I got an Email today from someone saying "Sell everything! Everything's going to crash". Well, not so fast, here's why.

Money flows to where it gets it's best return. One thing that comes to mind is the Ray Dalio - All Weather Fund -

There are only four things that move the prices of assets:

1. Inflation

2. Deflation

3. Rising economic growth

4. Declining economic growth

There are 4 different environments that'll make asset prices go up or down:

1. Higher than expected inflation (rising prices),

2. Lower than expected inflation (or deflation),

3. Higher than expected economic growth, and

4. Lower than expected economic growth.

The breakdown for the fund is as follows:

Money flows to where it gets it's best return. One thing that comes to mind is the Ray Dalio - All Weather Fund -

There are only four things that move the prices of assets:

1. Inflation

2. Deflation

3. Rising economic growth

4. Declining economic growth

There are 4 different environments that'll make asset prices go up or down:

1. Higher than expected inflation (rising prices),

2. Lower than expected inflation (or deflation),

3. Higher than expected economic growth, and

4. Lower than expected economic growth.

The breakdown for the fund is as follows:

- 30% in STOCKS

- Long-term GOVERNMENT BONDS. 15% in intermediate term (7- to 10-year Treasuries) and 40% in long-term bonds [20- to 25-year Treasuries]. Bonds counter the volatility of the stocks.

- 7.5% in GOLD and 7.5% in COMMODITIES. This will do well with accelerated inflation so you would want a percentage in gold and commodities

- Equals 100%

We know capital flows from one asset class to another and from country to country. So where does that leave us? Well, we know that the bond yields are the lowest in all of history and money wants return on investment. Money leaves the bond market and into STOCKS? If this scenario happens we could possibly see a mass and swift exodus out of bonds and into equities. Only the US blue chips (Dow and S&P 500) made all time new highs but only on low volume and corporate share buybacks. Back in the 70's, stocks made all time new highs for a short time only to plummet by 30%, 40%, 50% until a sustained breakout in the early 80's.

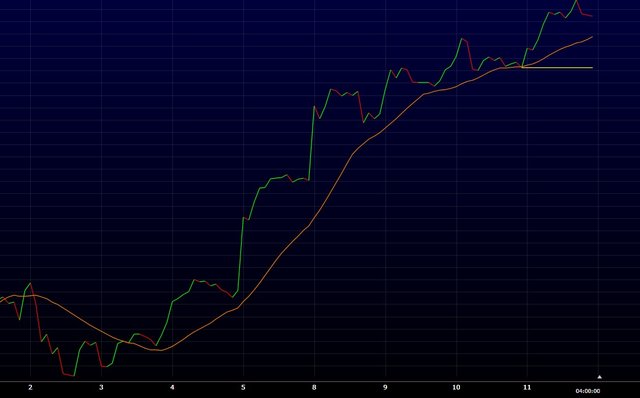

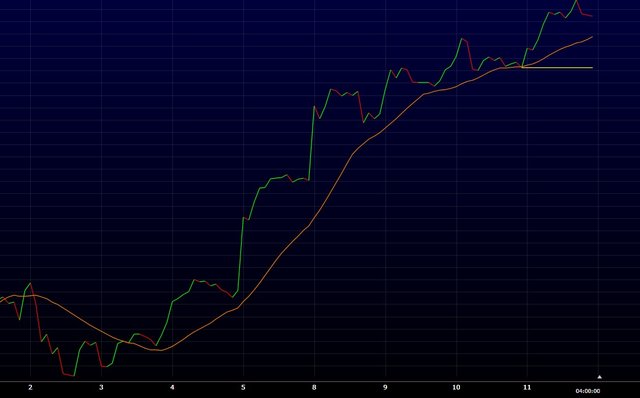

The timing tool went positive again, so on a bullish bias again.... how long? I don't really know.

That leaves us with precious metals and even bitcoin. The precious metals and commodities sector are very volatile and will go up or down BIG, so that's why there's only 7.5% in gold and 7.5% in commodities.

So how do precious metals and commodities play into this? good question, could possibly go up in tandem with equities or equities could actually fall and a massive amount of money goes into precious metal and commodities. You make that guess.

I keep thinking about Martin Armstrong's outlandish idea that the US index's could even double, he could be correct. Martin Armstrong's timing model. "The Fed has really lost control of the economy, but the mainstream still needs to figure this out. Our model goes nuts from 2018 into 2020".

So... If you want to sleep at night. The Ray Dalio all weather fund is about weathering out any financial storm. The very instant I saw the components of the fund I noticed the ingenious in it's simplicity, money just goes from one asset class to another, the big question is WHERE!

- We know the bond market is in a bubble "capital flows out", that's a given.

- Investors are losing confidence in the government. Money into precious metals?

- Is it all into equities OR both?

All data and information provided is for informational purposes only. Trend Wizard makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

This was an interesting read. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit