we stay with landlord friendly states. i want to know what is your opinion about it ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well I'm from New Zealand which has quite different rental rules than USA, apparently USA is pretty annoying with renting in terms of state legislature so I would go with Landlord friendly for obvious reasons.

However in New Zealand our tenancies are fairly tenant friendly (Which is actually a good thing In my opinion), and I tend to use Rental Managers such that I do not have to micromanage each property

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit