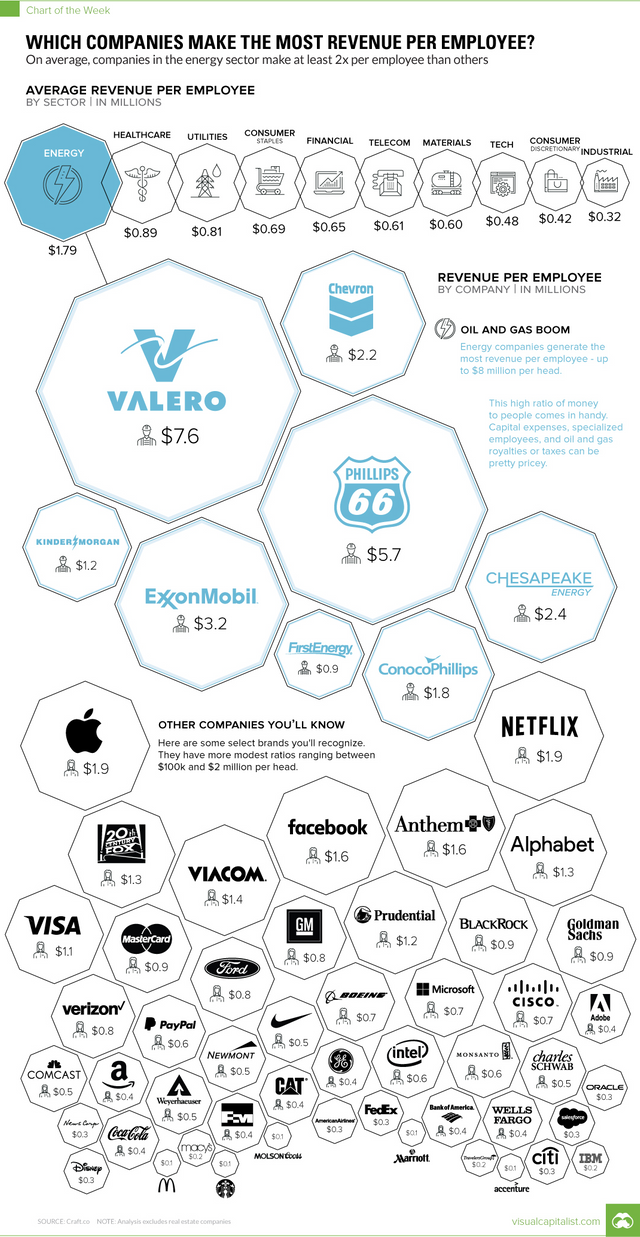

Employees are what makes a company and generates their revenues. Although, having more employees does not directly correspond to more revenue.

This interesting an infographic from Craft.co showing certain sectors have the capacity to generate high amount of revenue per head. The Energy sector dwarfs all other with almost twice the amount of revenue per employee. Valero, Phillips 66, ExxonMobil lead the rev per head for the Energy sector. Valero generates $7.6 million per employee from a total of approx. 10,100 worldwide! Healthcare and utility sectors round up the top three sectors with an rough averages around $0.8 million per head. Technology and media corporation such as Apple, Netflix, Facebook, 21st Century Fox, Viacom all have revenues per employee from $1.9 - $1.3 million, which similar to some majors such as ConocoPhillips ($1.8 mil). Restaurant chain's with several thousands of employees is not going to paint a good picture here and is thus the case for McDonald's and Starbucks (<$100,000 per employee).

Revenue isn't everything, when you take away all the expenses your are left with the profit. Profit usually is very interesting metric for investors and this give a broader picture of the companies underlying ability.

Ishtyaq Habib's revenue vs profit compares some of the companies discussed previously. Here is where the real "tech bubble" come into clear view. Apple leads the profit chart with $45 billion, more than double to the closet competitor Alphabet ($19 billion). Automotive companies also enter the top 10 profit makers list with the likes of Toyota ($17 billion). The Oil and Gas companies fall much shorter here as their have large amount of investments, which drastically pull back their profit margins. The likes of Chevron loosing money and BP almost breaking even. Apple made 21% profit against a revenue of $217 billion. This a rarity as most companies only have a slim profit margins in the region of few percentage - Walmart $14 bill/$$485 billion (2.8%) and Amazon 1.7%. Financial sector also rakes is good margins, second to the technology sector. Berkshire Hathaway ($24 billion) is the second largest profit generator, almost half of Apple's profits. JP Morgan Chase, Wells Fargo and ICBC all have good profit margins.

*All data based on 2016 figures