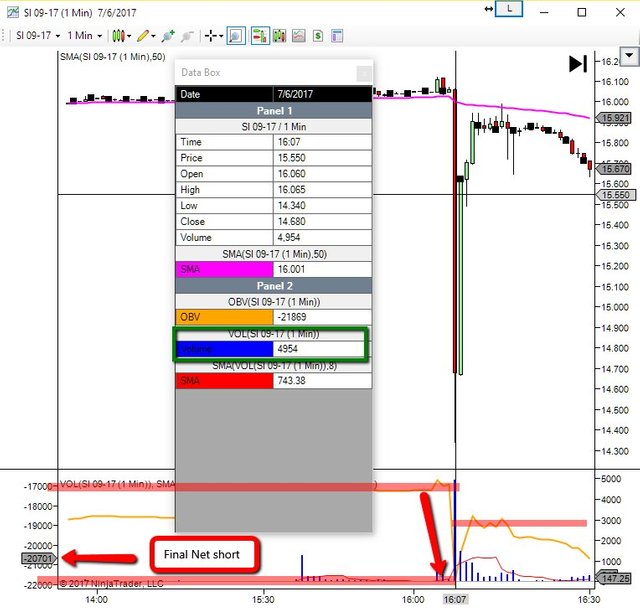

Thanks for the heads up. This is the pic of what occurred, at 4:06 there were 18544 net short contracts as seen in a technical indicator called On Buyer Volume, which is one of the few transaction based indicators (real info) which shows the number of shares traded and if they are net short or long. At 4:07 for 1 minute 4,954 contracts - each contract is 1000 ounces, was fired off SHORT at market and went down to 14.34 with a close at 14.68.

What is interesting is that the OBV was -21,869 at close from a low of -23,600 contracts. Next minute 1300 buys, then 1000 buys, then gradually more and more buys, until the price came to 15.86 .

So the same number of contracts sold (shorted) into this market were then bought right back, but the net of the reaction was to bring the outstanding contracts to -20701 outstanding.

The next 23 min utes it hit -22,000 contracts and price stabilized (not really stable though) at $15.82.

this is a shot of it.

this is a shot of it.

Problem is that the BID is shallow in Silver, it is an expensive contract and no one leaves a bid on in the overnight session. So, if you wanted to crash the market after hours is easier because of less bids at all price levels.

I think your right. Do they really think anyone would sell for that price? Lets just take advantage of this and buy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/silver/@moneymakeredge/silver-crash-or-a-buy-usd16-has-a-little-resistance is the article I mentioned earlier.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit