Introduction

I've been involved in conversations about sound money here on Steem lately. A common theme seems to be decrying banks and bankers. But what different people consider an appropriate remedy to the situation differs a lot. I will shortly discuss questions like the nature of money, what kind of money exists, what the fractional reserve system is, whether it would make sense to go back to the gold standard or any equivalent money system and what I think would be the best way forward and what role cryptocurrencies may have in the future.

The nature of money

By definition money is the following:

- a medium of exchange

- a measure of value

- a store of value.

To fulfill those roles, money has to be

- scarce

- divisible

- transferable

- durable

- fungible.

The scarcity of money simply means that it is hard to copy. The scarcity of fiat money is enforced with regular audits and law enforcement. The scarcity of cryptocurrency is enforced with preventing double spending using cryptographically secured distributed ledgers. The divisibility of money means the ability to divide it into smaller units. The transferability of money means the ability to transfer it to others. In case of fiat money this is accomplished using centralized datacenters used by banks and other money transmitters or in the case of cash just handing it over. Bitcoin is the first peer-to-peer digital money system that solved the double spending problem and made the network secure. The durability of money means that it is possible to store and use for a long time, preferably indefinitely. Both fiat money and cryptocurrencies are as durable as the IT infrastructures that support them. Cryptocurrencies have the added benefit of being decentralized and robust. The fungibility of money means the equivalence of the units of money. Coins are nearly always fungible but notes are not because they are marked with serial numbers. Units of cryptocurrencies with public ledgers and transfers are potentially not fungible because they can be easily traced. Only those cryptocurrencies that use zero-knowledge-proofs such as Monero, Zcash or Zerocoin have fungible units because they cannot be traced with any reasonable effort. The protocol ensures that all transfers can be mathematically proven to be correct despite being encrypted and not knowable. Ring signatures is one technique used to obfuscate the sender and receiver of a transaction.

What is the money supply like?

There are many types of money in the total money supply classified according to their velocity of circulation:

- M0 includes notes and coins in circulation

- M1 includes M0, travelers checks, money on bank accounts and deposits on which checks can be written

- M2 includes M0, M1, time deposits, money market deposits

- M3 includes M0, M1, M2 and large time deposits and liquid money market assets

How is money created?

M1-M3 is created in commercial banks using the fractional reserve system. Commercial banks are allowed to lend more money than they have in their reserves to their customers and charge interest. This is called credit expansion. It is the main mechanism of money creation in the modern monetary system.

What are the problems and advantages of the fractional reserve system?

Many layman critics of fractional reserve banking - with many found in the cryptosphere - decry fractional reserve banking for allowing banks to generate a lot of income from relatively small reserves by lending tens of times more money and keeping the interest. These critics forget that banks also have costs, not just income. They have to pay for their IT infrastructure, the salaries of their employees, office space and taxes. Large commercial banks are public companies and their financial statements are public information. They are not insanely profitable. Their profits are normally in line with typical large established corporations. A problem of fractional reserve banking is, of course, bank failure and insolvency as a result of too reckless lending. Too small reserve requirements and a lack of sufficient oversight may cause that. The main advantage of fractional reserve banking is, of course, the ability of banks to issue sufficient loans to finance economic growth. If there was no credit expansion, it would be extremely hard to secure a loan for any business venture.

The gold standard and it's abandonment for fiat money

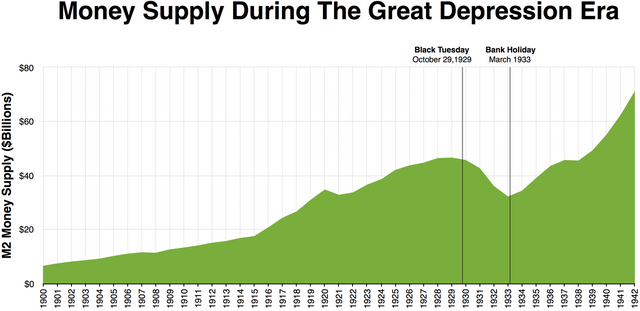

The gold standard means pegging a currency to a standard unit of gold. It was widely adopted in Europe in the 18th and 19th centuries. The gold standard resulted in governments having insufficient liquidity on many occasions if they could not collect enough taxes. Just like fiat money artificially held at a certain value national currency under the gold standard can be and historically has been subject to speculative attacks. The standard was given up for or suspended during World War I in the USA and many other countries. It was reintroduced after WW I and some consider that to be a major cause of the prolonging of the Great Depression where a death spiral of deflation and decreasing spending and liquidity led to a vicious cycle of business failures, unemployment, aggregate demand going down, leading to more of the same. In the USA, Keynesian public spending policies adopted by the government under Roosevelt called the New Deal alleviated the problems. On the other hand, hyperinflation experienced in some countries is impossible under the gold standard.

Under the gold standard money was backed with gold. Money in circulation was intended to be redeemable in gold. Fiat money, in contrast, is backed by nothing but the government that issues it (the national central bank is considered to be part of the government here). It is thought that fiat money is given value by the fact that the government has the sovereign right to demand taxes and fines be paid in it and setting accounting obligation in the national legal tender for those entities that have accounting obligation, thus creating demand for the fiat currency. Fiat money also allows the government to (the central bank to be exact) to control the money supply via instruments of monetary policy to react to situations where a lack of liquidity threatens to cause the economy to grind to a halt. The world seems largely have forgotten the perils of the liquidity trap because the gold standard has been abandoned everywhere already in the early 1970's.

On the other hand we have seen decades of loose lending to the private sector and to governments under the fractional reserve system and fiat currencies lead to mountains of debt and weaker countries succumbing to hyperinflation or near insolvency if they have been members of a currency union (Greece).

I have no definitive answers as to how to how to solve the sovereign debt crisis that afflicts many countries in Europe and elsewhere.

Cryptocurrencies and their potential role

Bitcoin has every property of money in spades (except for weak fungibility). But does Bitcoin or something like Bitcoin have a future as a replacement for fiat money? I don't think so. There could not be price stability if Bitcoin or something like it, say, a Delegated Proof-of-Stake coin that were actually capable of scaling sufficiently were used instead of the fiat currencies of the world. Economic growth would cause deflation, encouraging hoarding and discouraging spending and consumption which are necessary components of the business cycle allowing businesses to have income flows, be profitable and thus stay afloat and provide employment. Without sufficient expansion of the monetary supply, whales and hodlers would potentially become enormously rich at the expense of the creators and producers.

Just like there are hundreds of fiat currencies in existence in the world there is room for thousands or more of different cryptocurrencies. The market should be allowed the decide their usefulness. Interoperability is key. With seamless interoperability, different cryptocurrencies underpinned by different blockchains can each fulfill a different role in the total cryptocurrency monetary supply. Analogously to the historical bimetallic money system (gold+silver), some cryptocurrencies are best suited to be used as high velocity money in everyday use whereas others are best suited to serve as long-term stores of value.

The blockchain and other cryptographically secured distributed ledgers are particularly well-suited for the machine economy as in economic transactions from the extremely small and frequent from the largest taking place directly and automatically between machines. This is achieved by cutting out the middleman. Contracts can be made self-enforcing by implementing them in code and secured by the blockchain. I think that the massive potential cost savings involved will eventually lead to a transformation of the financial sector into a decentralized one. The ERC20 protocol on the Ethereum blockchain, the Waves platform, or the Smart Media Token protocol in the works on the Steem blockchain enable anyone to launch a cryptocurrency. That is something very different from both rigid commodity-based money and sovereign government controlled fiat money.

Awesome write up. Trails from the pasts and dives into the future some have seen which all will eventually see.

The blockchain technology is indeed invaluable, goes beyong selling tokens and eventual cryptos and making life more comfortable, one can aswell run a code that passes information to every linked person within the loop and a whole lot more one could do with blockchain technology.

i'm privileged to be a part of this generation.

knowlege is money afterall

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow a very direct issue to the finnaciero system, who never loses, and who on the other hand make war on the blockchain, I particularly think that this war is given to the structure since it can not corronper everything is recorded. that to the banks in my opinion they do not combine them, and it is for all your explanation and the forms of the money, they (the banks) prefer it of physical way and that this backed in gold.

my grandfather said, with gold you never lose, because even if you lower your price you will always have gold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very useful information! Thank you very much!

Nice work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit