The once high-flying US dollar has had a year to forget in 2017.

The US dollar index, or DXY, has fallen by more than 10% since hitting a multi-year high in early January this year, undermined by a combination of political gridlock in Washington, soft US economic data and improved economic activity elsewhere in the world.

It’s been a remarkable turnaround from what was seen in late 2016.

Gone is the enthusiasm to what a Donald Trump presidency could bring, replaced by growing concern that he’ll be unable to deliver on his pre-election promises to cut taxes and boost infrastructure spending, two pillars that helped to power the US dollar, bond yields and rate hike expectations higher in late 2016.

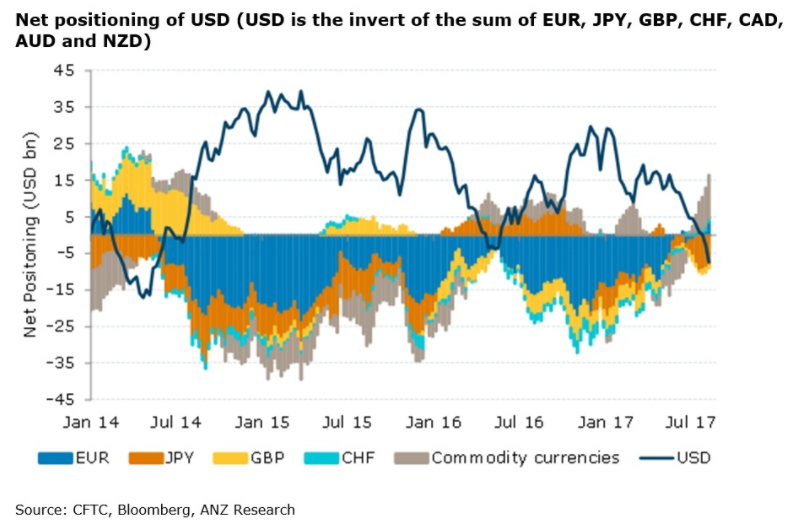

Nothing quite demonstrates how cold traders have gone towards the greenback than the chart below from ANZ’s FX strategy team.

It shows net US dollar positioning among speculative investors based off weekly data released by the US Commodity Futures Trading Commission (CFTC) each Friday.

Net positioning, shown with the blue line, has tumbled in line with the slide in the DXY, going from a net long position of around $30 billion at the start of the year to a net short position of $7.4 billion last week.

Net speculative positioning, defined by ANZ as non-commercial positions reported by the CFTC, is simply the sum of long and short options and futures positions in a particular asset, in this case the US dollar.

When net positioning is short it suggests that the market, as a whole, is looking for price weakness.

So with net short positioning now standing at $7.4 billion, the market, collectively, is now the most pessimistic that it’s been towards the US dollar since May 2014.

It’s little wonder why the DXY has fallen so far so fast this year.

The greenback is clearly on the nose with traders, seemingly drawing in even more bearish bets despite its substantial slide over the past seven months.

For the moment, traders think that the dollar will only continue to weaken in the period ahead based off recent trades.

Irene Cheung and Rini Sen, currency strategists at ANZ, said that the US dollar was sold off aggressively against all major currency pairs last week, lead by continued buying of the euro.

“US dollar selling in the week was broad based, with the most against the EUR,” the duo wrote in a note released on Monday.

“Funds added $US2.3 billion to take their net long EUR position to $US3.6 billion, the second consecutive week of net buying and the biggest long position since May 2014.”

Along with the euro, traders also continued to pile into commodity currencies such as the Canadian and Australian dollars, recording net buying for a seventh and ninth week respectively.

“Funds added $US900 million and $US800 million to take their net long CAD and AUD positions to $US3.7 billion and $US5.7 billion respectively,” Cheung and Sen wrote.

The buying in the Aussie dollar left net long positioning at the highest level since April 2013, helping to partially explain why the AUD/USD currently sits near highs not seen in over two years.

Traders also pared back short bets against both the Japanese yen and British pound with net positioning in both declining to $US800 million and $US8.2 billion respectively.

Seemingly, the buck couldn’t find a friend last week despite the release of a strong US non-farm payrolls report for July at the end of the previous week.

However, while it’s easy to see why traders have favoured other major currency pairs this year, the combination of short net positioning and increasingly bearish sentiment towards the US dollar suggests the risk of a short-squeeze in the DXY is building should pessimism towards the dollar start to lift.

We’re clearly not at that point yet, but with so much bad news already priced in, it’s an increasingly important factor to consider.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.businessinsider.com/united-states-dollar-bearish-bets-highest-since-may-2014-2017-8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit