Bad financial decision roots from misinformation - at least in my case. We gather it through our society – be it in the family setting, the school, even the entire nation through culture and traditions. What can you observe from our society? Some financial educators mentioned what is called “poor mentality” where financial management is given the least importance. There was even a documentary on why Filipinos can't be rich. In my case, what are the contributing factors, then, to my bad financial decision? I will consider just three.

CONTENTMENT AS I VIEW IT BEFORE. Before, contentment means being happy with what you have. There is no need to work harder or smarter. Apply for a job, receive your salary and save if a penny remains. It is okay not to have sufficient funds for the future – you don’t have to worry for it. BE CONTENTED WITH WHAT YOU HAVE RIGHT NOW. What’s the danger? No funds in case of emergency.

MONEY IS NOT THAT IMPORTANT. I had this mentality that you can be happy with less money – at times, I still find it true. But, when there are more reasons to feel the otherwise, I know that money can do something. My belief on this also root from my experience that fortunate things happen when I need money. I managed to finish college through financial assistance – not from parents nor from relatives. Likewise, I survived three years after college even with very small amount on my bank account. Never did I realized before that learning about money is VERY, VERY IMPORTANT.

WORK FOR JUST WHAT YOU NEED. Relative to contentment, I also did not tried harder earning funds. I let many opportunities pass just because I thought that I will not be needing much soon. I should have experienced working in a retail industry, in banks, restaurant and others that should have improved my skills and add up to my value – and the value that I can provide others. But… yeah, I DID NOT.

The mistake, or mistakes?

I DID NOT START EARNING EARLY. Except for what I did when I am schooling – after graduating – I did not forced myself to earn. I did not exert effort to learn anymore. I thought I was smart enough to live the CONTENTED life I aspire. I should be financially free right now if I started early. Moving on...

I DID NOT INVEST ON FINANCIAL LITERACY. My college degree touches some of it – making me feel stupid, tanga. Is it correct? Tanga means doing things in contrast with what you should know. I know about how interest works. I know how time and money can work together. But, I think, I did not learn because learning means changing behaviors – and my behavior towards money did not.

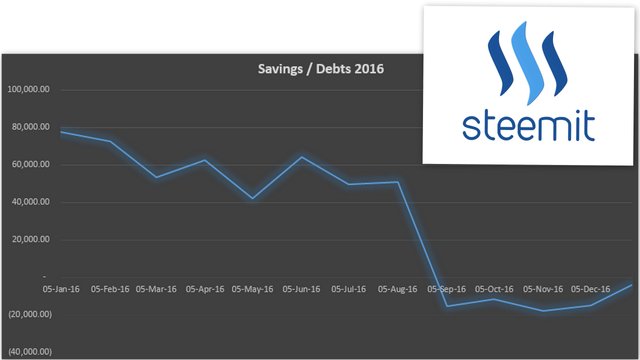

I LET MY FUND SLEEP (OR DEAD) ON SAVINGS ACCOUNT. Related to my being tanga, I just deposited the money that I am able to spare from expenses to be on my savings account. Aside from emergency expenses, inflation also eats up my savings – very, very fast. In the Philippines where I live, there is an estimated 3-5% inflation rate - on June 2018, 5.2% is the posted cpi or inflation rate. The small savings went even smaller in value.

I RELIED ON MIRACLE. Just like what I narrated, I seem to have something to get what I need. So, I thought, it will be the same over and over. I thought, there is a financial hero - supermoney and wondermoney, i guess, haha - coming in for a help – it could be that one who gave educational assistance or through hand-me downs from kind people. It was proven wrong when financial crisis kicks in, it was disastrous.

Looking back, I blame myself for not doing the good decision. Again, I am still clueless why I am still sane (or am I not, haha). Well, there are some cases I talk to myself. In some occasion, I wake up at 2AM and tears just… you-know-what, sometimes for no reason, most of the time finding out the reason makes it worse. Include those problems that are non-financial, then, yes, it’s easy to go insane. But, shifting my attention to the brighter side, if you consider there is, I think I know better now. It’s inevitable to think what could have been or what should I have done. But, I guess, it’s better to think about what to do, now – now that I made a bad decision. I remember that one person who told me to capitalize on that experience to be better.

I will be covering that on the next section. Here, on my Chronicles. Hang in there... my plan for financial freedom will be written and posted soon. :D

By the way, I am not sure if you are aware about voting for witness. Please go to https://steemit.com/~witnesses and look for @steemgigs . You will be glad you did. :D