In last month or so, I've been talking about the surprisingly high levels of pessimism in the silver and gold stacking community. I've noticed this on my channel, and through the comments people leave, but I've also seen it in other places, on forums and such. Eventually, I coined the term "Peak Despair" to describe this. Essentially, it would appear that a high percentage of silver and gold owners, are sick of how the market has been behaving, particularly since last summer.

(Feel free to watch the video, or continue reading)

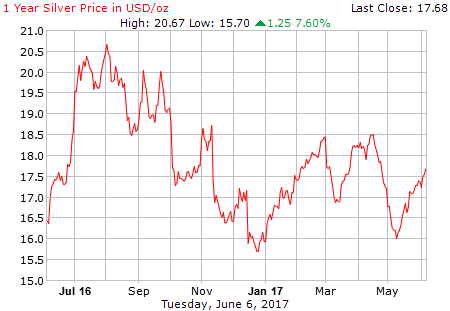

Last summer, we witnessed the price of silver top $20 for the first time in almost 2 years. It was an exciting rally for many, considering silver was below $14 at times, during the previous winter. Yet, that rally fizzled out. All eyes were on the election.

Regardless of their political affiliation, most Silverbugs were excited to see Trump pull off the upset, and win the election. They were excited, because most mainstream pundits and analysts were predicting a stock market crash, and a precious metals rally, if Trump were to win. Of course, that narrative disappeared about as fast as Hillary Clinton did from the political scene. All of a sudden, Trump was supposedly great for the world. He was great for stocks, earnings, jobs; he was going to make America great again. Or at least, that's the narrative the mainstream media pushed on the markets, while simultaneously trying to undermine his every move.

The result of this exuberance, was a crash in the price of precious metals. Silver fell from over $18, to under $16. However, starting right before Christmas, silver once again began a rally in the winter, much like it had the year before. It rallied above $18 in February; stackers were getting excited again. Then, it was smacked down. It mustered another rally above $18, and was once again smacked down to around $16.

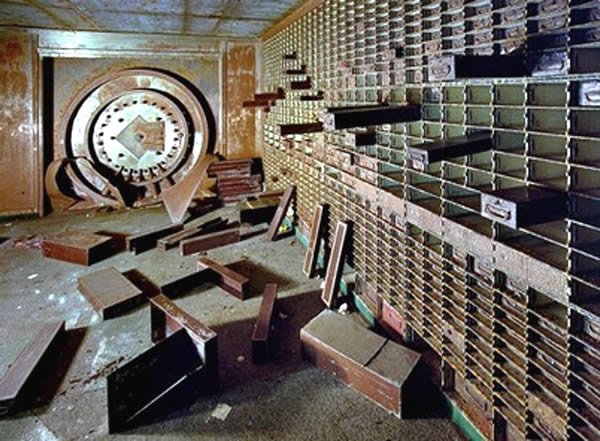

This pattern of rallies and crashes is familiar to the long-time stacker. Silver is not only a volatile metal, but it is a manipulated market. Furthermore, the price of silver is largely controlled by the paper market, for the time being. What this means, is that even though the physical supply and demand fundamentals for silver are incredibly bullish, going forward, the paper market is currently what sets the price. The veteran stacker realizes this, and takes advantage of these dips. They are looking forward to the day when fundamentals finally catch up to the paper market. They are looking forward to the day when there is no longer a strangehold on the silver market. In the mean time, they stack.

A stacker having his silver delivered, after buying the dip

However, I think this past May was particularly tough for many silver and gold owners to handle. Keep in mind, that most of this "Peak Despair", was coming from those that are relatively new to silver and gold, and will likely be persuaded out of their positions by the low prices. The strong hands likely were happy to take advantage of that dip.

Here we are in June; is the worst over for silver? I'd be a fool to conclusively say that we will never see prices around $16 again, especially when you consider we have a FOMC meeting less than a week away. Currently, it would appear the Fed will once again raise interest rates, which could certainly cause silver and gold prices to drop. However, I don't think they will fall by much, when you consider that this rate hike is largely priced in by the market. At this point, even though this is a manipulated market we're talking about, I'm not convinced we'll continue to see these heart-wrenching dips. Each time silver is hammered down in this manner, manipulators are digging themselves in a deeper hole of physical supply shortages.

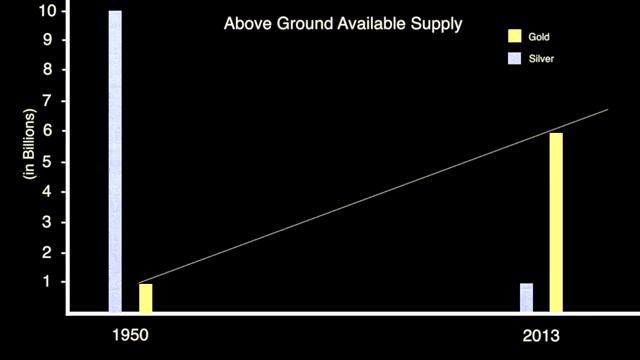

Something I've talked about in past videos, is how billions of ounces of above ground reserves of silver have been depleted in the last 50+ years. This extra physical supply, has served to suppress the price of silver, year after year. However, each dip in price is often also taken advantage of by the buyers. Stackers buy the dip, oftentimes. However, stackers are not the only entities that understand the long term fundamentals of silver and gold. Eastern giants, like China and Russia, are also likely taking advantage of these dips, as they continue to accumulate physical assets.

From 2013; reserves today are even smaller

Is the worst over for silver? I believe that may be the case. I'm not convinced we'll see a crash in silver prices that coincides with a crash in stocks, similar to what happened in 2008. Though, I wouldn't rule out the possibility. The big picture idea of this video, is not to make a correct prediction of whether silver will be hammered down, like it has been in the past. Perhaps I will be correct, perhaps not. The message to take away from this, is that it doesn't matter. A short term crash in the price of silver, only makes the fundamentals even more bullish. It doesn't fix the physical supply and demand problem. It doesn't suddenly negate the value of silver as a safe haven asset. None of the world's geopolitical, economic, fiat, and debt problems are solved by a brief crash in silver prices. In the end, these dips, are exactly that, dips. They are a buying opportunity, a chance to load up, before the eventual and inevitable collapse of the current system, and the manipulation that is enabled by this system.

Image Sources: https://docs.google.com/document/d/17pbiAwufzoXSJ-nxrjgb6085TUIeda-rFkM5ZsXiiAE/edit?usp=sharing

I just bought a large safe to mount to a wall, and store my silver bullion coins.

now silver have no choice but to go up, and fast !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I caught the silverbug late in the game. I'm investing as much as I can in silver now, while the prices are so low. If the fix were to end tomorrow, I'd be greatly disappointed because I ran out of time to consolidate my position. To me, the longer the price fix stays in, the more time I have to buy.

Those who are upset about silver price need to ask themselves why the are so. Are they looking to somehow profit off of silver in the short run and believe an unmolested price will help them do that? Are they looking to cash in after years of accumulation, hoping the price will go up so they can take profits? Or are they holding silver for the long run, as insurance against a market crash or worse?

I fall into the latter category, and to me, the longer the price stays here, the better. The only time I want the price to go up is when I'm planning on needing it, when the economy tanks. Basically, Silver is insurance to me, and I want plenty of low cost insurance to protect myself from an eventuality. Profit is not my primary objective with this asset class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think the majority of stackers agree with you. I just feel bad for the retirees that are ready to sell, after decades of buying. That, and the fact that low silver and gold prices help enable the current system of Fiat and debt.

Stack on!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True, retirees don't get to see the full benefit. However, retirees do benefit from the anti-inflation properties of their investment, unlike if they had their money in cash, money market, or bonds.

Discussing this inspired me to write an article. You can see it here: https://steemit.com/silver/@infinite-monkey/silver-and-gold-for-insurance-not-profit-use-market-manipulation-to-your-advantage

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Already saw it 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A few years ago I thought it would be fun to buy silver! I bought a bit at around $24 per ounce. The price went up to $40 and I thought I was RICH! LOL ... then this. The crash. Now I'm holding wondering when/if I can get out and invest in something else. For now... I hold :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The periods of maximum pessimism are my favorite times to buy. Good post! Resteemed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buy when there's blood in the streets... 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly. To make loads money when investing, you need to learn what everyone else is doing wrong and figure out how to profit from it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm surprised by all this disheartened stackers, since 2016 things have been on the up albeit slowly!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @silverfortune, great content! What is your opinion on the likely rise of gold in my article? Do you agree with it? You can read it if you want, thank you! https://steemit.com/gold/@unknowncrypto/the-bulls-are-returning-to-the-gold-market

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting post. The whole idea is to buy low, when the pessimism is at its highest.

Three days ago I wrote a post , where I analyzed the gold-silver ratio.

This could interest you.

Here is the link:

https://steemit.com/silver/@nenio/is-silver-undervalued

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really hope the end of rigging silver is over soon...on top of that still be able to stack before its shoots up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never been a get rich quick kind. Just like inexpensive silver so I can afford to buy. Thank you and take care.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Last time the fed raised rates, gold and silver rallied short term. Maybe they will rally again if the rate hike is already priced in. $1300+ gold soon!??

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it hit a bottom after the first rate hike

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't invest in metals as a "get rich quick" strategy. I'm in it for the long haul. You've got to be patient with metals. The manipulation is enormous, but it can only last for so long. In 2004-2005 silver went up to $50 an ounce. Currently it's at about $17.80. I will keep stacking and see what happens. I'm extremely optimistic about valuation of silver and other precious metals in the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Silver reached around 50 USD in 2011.

Most undervalued asset on earth, IMO.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're so correct! I'm not sure why I said 04/05. Thanks for correcting that. Onward and upward my friend :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post. I've been buying since 2011, I think most of us expected gold and silver to surge to new highs before now - pretty clear where the hedge against fiat has gone the past 6 years! Will metals be needed in future? I think we're going to see Faith lost in both fiat and cryptos before then..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article mate I've been stacking for a while now and if I'm being honest I don't let the manipulation worry me to much I firmly believe that the silver bull will smash them in the end thanks mike

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unfortunately silver will continue to defy the market logic and stay relatively low..

I have a post that you mite like to see called the Silver bullion Secret

that shows I have a detailed understanding of the bullion market.

I'm going to put up a post soon to explain why its going to stay low for a while yet.

Cheers

nice upload

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's starting to look like it's building some good momentum. Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I highly recommend checking out the latest interview on @x22report spotlight:

To reach a greed climax the elites want everybody's money. So when it explodes they don't want anyone fleeing to the safe haven of precious metals. They have virtually unlimited fake, phony, & false paper "assets" with which to ravage the precious metal markets. Of course there will also be "natural" selling by people who need to cover margin calls.

In any case, there is a distinct possibility they will ruthlessly drive down prices. Gold could be driven down significantly, but perhaps only kilo bar buyers will be able to get it at those low prices.

So in essence, after they wiped out the stock & real estate owners, and have driven plenty of metal owners to panic and sell, they will swoop in and buy low and end up sitting on tons of precious metals.

Stay strong, and don't be surprised if they drive down prices in a blitzkrieg. @roused

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm in the "stay under 20 as long as you can" club for silver. I'm stacking for the long game, and like many others, I started as the price was coming down off the 2011 highs. There is a pawn shop on my way home that sells silver bars and rounds they get at just a dollar over spot, and they give me a better deal when I buy some bulk from them. Ill just slowly build my cache, and bide my time until I "need" to transfer silver to another currency, maybe directly to crypto, depending on the state of the world at the time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit