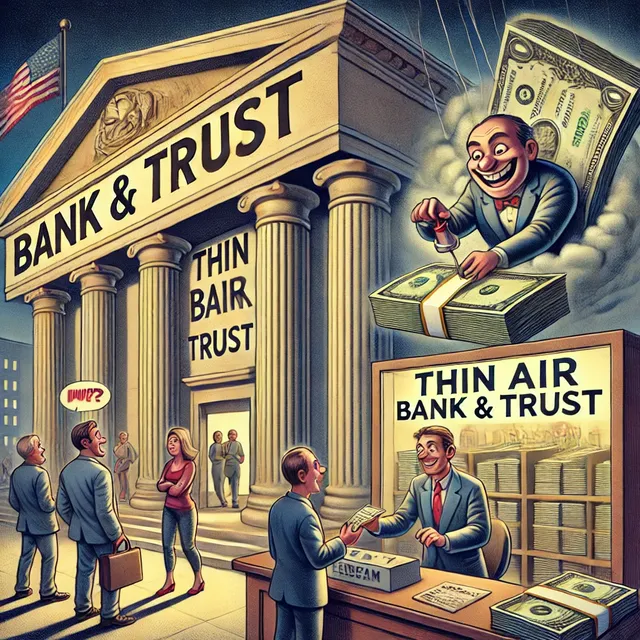

The Great American Loan Scam: How Banks Create Money Out of Thin Air and Get Away With It

For decades, Americans have taken out loans under the assumption that they are borrowing real money that banks possess. However, a deeper dive into the mechanics of the banking system reveals a disturbing truth: banks don’t lend actual money. Instead, they create money out of thin air, a process that has sparked legal challenges and controversies over the years.

But despite several court cases questioning this practice, the legal system continues to uphold it. So, how does this work, and why haven’t the courts shut it down? Let’s explore.

- How Banks Manufacture Money Out of Thin Air

When you take out a mortgage or a business loan, most people assume the bank is lending money that it actually has. However, under the fractional reserve banking system, banks do not need to have actual money on hand to cover the loans they issue. Instead, they create credit through simple accounting entries.

Here’s how the scam works:

- You apply for a $300,000 mortgage.

- The bank does not take $300,000 from its reserves or deposits. Instead, it creates a digital entry in your account.

- You are then required to repay this "imaginary" money with real labor and real assets—plus interest.

This process allows banks to collect massive amounts of money through interest on funds they never actually possessed in the first place.

- The Legal Challenge: Jerome Daly v. First National Bank of Montgomery (1969)

One of the earliest and most famous cases challenging this fraudulent practice was Jerome Daly v. First National Bank of Montgomery in 1969.

Daly, a homeowner, refused to pay his mortgage, arguing that the bank never actually lent him anything of substance—it merely created credit out of nothing.

He argued that this violated contract law, which requires both parties to provide consideration (something of real value).

The court initially ruled in Daly’s favor, agreeing that the bank had no actual money at risk in the transaction.

However, this ruling was later overturned and buried, as it threatened to expose the entire banking system.

- Modern Court Rulings Upholding the Banking System

In modern times, courts have generally ruled in favor of banks, arguing that the creation of money through lending is legal.

For example:

Case 1:15-cv-01310-RJJ-RSK ECF No. 34 involved a plaintiff arguing that banks' practice of "creating money out of thin air" imposed an unjust debt burden on borrowers. The court dismissed these claims, reinforcing the legitimacy of the current system.

Various other cases have upheld the idea that banks are legally allowed to generate credit as long as they follow federal regulations.

While some argue that this process is outright fraud, courts have consistently backed the banking industry, ensuring the system remains intact.

- The Constitutional Question: Is This Even Legal?

Many critics argue that the modern lending system violates fundamental constitutional principles and contract law.

Article I, Section 8 of the U.S. Constitution grants Congress the power to coin money. However, this responsibility has effectively been handed over to the Federal Reserve, a private institution that prints money and lends it at interest.

The original Coinage Act of 1792 mandated that U.S. money be backed by gold and silver. Yet, today's money is entirely debt-based—created by banks and the Federal Reserve from nothing.

Contract law requires "consideration," meaning both parties must exchange something of real value. But in modern loans, the bank provides no real asset, while the borrower pledges their house, car, or wages.

If this isn’t legalized fraud, what is?

- The Hidden Cost: Debt Slavery and Economic Control

The implications of this system go far beyond a single loan contract.

Student loans cannot be discharged in bankruptcy, keeping borrowers trapped in financial servitude.

Credit card companies charge predatory interest rates exceeding 400% APR in some states.

The national debt ensures that every American is born into a system where they must work to repay an ever-growing financial burden they never consented to.

Under the Thirteenth Amendment, slavery and involuntary servitude are illegal—yet, this financial system forces people into a lifetime of debt repayment for money that never actually existed in the first place.

- What Can Be Done?

Despite the courts continuously siding with banks, more people are waking up to the reality of this debt-based scam.

- Challenge the legitimacy of debt – Legal scholars continue to question whether bank loans truly meet the legal definition of a valid contract.

- Push for sound money – A return to gold- and silver-backed currency would eliminate much of the artificial debt cycle.

- Demand banking reform – Stricter regulations on fractional reserve banking and predatory lending could help curb financial exploitation.

At the very least, people should be aware of how the system really works—because if we don’t question it, nothing will ever change.

Final Thoughts: A Rigged System?

The U.S. banking system is built on a lie. Banks do not lend real money—they create it. Borrowers must work for years or decades to repay an illusion, while banks collect real assets in return.

Legal challenges like Jerome Daly’s case and modern lawsuits have tried to fight back, but the courts remain protective of the banking industry.

So, what do you think? Should bank

s be allowed to create money out of thin air and charge interest on it? Or is it time to demand a new financial system that truly serves the people?

Let’s discuss in the comments.