Blame The Federal Reserve

If you are under the impression that the current administration is some how to blame for what's happening in the stock market, this post is probably not for you, rather go watch some fail videos or CNN.

The current situation in the stock market and banking sector is due to decisions which were made a long time ago, and these things tend to take some time to rear it's ugly head.

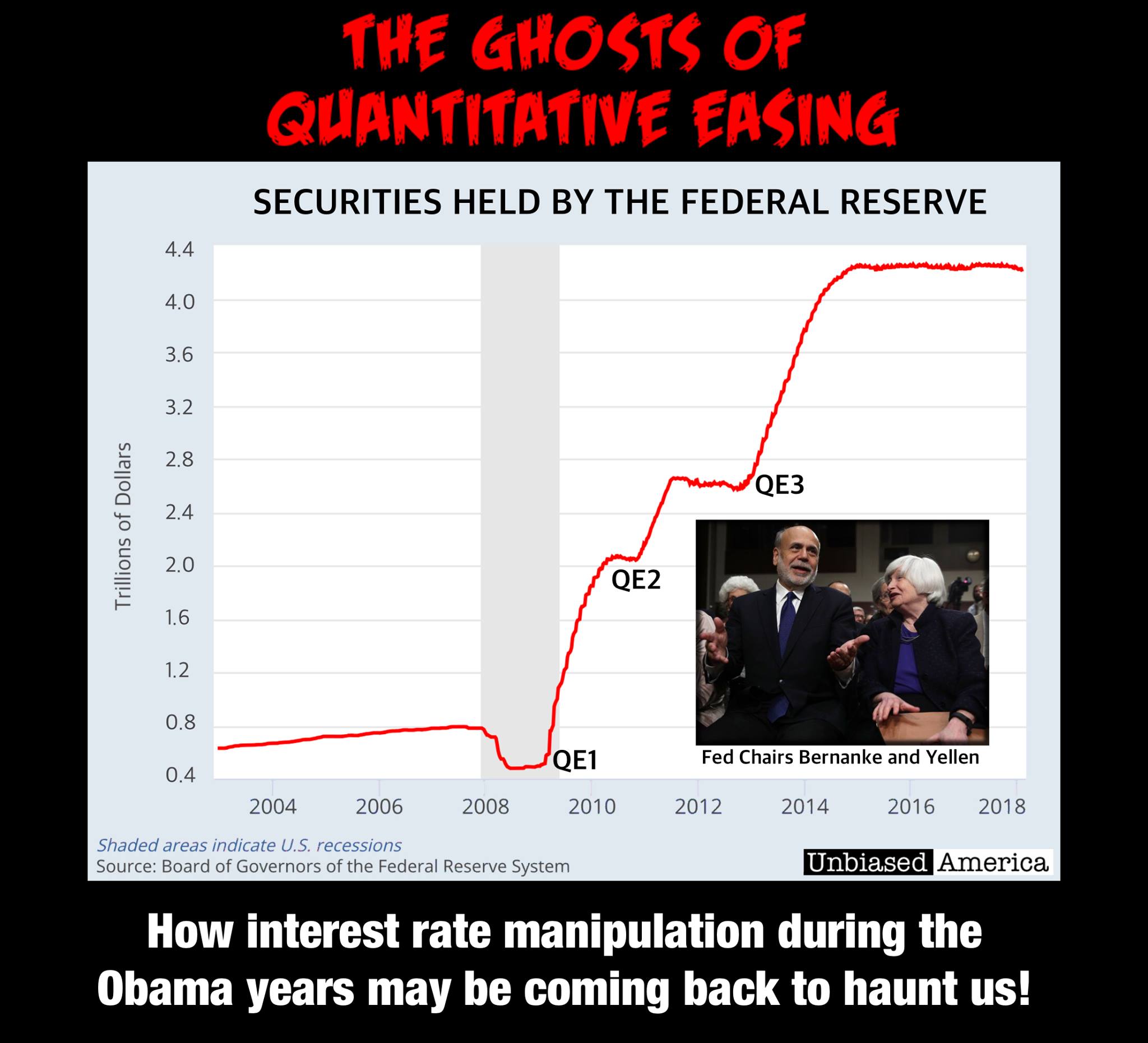

What, might you ask, were those decisions made? Well quantitative easing of course, or excessive money printing as we like to call it on the streets, me explain it. During times of recession, the Federal Reserve usually attempts to stimulate the economy by lowering short term interest rates, making it cheaper for banks to raise funds to cover lending, thus stimulating lending and investment. Unfortunately during the 2007 Great Recession and the weak recovery that followed, these short term rates were already near 0%, and could be lowered any further. Until Fed Chair Ben Bernanke at the time and the FOMC decided to start manipulating them.

"Since the global financial crisis and recession of 2007-2009, criticism of the economics profession has intensified. The failure of all but a few professional economists to forecast the episode - the aftereffects of which still linger - has led many to question whether the economics profession contributes anything significant to society." - Robert J. Shiller

The Fed began manipulating the economy by creating money electronically, out of nothing and used it to purchase longer term treasuries and mortgage-backed securities from banks.

This artificial increase in demand allowed borrowers to negotiate lower interest rates from lenders, stimulating the housing market and keeping the government debt rate low.

But as any historian knows, artificially low rates create bubbles. Asset bubbles are assets like houses, or stocks, whose value has been inflated by non-market forces. As in the housing crisis, it soon it became clear that borrowers could not pay back these loans, which never would have been made if the lender wasn’t forced to offered guarantees by the government. Defaults exploded, houses were foreclosed on and the real estate prices plunged. The housing bubble burst.

"What bitcoin does better than the current financial system is it's a better stored value globally. There are a lot of countries that really don't trust their banks or their currency, and bitcoin is an alternative." - Adam Draper

The quantitative easing that have kept interest rates artificially low have resulted in asset bubbles all over the economy.

Today were are literally back where we were in 2007, only this time it's the stock market, student loads, car loans, credit card debt, pension funds government debt and also housing market, all in massive bubbles due to interest rate manipulation by the Federal Reserve. We are about to find out the extent of that manipulation, so prepare yourself accordingly. Shit is about to get real, and those decisions made by Obama and Bush are coming home to roost.

You're either laughing or you're learning.

Thanks for popping in, hope you liked the post. Please leave me your thoughts and or opinions in the comments below, have a beautiful day.

Proudly powered by ADSactly - click this image above to join our discord server - you are ADSactly

✯ ✯ ✯

lol -

As started reading your post, I was thinking I'll have to comment and point you in the direction of Molyneux's you tube...

doh! lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hahaha yeah, big follower of Molyneux.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Me too, mate.

I'm currently writing some posts (up to part 3 at the moment), inspired by his IQ discussions..

https://steemit.com/blog/@lucylin/let-s-not-get-blinded-the-elephant-isn-t-going-away-yet-part-2

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The market is green, Nobody will ban bitcoin, Crypto currency is the future. yee

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes it is!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We are unstoppable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing this post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

a great post ... if any free time visit my post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

just the beginning of the correction. when you have POTUS making promises, (no offense) and acting less, what do you expect as the outcome? mass psychology of the markets. let's not forget either way the market moves, bulls make money, bears make money but pigs get slaughtered.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit