It seems to be advice most have heard at one point or another.

" You should have 3 - 6 months of expenses saved in an readily accessible account" - People who don't understand the power of compound interest over time

The pragmatist in you may say "That sounds like a smart idea, why are you against it?". Let me clear, I am not against having 3 - 6 months of funds saved in case of an emergency. My problem lies in where you keep it.

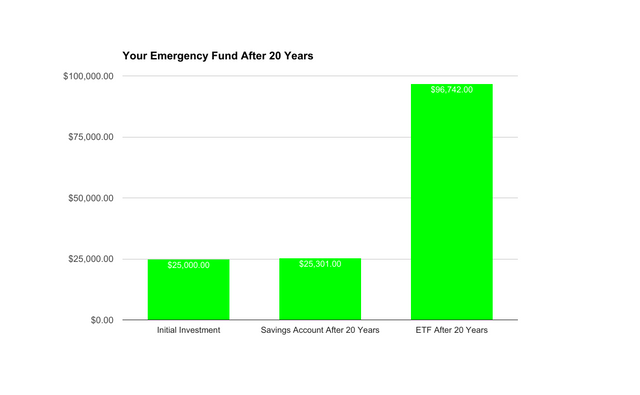

If you have a household income of $100k (for easy math) and you have 3 months of money ($25k) saved for emergency expenses. The short sighted person from above would tell you to put it in a savings account, which gains you a measly 0.06% interest. THAT IS NOTHING! That is less than inflation, which means every year that money sits there it loses purchasing power and EVEN WORSE it isn't working for you.

If you put that $25,000 into a quality ETF getting you 7% per year instead of a savings account here is what your money would look like 20 years later.

So what am I suggesting you do with your emergency fund?

- As a long-term rule, your money should be in something growing faster than inflation. In the war against inflation, if you aren't winning you are losing. Savings accounts and other low-interest investment vehicles should be avoided at all costs. If you have (wisely) saved up this money let it work for you. Let it help you achieve your goals. That would be like hiring an assistant to have them sit in the closet and not do anything, but wanted them around "in case" you needed them.

- Use credit availability for immediate purchases and be prepared to sell of investments if needed. A few good examples of credit availability are high limit credit cards, Home Equity Line of Credit (HELOC), or personal line of credit. In both situations you can have fairly substantial borrowing limits without any penalty for having them.

- If an emergency situation does arise, pay for it from your expenses and that gives you a brief amount of time to sell your investments to pay off borrowed money.

- In the rare scenario that you need this "emergency" money, you will likely have left over money in your brokerage account because of the interest you gained from the power of compound interest.

Some reasonable questions:

- What if the stock market crashes and that is when I need my money? - First I will say that the average bull market lasts about 8 years, and the S&P 500 also about doubles every 8 years. So if you avoid significant emergencies (beyond a furnace replacement) for 8-10 years, there is a good chance you will have enough money to lose half and still be able to cover your emergency through a recession. For example, if you put your money in the market 10 years ago (just before the crash in 08) you would still be up almost 60% now. Additionally, I think if you are well-organized and aware person, there should be VERY few emergencies throughout your lifetime. Furnaces last ~16-20 years today, so if your 23-year-old furnace dies on you...... you better not call it an emergency or unexpected.

- What if I rent, I only put 5% down on a house, or if I just bought my house? - In any of these situations (and more) HELOCs will not be available to you. Your ability to execute this strategy is predicated on being able to have the credit availability. If you are not able to get enough credit availability, you may need to have a portion of the emergency fund in a savings account to be sure you have all of your risk covered? You may be able to get enough credit availability with just credit cards and a personal line of credit.

- What if I have too much credit card debt? - PAY IT OFF NOW! If you have a pot of money in your savings account and significant credit card debt, that is a financial emergency (a self-made one) and you need to solve it and then do some serious self-reflection. The average credit card interest rate is ~15% and there are not many investments that pay more than 15% over a long period of time. There is almost no scenario that involves a justifiable reason for carrying debt on a credit card longer than a few months. PAY IT OFF. NOW! If you don't have any money and have credit card debt, use another loan type to at least lower the interest rate on your credit card while you pay it off.

Original article: http://www.trillionairesclub.net/emergency-fund-losers/

Right. Don't save your money. Work your money!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit