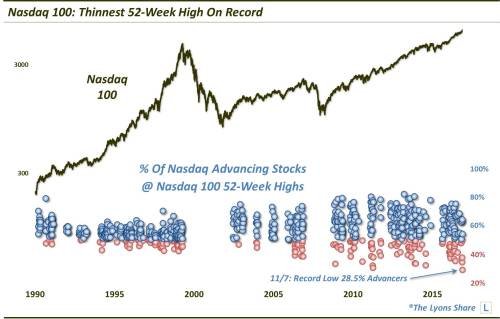

The stock market has been rising due to central bank intervention. We all know that now. You can see just how weak this rally really is when you look at the MARKET BREADTH. How many stocks are actually rising? Hint: Not very many.

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

ETHEREUM: 0xece0Dd6D0b4617A8D94cff634C64155bb1cD8C2C

LITECOIN: LWh6fji4WrJT7FAbFvFSZ9jVNCgVM3dHod

DASH: Xj9RXrvhXbaL3prMDvdzAxM8gDB2vDiZrh

MONERO:47q5qDPkDBLRadwcSXDsri3PNniYRYY1HYAhidXWAg8xXHFFZHFi7i9GwwmZN9J5CJd8exT4WARpg2asCzkuoTmd3dfcXr6

Earn 1% Compound Interest DAILY With BitConnect: http://bitconnect.themoneygps.com

STEEMIT: https://steemit.com/@themoneygps

VIDME: https://vid.me/themoneygps

T-SHIRTS: http://themoneygps.com/store

Sources Used in This Video:

https://goo.gl/UpprQe

tumblr_inline_oz36pdEHbw1sq14jh_500.jpg (500×319)

Dana Lyons' Tumblr — Razor Thin New High For The Nasdaq 100

http://jlfmi.tumblr.com/post/167265785910/razor-thin-new-high-for-the-nasdaq-100

20171108_msci.jpg (965×508)

Sen. Sherrod Brown to unveil multiemployer loan program legislation - Pensions & Investments

http://www.pionline.com/article/20171107/ONLINE/171109874/sen-sherrod-brown-to-unveil-multiemployer-loan-program-legislation

America’s ‘Retail Apocalypse’ Is Really Just Beginning

https://www.bloomberg.com/graphics/2017-retail-debt/

Premiums for popular Obamacare plans to soar 37% for 2018 - Oct. 30, 2017

http://money.cnn.com/2017/10/30/news/economy/obamacare-premiums/index.html?iid=hp-stack-dom

US health spending has rocketed $900 BILLION since 1996 | Daily Mail Online

http://www.dailymail.co.uk/health/article-5058643/US-health-spending-rocketed-900-BILLION-1996.html

Hello & Cheers!! I'm a content detection and information bot. You are receiving this reply because a short link or links have been detected in your post/comment. The purpose of this message is to inform your readers and yourself about the use of and dangers of short links.

To the readers of the post: Short links are provided by url shortening services. The short links they provide can be useful in some cases. Generally their use is benign. But as with all useful tools there are dangers. Short links can be used to hide all sorts of things. Quite frequently they are used to hide referral links for instance. While not dangerous this can be deceptive. They can also be used to hide dangerous links such as links to phishing sites, sites loaded with malware, scam sites, etc. You should always be extremely cautious before clicking on one. If you don't know and trust the poster don't click. Even if you do you should still be cautious and wary of any site you are sent to. It's always better to visit the site directly and not through a short link.

To the author of the post: While short links may be useful on some sites they are not needed on steemit. You can use markdown to format your links such as this link to steemit. It's as simple as

[steemit](https://steemit.com)Unlike short links this allows the reader to see where they are going by simply hovering over the link before they click on it.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Federal Reserve has been manipulating the stock market for years with open market operations. It has been artificially raising stock prices ans artificially suppressing precious metal prices. Abolish the Fed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I completely agree!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People are used to FED manipulation that protects the stock market. This makes them (together with the FED) buy each and every dip in the market. Just like the one yesterday, on Nov 9th 2017.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good point!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit