Everybody is aware about Infosys, it is a leading IT company which was established by 7 founders in Pune with a capital of just $250. It came into stock exchange with an IPO (initial public offer) in February 1993 and stock exchanges have listed its share on June 1993.

This initial public offer was issued with a price of Rs 95/- per share which was listed at a premium of Rs 145/- per share and that was nearly 52% above its issue price(Rs95/-). Currently it is trading @ Rs1426.55/- , you can google it or cross check it in www.nseindia.com. This company was very transparent with their customers and investors which results in becoming a leading IT company during 2008. With the flow of its growing business, today this $250 company (in 1993) has converted itself to $10.9 billion in 2018 and its market capitalization is approx $40 billion.

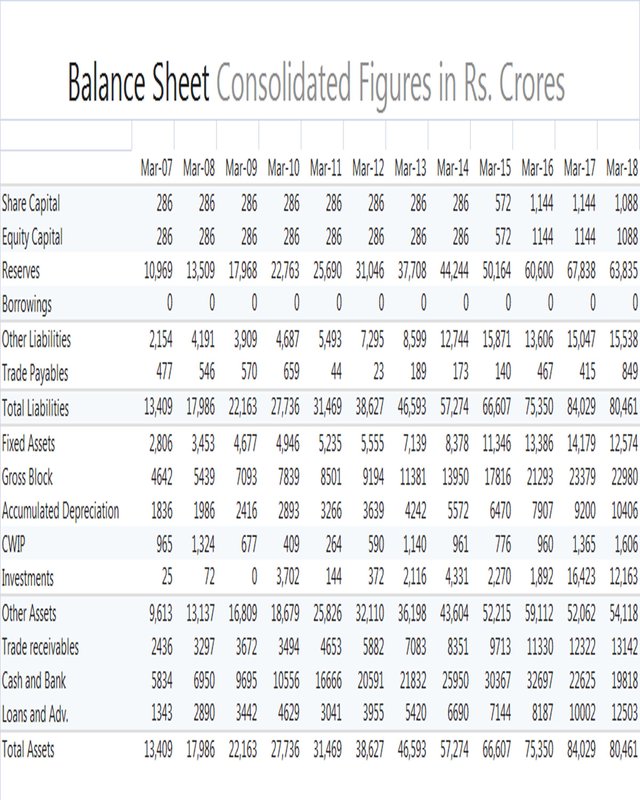

Here is the balance sheet of last 12 years of this company:-

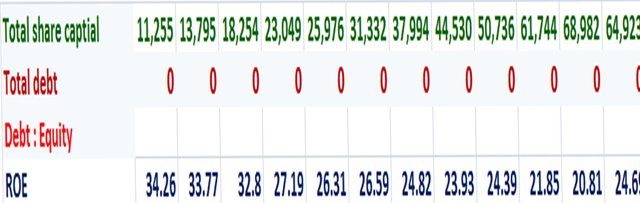

Results of the analysis of the above balance sheet:-

This analysis shows that the company holds a very good fundamental structure with zero debt and continuous flow of positive returns to investors.

Now let us see how this company have given Rs 7.30 crore to its investors. As we have seen above that how this company has managed its strength with good fundamental structure, their management have always uplifted their investors by paying regular dividends and bonus since its listing. It has offered 1:1 bonus shares in 10 years out of 11 years. Let us have a calculation of this bonus shares

• In 1993, if an investor bought 100 shares at Rs95/- per share

• In 1994, company declared 1:1 bonus = Investor receives 200 shares (1:1=100 shares + 100 shares)

• In 1997, company declared 1:1 bonus = Investor receives 400 shares (again 1:1 = 200 shares + 200 shares)

• In 1999, company declared 1:1 bonus = Investor receives 800 shares

• In 1999, company split the share of face value Rs 10 to Rs 5 = Investor receives 1,600 shares

• In 2004, company declared 3:1 bonus = Investor receives 6,400 shares (3:1=1600 shares x 3=6400 shares)

• In 2006, company declared 1:1 bonus = Investor receives 12,800 shares

• In 2014, company declared 1:1 bonus = Investor receives 25,600 shares

• In 2015, company declared 1:1 bonus = Investor receives 51,200 shares

The above data of bonus share and share split details can be found in www.nseindia.com

With the observation of above data it is clear that if any investor had bought 100 shares of Infosys in 1993 and have kept it till date without doing any hard work, then he is having 51,200 numbers or share of Infosys today 18/08/2018

Today the current price of Infosys as on date 18/08/2018 is Rs 1426.55/- per share. So by calculating, if anybody have 51,200 shares @ 1426.55 then it is equal to Rs 73039360/- ( Rs 7.30 crore approx)

In 1993 :-

100 shares x Rs95/- = Rs9,500/- (total investment

Today In 2018:-

51,200 shares X 1426.55 = 7,30,39,360 /- (approx 7.30 crore, Infosys is giving)

Hence if you have a quality of understanding a fundamental structure of any company, you can still find a lot of company in which you can make crores of fortune with no hard work.

For learning a process of fundamental analysis you can comment below and I will guide you about how to find a company which can make you crorepati.

I hope you might have understand the importance of investment.Now can you say this 7.30 crore would continue to become 70 crore in next 10-20 years??what is your opinion??