Full article here

Below are a few excerpts from an article I came across that was published yesterday by Sol Palha of GoldSeek. Does anyone feel like cryptocurrencies could play a role in the large disparity between Chinese and Americans with regards to how much they have saved? Or could it be that, being closer to the source of goods that Americans ultimately import from China is much cheaper for them which eliminates most of the added costs that Americans incur?

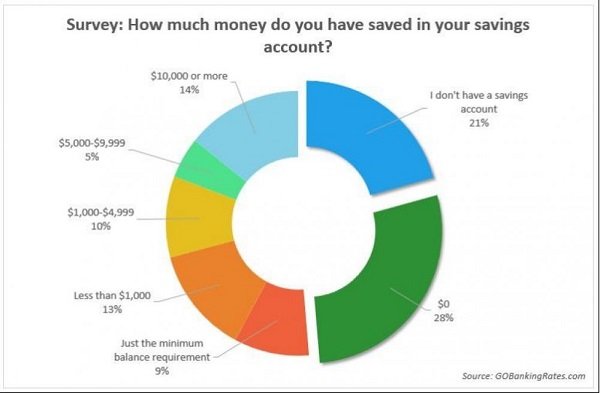

A key sign of financial health is savings; if one does not have a decent amount of money tucked away for a rainy day, it is a sign that all is not well. Americans have a very hard time sticking to a budget and saving, compared to their Asian counterparts. This is reflected in the startling revelation that over 62% of Americans do not even have $1000 in their savings account. Foreigners are shocked when they find out that Americans have so little money saved for a rainy day.

“It’s worrisome that such a large percentage of Americans have so little set aside in a savings account,” said Cameron Huddleston, a personal finance expert and columnist for GOBankingRates. “It suggests that they likely don’t have cash reserves to cover an emergency and will have to rely on credit, friends, and family, or even their retirement accounts to cover unexpected expenses.”

If 62% don’t have $1000 or more what will they do if someone misfortune should strike? Hope that some Good Samaritan throws money on their laps. Many Americans are having a hard time but if one examines some of the things the typical American family purchases one will note that there are many items that would fall into the category of non-essential’s.

The situation in China, on the other hand, is quite different; in one of our recent articles of which an excerpt is posted below, we illustrated how many of the Middle-Class Chinese have $50,000 or more in savings.

I upvoted you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit