Apple had their best ever 3Q ever. EPS grew by 40% year over year, revenue grew by 17% year over year and Apple beat the Wall Street estimates handsomely:

EPS: $2.34 vs. $2.18 estimates

Revenue: $53.3 billion vs. $52.34 billion estimates

iPhone sales: 41.3 million vs. 41.79 million estimates

Apple posted $9.55 billion vs. estimates of $9.21 in services' revenue for the quarter, an increase of 28% from the same quarter a year ago. But it was their forward guidance of being on target to reach their goal of doubling their 2016 services revenue by 2020 that resonated with investors. As I mentioned in a recent post, the amount of money their service division makes is on par with a Fortune 100 company.

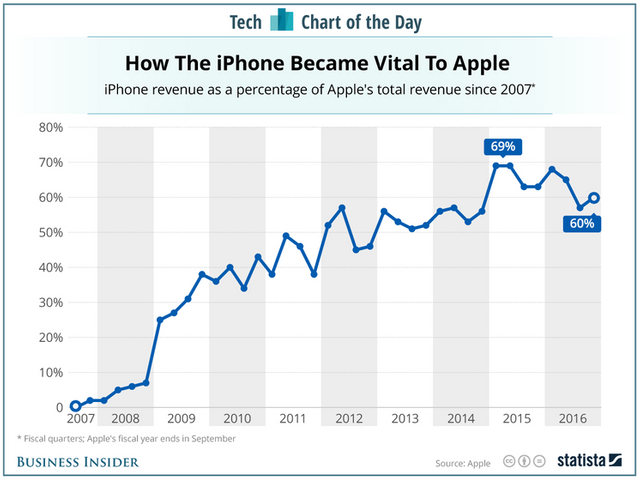

Roughly 66% of Apple’s revenue comes from iPhone sales.

As you can see from their results, their sales of iPhones were flat and a bit under the Wall Street estimates. However, there is a reason Apple is the most valued company on earth. The make a product that they can charge whatever they want, that customers still salivate over.

A metric not included above is the average selling price of the iPhone and it jump considerable to $724, up from $606 a year ago. The only culprit that could be responsible for this was the iPhone X at a price of $999.

NOTE: You never sell anything at a whole price, so to give the impression that the product isn’t that expensive, you sell it for $1 less.

As Apple starts to become less and less reliable on the iPhone for its revenue, another segment at Apple that I will start paying attention to is Apple Pay. Transaction amounted to over 1 billion transaction for the last quarter, triple the amount from just a year ago. This was more total transactions than Square and more mobile transactions than PayPal."

Issuing forward guidance that is ahead of Wall Street estimates doesn’t hurt either. Apple guided fourth-quarter revenue between $60 billion and $62 billion vs $59.47 billion estimates.

On Wednesday, the stock price responded to the result because everyone was playing catch up. Shares of Apple hit a new intraday high in Wednesday morning’s trading up 5.3%, to $200.31. To get to that $1 trillion dollar market cap value, Apple’s stock needs to rise $3 more dollars.

Based on analyst price targets,

Analyst Wamsi Mohan reaffirmed his $230 price target.

Analyst Katy Huberty reiterated her overweight rating and $232 price target.

Analyst Michael Olson reaffirmed his overweight rating and raised his price target to $218 from $214.

Apple will have no problems getting their and I think they get there within the next several trading days. But now I’m confused…

is it the iPhone X or Warren Buffett that is responsible for Apple’s rise to $1 trillion market cap?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

apple is apple

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nice technical and fundamental analysis. Top!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit