Feeling Stressed? Well you shouldn't be. The sooner you take accountability for your own actions the better. It's always in the charts, the charts from 1897 look the same as the charts from 1932 as the charts from 1974 ...... 1987 ...... 2003...... 2009....... 2018 ...

- It's not you against the market...... it's you against yourself.

Trading and investing is a game of probabilities so therefore, find opportunities which have higher probabilities of success. Using Fibonacci levels on their own are not always reliable so combing Fibonacci with other technical tools increases the chances of success.

Convergence of a Fibonacci level (especially the 61.8 or 78.6% retracements, or the 161.8 or 261.8% extensions) with previous support/resistance, trend lines, major highs/lows and daily moving average and then using momentum indicators.

The sequence of numbers 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on to infinity is known as the Fibonacci sequence or golden rule. The sum of any two adjacent numbers in this sequence forms the next higher number in the sequence.

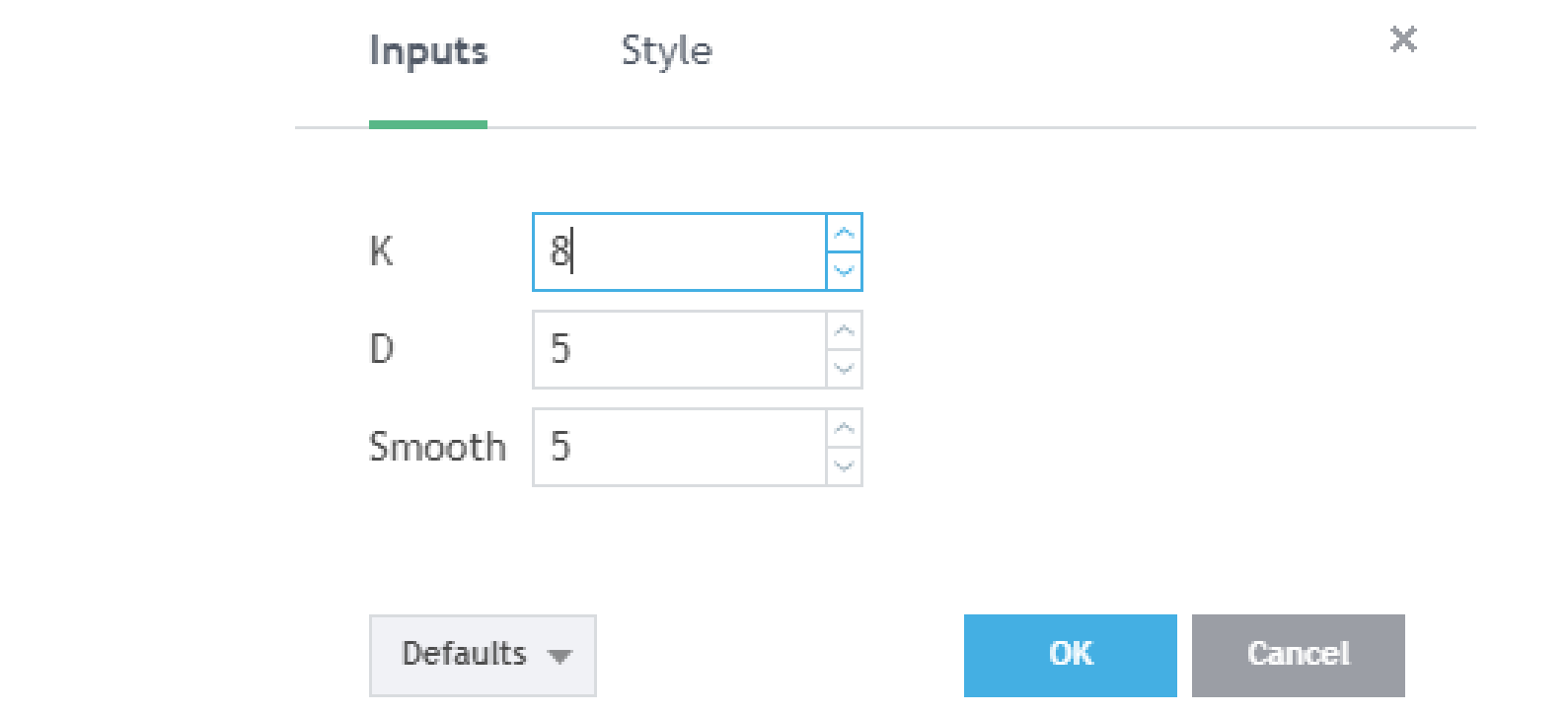

- I like the using the stochastics momentum indicator using 8, 5, 5

Stochastics %K = 8 ...... %D = 5 .... Smooth = 5

I like using Fibonacci moving averages. The thick green and blue moving average is a calculation of Fibonacci numbers.

I like using areas of price convergence whether retracement or price breakout (extension).

I like using trendlines for probable support / resistance.

I like using volume, simple supply and demand. Increasing volume on an impulse means increasing demand and so on.

This is me, you need your style.

The most important thing........... you can't be dogmatic about a position. There could be the real possibility the cryptos are in the vortex of a bell curve. I personally don't think so only because the masses aren't in it but i'll the market decide this.

All data and information provided is for informational purposes only. Trend Wizard makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

"This is me, you need your style." The truth... every trader needs to develop their own. Like your style... Don't understand the Fibonacci levels yet, myself, but moving averages are my style. Especially the 50 and 200

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit