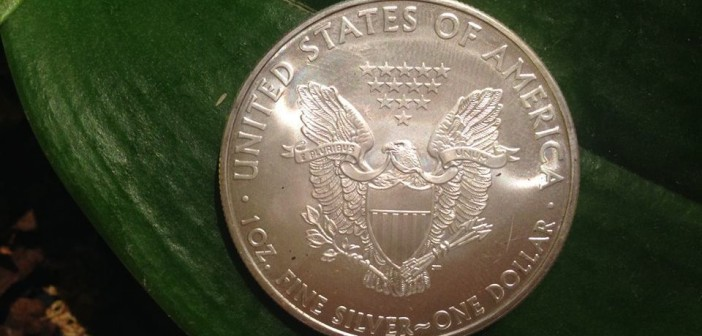

Because of recent swings in the prices of silver and gold, it is important to remember why you have it if you treat it as a wealth cycle investment.

The people who own silver and gold are like coconut trees.

The coconuts represent your holdings in precious metals.

And the market, acts like wilds bears and bulls trying to shake your coconuts away from you.

Your job is to hold on to as many coconuts as you can till it’s time to let them go.

The bull run of precious metals will end one day

Let’s encourage each other with good information to helps us all hold on to as many coconuts as we can until it’s time to finally let them go. So often in history, the middle class gets slaughtered because they come rushing in to invest at the end of a bull run.

It’s also important avoid false bull runs.

David Morgan of the Morgan Report points out something interesting during the last silver and gold bull run.

The price of gold went from $100 to $200. Then it went back down to $100. He recalls that few were still interested in gold when it dropped down to $100. Yet shortly after this event, the price went all the way past $800.

The bears and the bulls will shake your coconut tree. It is up to us as individuals to hold on to as many coconuts as you can until that final market pulse of the heart beats with momentum.

Michael Maloney, in the video below, does a great job presenting a case why gold and silver prices are heading higher. He also presents the case why the next financial crisis may be your greatest opportunity.

it's all going to BUST loose one of these days and precious metals will go to the MOON!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit