Broke people buys stuff

Middle class buys liabilities

Rich folks buys assets.

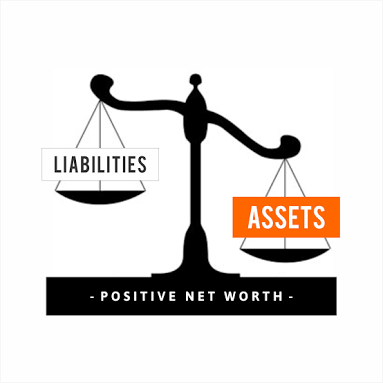

Often times, people find it quite difficult to distinguish between Asset and Liabilities

Accounting standards defined an asset as something your company owns that can provide future economic benefits; Cash, inventory, accounts receivable, land, buildings, equipment. Liabilities are your company's obligations either money that must be paid or services that must be performed.

In order words, Assets pays you whilst Liability costs you.

Or better put an asset is something that you OWN while a liability is something that you OWE.

Let me share this true life story that happened in Nigeria to portray this point properly.

SHINA PETERS VS JIM OVIA

In 1990, Shina Peters built a house with N20,000,000 (~$55,530). The same year, Jim Ovia started Zenith Bank with the same amount.

Today, you and I don't have a room in Shina's house but might have an account in Jim's bank.

Shina's house was built in Iju Lagos and remains there till date.

Jim's bank started in a corner and now has over 500 branches in Nigeria, and many international branches.

Millions upon millions transact business in Jim's bank daily.

Shina's house is becoming dilapidated...in 2015, he spent more money to renovate the house and bought a Nissan Pathfinder with N10,000,000 (~$27,500) additional liability, while in the same 2015, Jim's bank made a huge profit of N105,700,000,000 (~$294,000,000)

Zenith bank employs hundreds of thousands, and feeds their families.

This is the difference between Assets and Liability. This is a practical life scenario of the difference between Asset and Liability.

Spend the little money you have today wisely.

The Porsche cars of today will become obsolete in 10 years time.

Your house could be an asset or a Liability.

If you built a house and gave part or all of it for real estate investment definitely, you have a valuable asset.

A house built basically for residential purpose is a Liability.

Not necessarily. If you have to pay rent to live somewhere and instead you built a house that costs you much less long term you reduced your liability a lot. Also in many markets your house is worth next to nothing while your land appreciates in value in skyrocketing pace. Then while you are saving a lot of money on a place to live in, you are also sitting on an asset that will appreciate in price in a long term. In some cities in the world land doubled or tripled in price in the last 5-10 years.

At the same time your example about bank is good for the one that succeeded. But for every one that succeeded you will find 10 that didn’t. You just wouldn’t hear about those stories much.

So for those 10 that didn’t succeed their investment was very risky and cannot be treated as an asset until it grows and becomes an asset. Until then it’s just a risky investment. Like a lottery. It may pay off well. Or may not.

While a house for someone else might become a real asset if it saves a lot of money. Or makes money if you sublet a part of it (like rent out a basement) while your asset appreciate in price. Even if the house itself (the structure) depreciates while the land appreciates way faster than the house depreciates.

So it’s not always so obvious black and white.

It’s often determined by how the situation unfolds. Easy to know after the fact. Very hard to predict the future.

Although for that - there is risk management. If you make a lot of decisions and manage risk with best statistical approach you might be ahead of the game IF(!) you base your decisions on correct data and process the information evaluating the most powerful contributing factors with more weight than weaker considerations.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I get your point and it is well stated and articulated and shows a wealth of experience in the aforementioned subject area.

Thanks for showing me the other side of the coin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit