Dear friends, many of you have asked me about the China banning ICO news. South Korea is also making moves. I have this to say for Hong Kong:

NOT SURPRISED. KEEP CALM AND CARRY ON.

Before summer, I predicted that the authorities will crack down on ICOs because many are for all intents and purposes securities with speculative properties, intentional or otherwise [Crisis of the Coins].

Our team has thus far been doing everything right.

- Our token is non-speculative

- Our token is not a security

- Our economy has tools against hyperinflation

- Our ICO follows best practices

- Our ICO is audited by lawyers

- Our ICO is broken down and milestones-based

Long-term gain is better than short term gain! We're not interested in getting rich quick. We're interesting in building the future.

Where did ICOs come from and why are they so popular?

Seven months ago, I was having lunch with a bunch of my banker friends in the bustling central financial district in Hong Kong (which by the way is aptly named "Central"), talking about typical things you'd expect people in Hong Kong and in banking and in Hong Kong banking to talk about: how to get rich (quick). Startups quickly became central to the conversation.

The conventional wisdom is laughably simplified:

- Get an idea

- Start a company

- Profit aka IPO

Since these were no ordinary bankers — I have the privilege of calling them my friends — I was compelled to expand their worldview a tiny bit:

- Ideas are actually quite easy to generate with the right mindset, but product-market fit is way more important than ideas

- Ideas are comparatively completely worthless in light of how hard execution is, because it is a lot f*cking harder than a typical person could imagine, starting a company is simply step one out of hundreds

- IPO is not the only exit... in fact, IPO is rarely the exit for most tech startups! There are mergers & acquisitions, make so much profit that you pay dividends to investors, or the most recent liquidity event, the ICO.

For sake of brevity, I explained ICO is like the IPO but not. It definitely is not.

For companies to IPO, it is not the beginning of the end, but the end of the beginning, especially for founders and key employees. An ICO is literally the beginning. Besides a 67% character match rate in their acronym form, there are quite a few differences:

ICO vs IPO in Chinese 「首次貨幣發行」與「初次公開發售」分別

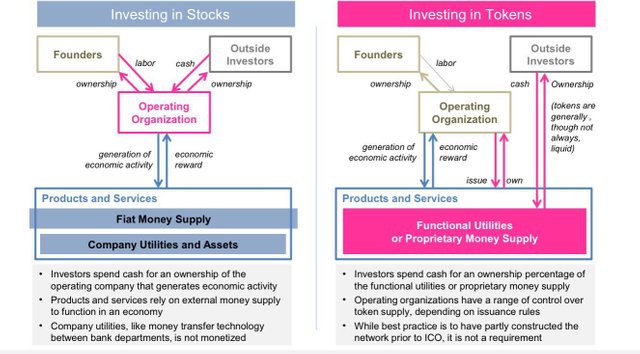

Coins (tokens) vs stocks

The biggest difference is that IPOs have existed for a long time and thus are heavily regulated. ICOs being completely new are self-regulated, which for most people means unregulated. Honest people leverage the ICO to fundraise quickly and also let their friends and family participate in what traditionally would be out of reach for them. Dishonest people market the shit out of their ICO in a bid to take in as much money as possible; if an ICO is making too much noise, that's a red flag (not the PRC nor HK one!)

Unfortunately for humanity, honest people (that can execute) are in very short supply on this planet. Projects may be decentralized but people are not. And that's where governments come in.

China goes nuclear

Thanks to One Country Two Systems, what happens in China stays in China. And China did what they had to do, given its national priorities, which is to stop scam ICOs and other illegal fundraising activities, because they have dire social stability consequences. Scam ICOs are this decade's subprime crisis. The Chinese Communist Party only survives because it is building a stable society. Nuking all ICOs first and deal with the consequences later is the best move for them.

Meanwhile in Hong Kong, the HK SFC statement is actually following the US SEC stance, basically saying, "some tokens are securities, therefore some ICOs are illegal, but not all, so stay tuned for more updates!" Unlike the Mainland of China, Hong Kong's volume does not affect social stability. Furthermore, Hong Kong being a major commercial hub (like Singapore) cannot afford the consequences of a nuclear strike; surgical strikes serve as much better tools for regulating this budding industry. This is the most responsible thing for them to do right now. In a curious twist of fate, Hong Kong is perhaps set to become a financier of China once again. Some say history repeats itself, but I say it definitely spirals.