On an article published on Fortune, Multicoin Capital said that “My point is, if Ripple is labeled a security formally by the SEC, all of the crypto exchanges are going to stop trading Ripple,” he said. “So if that happens, liquidity is going to dry up on XRP and the price will plummet.”(http://fortune.com/2018/06/29/cryptocurrency-buy-ethereum-eos-ripple-litecoin/)

I would like to point out that the opinion above is based on wrong facts and demonstrates a lack of understanding of how capital markets work in other parts of the world out of the US.

Even if Ripple is labelled as a security by the SEC in the US, other regulators in other countries are not bound to follow the SEC's lead. In fact, the SEC in Thailand already expressly prohibits the trading of Ripple(https://www.bangkokpost.com/business/news/1481525/sec-releases-crypto-details).

It is wrong to say "all of the crypto exchanges are going to stop trading Ripple". It is more accurate to say that crypto exchanges in the US will stop trading Ripple until they get a security broker license. Other exchanges outside of the US are unaffected. Investors can still trade Ripple in exchanges out of the US.

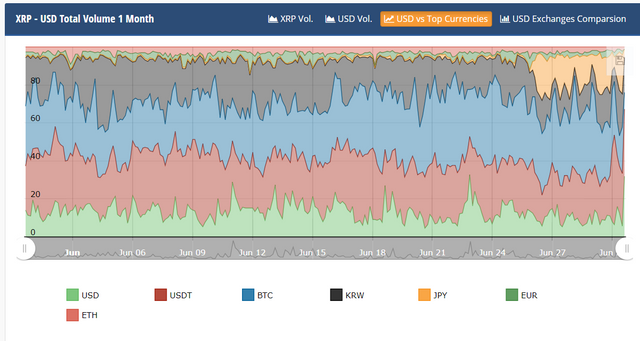

It is wrong to say "liquidity is going to dry up on XRP and the price will plummet.”. If you look at the graph below, USD trading of Ripple accounts for only about 15 - 20% of Ripple's volume. It is more accurate to say that liquidity may be reduced in the US. Do not overexaggerate the importance of US market for Ripple. The key markets are in Japan and Korea.

Source: CryptoCompare