Freeland unveils tax credits of 30-40% for investment in clean technology and hydrogen: Naimul Karim

Ottawa willing to accept lower returns, more risk to put $15-billion growth fund to work: Barbara Shecter

Ottawa aims to balance fiscal restraint with targeted support amid darkening economic outlook: Stephanie Hughes

Ottawa reveals plan for new tax on stock buybacks: Barbara Shecter

'A softer quarter': Barrick Gold production falls amid rising costs: Gabriel Friedman

Barrick Gold lowered its dividend as net earnings dropped 50%. Find out more.

Price hikes help drive major sales growth at Tim Hortons: Jake Edmiston

Tim Hortons same-store sales grew 11.1 per cent in Canada thanks to price increases. Find out more.

Here's how three portfolio managers are navigating the global economic storm: Stephanie Hughes

David Rosenberg: Fed pulls the old bait and switch and investors are left kicking air: David Rosenberg

Ottawa orders Chinese companies to exit three Canadian lithium miners: Naimul Karim

Lightspeed posts wider $79.9-million loss in second quarter: Marisa Coulton

CRA says T4 slips insufficient evidence of income for CRB eligibility and judge agrees: Jamie Golombek

Trudeau to propose new tax on stock buybacks in Canada: Hsbc Breadcrumb

Trudeau to propose new tax on stock buybacks in Canadafinancialpost.com

Tim Hortons' parent company beats profit expectations as sales surge past pandemic funk: Jake Edmiston

Canadian Natural Resources boosts dividend 13%: Meghan Potkins

Aggressive Bank of Canada rate hikes could add more strain on Ottawa’s debt servicing: Stephanie Hughes

Aggressive Bank of Canada rate hikes expected to put more strain on Ottawa's finances: Stephanie Hughes

Telus doesn't need CRTC approval to surcharge majority of customers, regulator says: Denise Paglinawan

U.S. Federal Reserve delivers another big rate hike: Read the official statement: Financial Post Staff

Read the U.S. Federal Reserve's officials after it raised interest rate by 75 bps to fight inflation

Bank of Canada is walking a fine line, but rates will go higher, says Tiff Macklem: Stephanie Hughes

Rio boosts chances of Turquoise Hill takeover on deal with activist shareholders: Naimul Karim

Canada Goose lowers outlook as China's zero-COVID policy hits sales: Bianca Bharti

Is the Bank of Canada reaching the end of its rate raising cycle?: Gabriel Friedman

Sparks fly at Rogers-Shaw case conference with Competition Bureau: Barbara Shecter

Canada to admit 1.4 million immigrants in three years to address labour shortages: Naimul Karim

Calgary home sales on track for record year even as market eases in October: Shantaé Campbell

Postmedia names Mary Anne Lavallee chief financial officer and chief transformation officer: Financial Post Staff

Lavallee had previously been the company’s chief operating officer and interim CFO

Foreign students accuse Canada of exploiting them for 'cheap labour': Randy Thanthong-Knight, Bloomberg News

Vass Bednar: Let cash be king again — Why businesses should be forced to accept paper money: Special to Financial Post

Vancouver miner Pure Gold seeks creditor protection after suspending operations for lack of money: Naimul Karim

Elon Musk orders Twitter staff to work 24/7 on 'blue tick' charge: Hannah Murphy in San Francisco, Cristina Criddle in London and James Fontanella-Khan in Milan, Financial Times

Forcing real estate brokers onto MLS probably a good thing for both buyers and sellers: Special to Financial Post

Market corrections are where returns are made so don't head for the sidelines: Martin Pelletier

Martin Pelletier: Beware the doom-and-gloomers with their all-or-nothing approach

Ottawa's finances are in better shape than expected — but don't get used to it, say economists: Financial Post Staff

Everything you need to know about the Bank of Canada rate hike: Financial Post Staff

Ottawa raises the bar for foreign entry into Canada's critical minerals industry: Naimul Karim

Hybrid work is the future, but expect to be in the office more often than not: Victoria Wells

David Rosenberg: Canada's housing bubble has burst — now brace yourself for the economic hit: David Rosenberg

Air Canada loses $508 million in 'operationally challenging' quarter: What you need to know: Marisa Coulton

The very Canadian problem at the heart of our supply chain woes: Jake Edmiston

Elon Musk takes over Twitter, firing top executives: Sheila Dang and Greg Roumeliotis, Reuters

The CEO and CFO were escorted from the building when the deal closed, sources say.

There's a good side to oligopolies and a lack of competition if you're an investor: Tom Bradley

Three strategies for retirees to consider in times of market volatility: Special to Financial Post

FP Answers: Is whole life insurance a good investment? If so, in what circumstances?: Julie Cazzin

Elon Musk completes US$44B Twitter takeover, fires CEO and other top executives: Sheila Dang and Greg Roumeliotis, Reuters

Aritzia sets sights on U.S. growth following pandemic-era success: Bianca Bharti

Teck Resources' oilsands exit will allow it to lean into 'low-carbon metals,' says CEO: Gabriel Friedman

Miner sells its 21.3% stake in the Fort Hills oilsands site to Suncor for $1 billion. Read on

Vass Bednar: Why Champagne's intervention in the Rogers-Shaw merger rings hollow: Special to Financial Post

Toronto rent prices surge by double-digits in third quarter: Shantaé Campbell

'We've never been in better shape': CP Rail boosts profit and outlook ahead of 'top five all-time' grain crops: Jake Edmiston

Kevin Carmichael: Why Tiff Macklem is willing to risk a recession to crush inflation: Kevin Carmichael

Precision Drilling returns to profitability for first time since 2019: Meghan Potkins

Revenues jump on a tight rig supply and a 27% increase in North American drilling activity. Read on

'We're not there yet': Macklem signals more rate hikes as economists make bets on how high they'll go: Stephanie Hughes

Getting a head start on tax-loss selling? Keep these five things in mind: Jamie Golombek

Property tax rate balance tilting further against commercial properties, report finds: Shantaé Campbell

Canadian banks raise prime rate to 5.95% after Bank of Canada hike: Financial Post Staff

Manufacturing labour shortage costing Canadian economy almost $13 billion: Denise Paglinawan

Hundreds of businesses call on governments to require them to release biodiversity data: Marisa Coulton

Bank of Canada swerves in 'game of chicken' with inflation: What economists say: Stephanie Hughes

Bank of Canada hikes interest rate by 50 basis points: Financial Post Staff

Bank of Canada hikes interest rate by 50 basis pointsfinancialpost.com

Bank of Canada raises interest rates: Read the official statement: Financial Post Staff

Ontario announces 'bold' new plan to meet target of building 1.5 million homes: Stephanie Hughes

CN boosts profit forecast after record revenues in third quarter: Jake Edmiston

Ottawa has 13% support on its oil and gas policies: Opinion: Special To Financial Post

David Rosenberg: The economies best positioned to withstand rising rates: David Rosenberg

CIBC CEO calls for overhaul of immigration policy, highlighting threat posed by labour shortages: Naimul Karim

The markets killed your early retirement dream, but there is a way to Freedom 65: Special to Financial Post

Competition watchdog to probe grocery sector amid inflation concerns: Jake Edmiston

Bracing for interest rate hike, Canadians are feeling the pinch: Pamela Heaven

Bracing for interest rate hike, Canadians are feeling the pinchfinancialpost.com

Fundamentals 'Flashing Red'; Last Pillar of Credit Crumbles...: financialpost.com

Victor Dodig: Canada must urgently address affordability, housing woes so immigrants can thrive: Special to Financial Post

Investors need to leave the past in the past and focus on doing the right thing in the present: Martin Pelletier

'Whistling past the graveyard’: Bank of Canada expected to go big with October rate hike as recession risks loom: Stephanie Hughes

How Montreal's video game industry is changing to meet labour demands: Caitlin Yardley, The Canadian Press

Lifting work cap on international students a good start, but more needed to tackle labour crisis, experts say: Naimul Karim

Senate should kill online censorship bill: Opinion: Special To Financial Post

This Toronto-based company wants to turn Mexico's dollar store industry upside down: Marisa Coulton

Five winning investments in 2022 and their prospects ahead: Peter Hodson

Peter Hodson: There is always a bull market in something

FP Answers: Should I invest in an RRSP or non-registered account when saving for a home?: Julie Cazzin

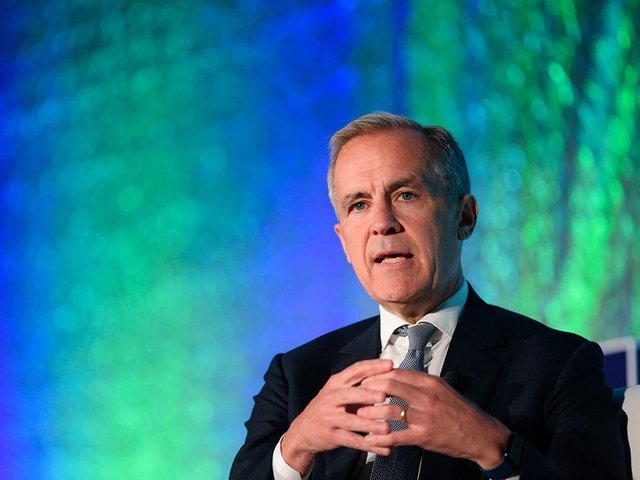

Mark Carney says fiscal discipline 'imperative' to combat global inflation, instability: Stephanie Hughes

Small businesses can still make claims in credit-card class action after deadline extended: Denise Paglinawan

CRTC decision paves way for cheaper cell-phone bills — but Canadians may still have to wait: Barbara Shecter

Why a business owner who paid himself dividends got into trouble with the CRA: Jamie Golombek

David Rosenberg: Canada's message to the rest of the world: Bring us your workers: David Rosenberg

Forget the corporate PR campaigns, here's how to really save on groceries: Special to Financial Post

There are ways to cut back on what you spend at the supermarket. Find out here.

Inflation relief or PR stunt? Loblaw's No Name price freeze looks a lot like a routine holiday tactic, insiders say: Jake Edmiston

Here's who's investing in cryptocurrency in Canada: Barbara Shecter

Odds of a 75-bps hike from the Bank of Canada just went up, economists say: Gigi Suhanic

Inflation slows to 6.9% — but that's still too fast for the BoC: What you need to know: Kevin Carmichael

Inflation pressures in Canada appear to be receding, albeit slowly, writes Kevin Carmichael. Read on

[news curation]@wakanda-forever

Posted using Partiko Android

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit