In the new era of smart phones and cutting edge technology there have been many new ways for people to invest and save for the future. Many Americans, especially millennials know fairly little about the stock market and have no desire of saving for their future. As a teen I took a course in learning about the smart investing, but as with many things I learned at that age, I quickly forgot. In order to combat this problem, in the past few years many new simple investing apps have been created to allow the average person to invest. I personally use Acorns and Robinhood, which can be found in the app store given your current smartphone. Although these are my favorites there are many others which can be used such as Betterment, Stash, Wealthfront, and Openfolio. In this post I will only focus on the apps I use since I’m the most familiar with them, but I would suggest you do your own research to find what apps you like the best.

Acorns

I have known about Acorns for about a year now. I was introduced to this new investing app through a tweet from my cousin. At first I was timid and impatience about putting money in the account, wanting that instant gratification of making money that I had so sought after when thinking about the stock market. This caused me to neglect the service and not really put money into it like I should’ve because unrealistic expectations I had in mind. This caused me to delete the app and forget about it for about a year. (I was still in college at the time so saving what little money I did have was not my highest priority)

So, after about a year, fresh out of college starting a new job, I decided that investing was something that I really wanted to do. This would be important in having money in the future to be able to have that financial freedom in which is so coveted today. I decided to download Acorns once again and low and behold, realized I left money in my account. I wasn’t aware of this, but was excited by this news. Even though there was only a mere amount of $19.83, I was able to see the great potential of investing through the app.

You see, I had only had $17.30 in the account when I had decided to call it quits. I had made $2.53 throughout the course of the year doing absolutely nothing. Now you might be thinking to yourself that that’s relatively nothing and I would have to agree, but it dawned on me to do the math that’s a return of about 12%. This really struck me because I realized that if I had put more money into my account I would have much greater returns. For example I would’ve made about $12 from $100 or $1,200 from $10,000. This really excited me and got me to decide to really commit to using the acorns app and saving for my future through investing.

The thing about Acorns is they made it really simple to invest without making us, the users, really have to use much effort. Acorns invests your money in diversified ETF’s of over 7,000 stocks and bonds, re-invests dividends earned, and rebalances your portfolio for you as warranted. They also provide different portfolios depending on what you are looking for and the type of person you are. For example, I use the aggressive portfolio because it has the highest earning potential in the short term. This is very helpful especially in a busy person’s life because they can know they are saving and don’t have to worry about devoting time towards it. Acorns allows for you to invest with as little as $5 and only costs $1 a month for accounts investing less than $5,000. After surpassing $5,000 the cost is 0.25% of your account annually, which at $5,000 this still comes out to be about $1 a month, so the costs are still very convenient.

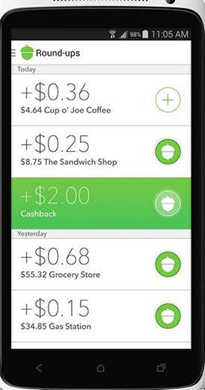

What really makes Acorns unique is their round-up feature. Through linking a debit card to your account Acorns will round-up to the nearest dollar of purchases made using your debit card. By rounding up Acorns adds up the spare change until the value reaches at least $5 in which can be invested. This can be done manually in where you go in an add the spare change wanted and invest a certain amount as long as it’s over $5 or you can turn on the auto feature which will allow Acorns to do this for you and automatically invest any amount over $5 once spare change has been added. For an even added bonus to your round-up savings Acorns allows for you to add a multiplier to save even more money.

Another great feature included in Acorns is the recurring investments. Instead of just putting money into your account whenever you remember or feel like saving, you can set up a recurring investment amount which can be daily, weekly, or monthly. I personally have mine set for $20 a week knowing I have the peace of mind that I am putting something away that will add up over time.

What I have mentioned so far are the main benefits to Acorns, but there are still I few added features I have yet to mention. These features include:

o A graphical representation of potential account value at a certain age given current standing of current account

o Grow – a tab in Acorns that provides you with information about investing so you can increase your knowledge

o Found Money- A feature in which companies will invest a certain monetary amount or percentage in your account if you shop purchase something from them through the app.

o Ability to withdraw money from your account straight to bank account

Overall, I believe that Acorns is a very good app to have if you are looking to save a get into investing. Acorns really takes the hassle and monetary restraints that most people associate with investing. I recommend everyone create an account. Right now Acorns will invest $5 for getting friends that you invite to join so, I have provided my link if you would like to join and start saving with me.

https://acorns.com/invite/634GL5

Robinhood

As with Acorns I stumbled upon Robinhood about a year as well. This was mostly due to my impatience with Acorns. I wanted to see the money being made now, while also finding a similar service to Acorns in which I could invest with a fairly little amount of money. Robinhood was just what I was looking for because it gave me the chance to actually trade stocks and bonds that I wanted, starting with no account minimums.

The greatest feature of this service however is the free trading. If you have traded in the past or have looked into trading you know that most brokerages charge a fee for each charge which bites into your earnings. This is frustrating for most investors especially if they are looking to make money in the short term, because you will focus on maximizing the value of your trade. Trades on other sites can be around $10 which can add up especially depending on the rate you which to trade. If you plan on making trades pretty regularly or even daily having no fees is a huge payoff. Another pretty big benefit of this app is the buying power. This allows for you to have buying power and trade stocks before the money from your bank is deposited in your Robinhood account. This is good when needing to make a well-timed trade. The downside to this is the opposite of this in having to wait about 3 days for funds to transfer from your Robinhood account into your bank account.

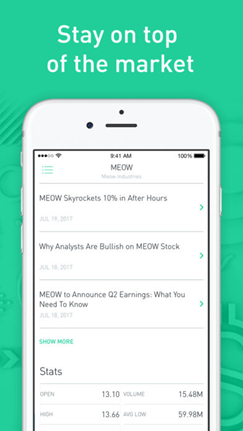

Now with Robinhood you will have to do a lot more thinking when it comes to how you invest. In order to be successful you will have to do a little research on the side to make sure that you are investing your money wisely. I personally like to visit sites such as CNN Money, CNBC Money, and Yahoo Finance. Another benefit of Robinhood is that when you do have stocks in which you are thinking of buying, you can add them to your watch list and Robinhood will show updates and news on the stocks. This will allow you to make a more informed decision on when you choose to buy and sell. If you are just a beginner like me this is very helpful and will allow you to get your feet wet in the investing world. If you would also like to start trading please use my link below and we will each get free stock! Yeah, that’s right if you are a beginner like me and would love to get and started investing please use my link and we will each receive a free share of a stock.

http://share.robinhood.com/sterlim17

Thanks for Reading! Please leave comments before on what you think and critiques you may have. Also, let me know if there

are any other topics you’d like me to address!

Follow me @sterling11 where I will be posting more content regarding money, life, sports, and funny personal stories!

Congratulations @sterling11! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @sterling11! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit