In Australia and the U.S. real estate is looking like it’s taking a turn for the worse. There are certainly a few bright spots but the the trend is making itself known. Sales are down, interest rates are up, and the general sentiment is very shaky and uncertain. All those who bit off more than they can chew are not even aware of what they got themselves into.

House prices drop in Sydney, Melbourne stalls

https://www.news.com.au/finance/house-prices-drop-in-sydney-as-melbourne-prices-stall/news-story/5dfee82d7d18f97413b5a5c6884824fe

Construction set for its biggest fall since the global financial crisis - ABC News (Australian Broadcasting Corporation)

http://www.abc.net.au/news/2018-07-23/construction-set-for-biggest-fall-since-2008/10024948

Bank loan rules change: Refinancing home loan no longer an option for many

https://www.news.com.au/finance/real-estate/buying/aussie-homeowners-trapped-in-mortgage-prison/news-story/5467fbbdc933cbe18ab9019e81381885

Land tax increase in Victoria means tenants will pay more rent

https://www.news.com.au/finance/real-estate/buying/renters-resort-to-paying-for-tents-and-shared-rooms-due-to-high-cost-of-living/news-story/d3977d7c436ad9b4e94f11a56dee0fcb

1200px-Flag_of_the_United_States.svg.png (1200×632)

Southern California home sales crash, a warning sign to the nation

https://www.cnbc.com/2018/07/24/southern-california-home-sales-crash-a-warning-sign-to-the-nation.html

International buyers are dropping out of US housing market

https://www.cnbc.com/2018/07/26/international-buyers-are-dropping-out-of-us-housing-market.html

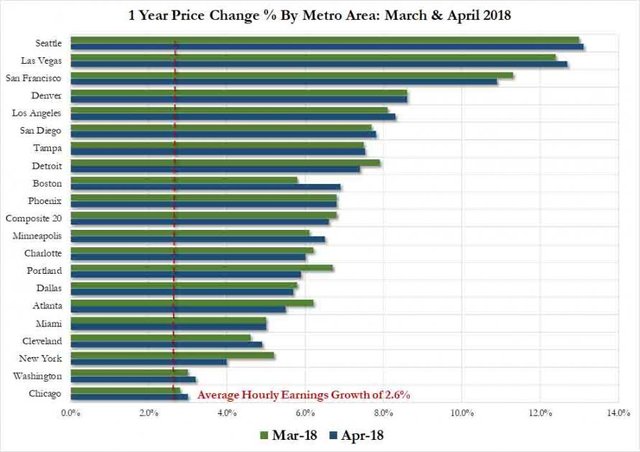

home prices price range.jpg (890×629)

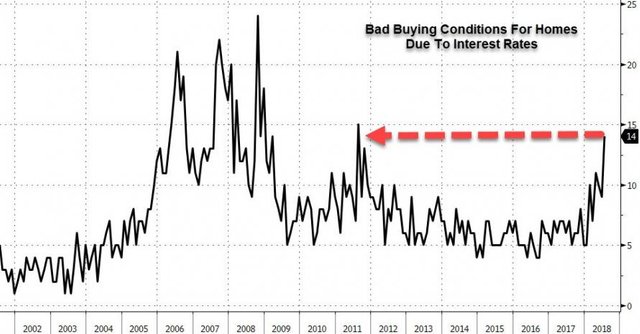

2018-07-27_7-18-13.jpg (890×464)

U.S. housing market could be headed for worst slowdown in years - Article - BNN

https://www.bnnbloomberg.ca/the-u-s-housing-market-looks-headed-for-its-worst-slowdown-in-years-1.1114264

U.S. Median Home Price Appreciation Decelerates in Q2 2018 to Slowest Pace in Two Years - ATTOM Data Solutions

https://www.attomdata.com/news/market-trends/home-sales-prices/q2-2018-u-s-home-sales-report/

▶️ DTube

▶️ IPFS

It does appear that there are many cracks forming. Most recently Netflix and Facebook did an about face. Prior to that we saw huge drops in traditional stocks like GE and SKX (I think GE is being under-reported with regard tot he impact). We've been watching credit card and subprime auto defaults rising for months. And of course, DB is circling the toilet bowl like a turd that just won't flush (but when it does, look out!).

It truly is the Mother of All Bubbles. Systemic risk is worse than before the 2008 crisis (tends to happen when you reward TBTF banks). Been following you for some time and, like you, we've been waiting for this bubble to pop for a while. It looked like it was starting to pop in 2015 and of course we saw the ECB and the BOJ double down to bring us to where we are today.

It does look like the credit cycle is rolling over now. We've predicted several times that it will probably happen this year.

Only time will tell.

Act accordingly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your post as I was not aware it is happening in Australia also.

If you do not mind, I'd like to express a few opinions.

First of all, I see the land tax has risen in Australia...a pretty good way to make purchasing a home uneconomical, woudn't you say? Changing the financing rules to make it more difficult is also another way for the govt to achieve its globalist plans

As for the USA. Quoting what is happening in California as a guide or indicator of what is happening in the USA is wrong and very misleading, since that State has raised taxes to exorbitant levels, while the State is also getting rid of their middle class, swelling their population almost exclusively from the illegal migrants.

Something else I read a few days ago is not mentioned (I admit I did not read through all the links you provided): There has been a substantial drop in property purchases from abroad; China, Arab and the EU being some of the main buying nationalities. I assume this is because most currencies are at a disadvantage to the US Dollar.

People should never panic because of a few reports. It is more prudent to study opinions from different parts of the political and national spectrum. Especially avoid trusting the MSM who have openly shown, in most countries, that they are in favour of corporate marxism, which means they want our economies to crash and everyone to lose their homes and cars.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmmm... This kinda reminds me a LITTLE of Lehigh Acres. Are we looking at the beginning of a bubble bursting?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://www.gov.uk/government/news/uk-house-price-index-for-april-2018

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey thats what you get AUSTRALIA 🇦🇺 for being a colonialist BITCH . Get rid of your communist QUEEN🇬🇧❗️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit