There is a new book just released by Kenneth Rogoff, supposedly one of the world’s leading “economists”, called The Curse of Cash. The thesis of the book is that the world is drowning in cash, which is making us poorer and less safe. I’m NOT recommending the book. I merely bring it up as an example of how ideas that would have been dismissed as silly in former times have now become mainstream. I, for one, will not be spending any of my hard-earned fiat cash on Dr. Rogoff’s book.

Most of history’s most successful investors have understood the value of CASH as a component of a balanced, diversified investment portfolio. Unlike stocks and bonds, which fluctuate constantly with changes in economic conditions, interest rates, inflation and company outlook, cash is a stabilizing force. Although it only provides meager returns in the form of short-term interest payments, one of its greatest benefits is “embedded optionality”. As the prices of other financial assets ebb and flow, cash can be reallocated strategically by nimble traders to take advantage of buying opportunities. Of course, that’s easier said than done, but the every trader harbors the conceit that he can time the market better than other participants.

During times of economic prosperity, active investors can reinvest idle cash and interest on bonds in the stock market, to take advantage of rising earnings and dividends of public companies. However, during periods of economic recession and falling earnings, bonds or cash may outperform stocks as corporate earnings fall, and central bankers use declining interest rates as a tool to stimulate economic recovery. During inflationary periods, investors may prefer to hold gold and other “hard assets” (real estate, for example) as a hedge against rising prices. Strategic and tactical allocation considerations such as these have been a reliable “tool kit” for decades, but it seems this paradigm has recently broken down.

In the past couple of years, central banks have imposed NIRP (Negative Interest Rate Policies), and this has even begun to spill over to institutional and retail banking in some areas of the world. Even in countries not directly affected by NIRP, the policy has driven savings rates to very low levels. Central bankers have made these negative rates stick through massive purchases of sovereign debt (government bonds) that has resulted in bubble-like valuations and driven down interest yields. Amazingly, over $13 trillion worth of government bonds are now victimizing investors with negative yields, which means that in many cases sovereign debt purchased and held to maturity is guaranteed to lose money. At today’s prices and yields based on experimental monetary policies, BONDS ARE A FOOLISH INVESTMENT. In this interest rate environment, which has never before been seen in recorded history, cash has a huge advantage over bonds (debt), since its value remains constant in nominal terms as bonds produce negative returns under ideal conditions of stable rates and potentiallly huge portfolio losses if rates return to normal levels.

The Road to NIRP

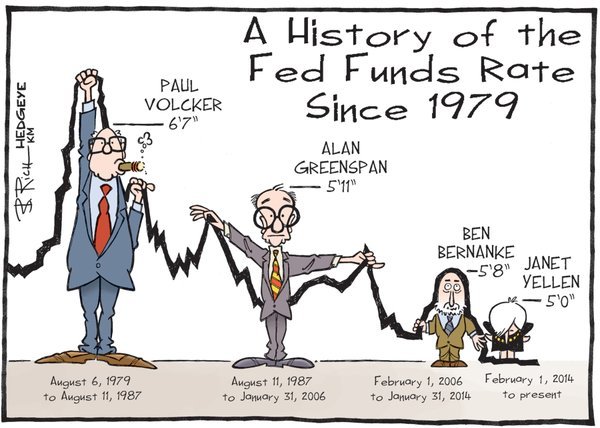

I found this cartoon here.

Negative rates are not just bad for savers. From the point of view of the Bankers running the system, NIRP also has a severe downside, since companies, investors and individuals have a strong incentive to remove cash from the system that NIRP is designed to support. As interest rates approach zero, and in some cases drop below zero (i.e. savers need to pay to store money in the bank), investors and households will rightly resist the idea of paying banks for keeping cash on deposit. It’s cheaper in many cases to “hoard” the cash in secure private storage or withdraw the cash to purchase hard assets such as real estate and gold and other precious metals, which is a traditional alternative form of money that every culture recognizes and an intuitive level. In fact, the primary objection to owing gold, i.e. that it “does not pay interest”, is removed by low and negative rates on savings.

And this brings me to the WAR ON CASH, which is being discussed with increased frequency by policy-makers, professional investors and ordinary citizens. Because even a small uptick in withdrawals poses an extreme degree of risk to a financial system that never recovered from its near collapse in the 2008 financial crisis and subsequent rounds of inflationary money creation, policy-makers will attempt to stop “hoarding” of cash at all costs.

The choice of words is revealing: When Bankers, politicians and law enforcement begin to routinely use the word “hoarding” instead of “saving”, they reveal that deep down, they fundamentally believe that others are more entitled to your money than you are.

This should set off alarm bells!

Big Brother views cash under the people’s control as a dangerous thing, and wants to convince the population that physical cash (gold, Bitcoin, whatever) is only the preference of those with criminal purposes.

DON’T FALL FOR IT!

Your cash and your privacy belong to YOU ALONE! Neither should be stolen from you.

I won’t pretend to know what strategy a saver or investor should follow in such a crazy, messed-up world of NIRP and near-NIRP. Caution and planning seem to be the prudent course. Bonds appear to be the “mother of all bubbles”. Valuations can’t be sustained in a market where investors are guaranteed to lose money even under the ideal scenario of gradual increases in inflation and interest rates leading to a soft landing. Stocks are at all-time highs. A surge of inflation or hyper-inflation could continue to push prices higher, but this would be more a reflection of a collapse of the currency in which the stocks are denominated, rather than a reflection of rising values of the underlying businesses. Cash similarly loses its value during outbreaks of inflation.

Some are predicting deflation… It’s possible, but unlikely in my opinion, as the preference of governments and central bankers will always be inflation, and these powerful actors usually get what they want, even if it’s not good for the rest of us. The reason for this preference is that as the largest debtor, the endgame of governments is not so much to default on its debt, but to pay it off with debased and worthless currency.

Two bits of advice that I believe are unassailable in the current scenario:

(1) Live within your means and with a minimum of debt. High expenses and debts will reduce any options you may have if there are tough times ahead.

(2) Take control of your savings and property, and secure them outside of the financial system to the extent this is possible. Real estate and other hard assets, gold, silver, cash and stored provisions are items that will preserve your wealth and may come in handy if there are tough times ahead. Even if we dodge a bullet this time, reasonable precautions are seldom a cause for regret. Especially with so many financial markets in “bubble” territory…

Although the future is unknown to us, we have every reason to suspect inflation and monetary debasement from the “geniuses” running our financial system.

I would welcome a discussion in the comments with anyone who has an interest in the subject.

This post is here to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make or don’t make involves risk.

If you like what you read here, don't forget to FOLLOW me so that future blog posts show up in your feed.