Every week I compile the best and most interesting news stories about multifamily commercial real estate and send them out to a select group of clients. I call this 5-Stat Monday. Our group at CBRE closes $6 billion in financing each year, so we know the market well, and our clients demand we stay ahead of the curve.

Here's a sample of this week's 5 Stats. Enjoy!

Here's your "5 Stat Monday" – the quick read from the Brian Eisendrath Finance Team with five (or so) interesting multifamily and capital market updates we discovered over the previous week.

Welcome back and we hope you had a great Labor Day. As we say good bye to summer and hello to the start of conference season, let us know what information you’d like to see from us in our emails to you.

This week, you’ll find out why interest rates jumped last week, and you can download a great 1H 2016 market report from our research team – it’s worth the time (if not for you, definitely for your analysts). Enjoy!

INTEREST RATES JUMP

A quick re-cap: last week, the ECB decided (maybe) not to extend QE beyond March 2017. The market then had a tantrum and rates increased about 12 bps to their highest levels since Brexit. Then a couple of Fed officials made hawkish speeches, and the market responded again. Today, after moving between small gains and losses throughout today's session, interest rates briefly dipped after dovish comments from Fed Gov. Lael Brainard, who during a speech Monday called for “prudence” in interest-rate policy.

After Monday, the Fed enters its “blackout” period ahead of its Sept. 20-21 policy-setting meeting. With these dovish comments from our future(?) Treasury Secretary, we are hoping 1.67% is the high end of the range until the Fed punts again on raising rates. However, a lot of economic data comes out this week, particularly Thursday and Friday, headlined by retail sales and inflation readings.

MULTIFAMILY COMPLETIONS OUTPACE DEMAND

CBRE Research, in its first half 2016 report, reported that there were 229,000 completions and 202,000 net absorptions. Vacancy remained low at 4.4%. 275,000 units are expected to be delivered this year. There is a lot of good data in this report - it's worth the read.

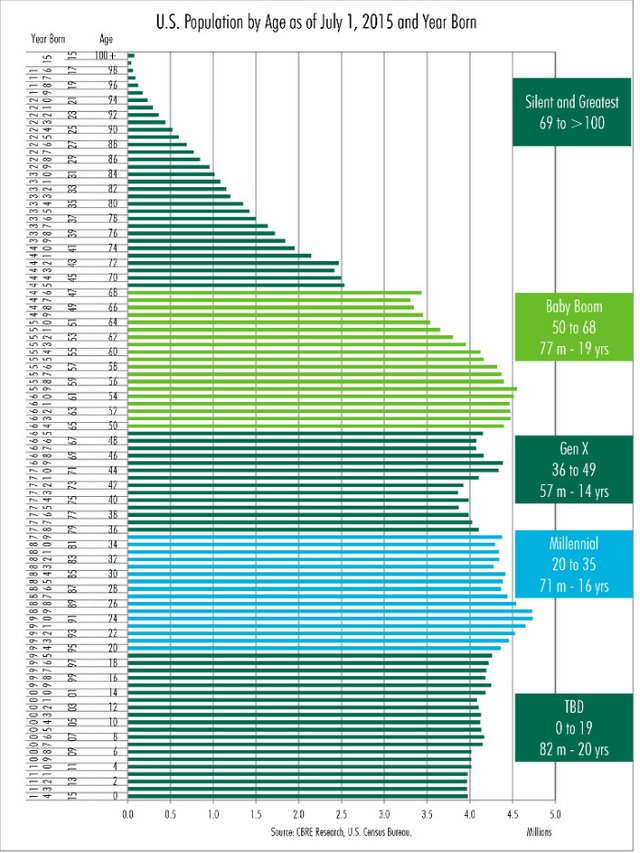

CHART OF THE WEEK

Every few years CBRE's head of research pulls the Census estimates for population by age and creates a visual representation of the generations. Email me for the PDF. There are 71MM Millennials and 57MM Gen-Xers, compared to 77MM Baby Boomers. There are 82MM under the age of 19, which is probably driving the student housing yields.

NFL ANALYSIS

In a nod to the start of the football season, here's a great detailed analysis on why Chip Kelly is horrible and a bigger view of how quickly you can lose success and what it takes to find it again.

Thank you for reading! As always, please let us know your requests and suggestions. Which bullet above is your favorite? What do you want more or less of? Let us know!

Brandon D. Smith

CBRE | Capital Markets

Debt & Structured Finance | Institutional Group

This post has been linked to from another place on Steem.

Learn more about linkback bot v0.4. Upvote if you want the bot to continue posting linkbacks for your posts. Flag if otherwise.

Built by @ontofractal

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit