MYCRYPTOBANK ELECTRONIC BANK SYSTEM TO MAKE VARIOUS BANK OPERATIONS

With the advent of Fintech into the world system of digital financing, there has been a rapid growth in double digit regarding its adoption in the last one year and 6 months.The pioneers of money transfer have actively increased the scope and developed the business even more. Moreover, according to the FinTech Retrieval Index of the accessible currency, it helps everyone without a bank account to gain access to funds and also enables quick and cheap fund transfer without any hindrance like geographical restrictions. The pivotal instrument that will release the full potential of MyCryptoBank is blockchain technology in conjunction with the popularity of smartphones, which will help the platform offer the full services of banking. The benefits associated with digital banking keeps going viral since it offers comfort, speed and safety, which are standard requirements in modern relations. The use of blockchain because of its decentralized nature disrupts any fraudulent act. Smart contracts will be is another effective tool in the blockchain platform that aids money exchange in a safe and non-conflict way, unlike the traditional method that goes through many protocols.

MEANING OF MYCRYPTOBANK

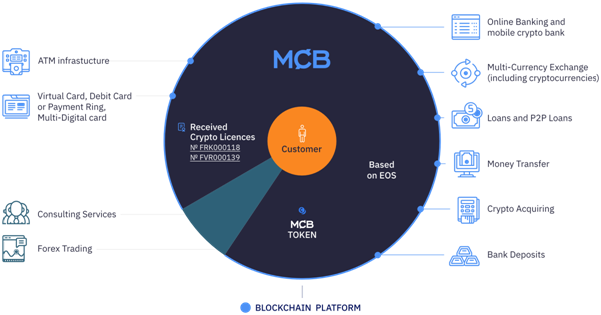

This is an online banking system that allows any client that is registered in the electronic bank system to make a full range of bank operations, and also make additional operations with cryptocurrency (processing of payments, debits cards, credit and cheap investment products, use of cryptoassets as credit security and many others) based on Blockchain Technology without a visit department. In a nutshell, the services of MyCryptoBank will include assisting customers to have a remote access to bank accounts, products, and services in order to perform banking operations.

The platform will be the world’s first multifunctional banking service, since it will combine both digital and traditional currencies, with the intent to solve problems such as the freedom to buy or sell cryptocurrency, fiat fund transfers for token purchases and further fund transfer worldwide without the risk of account blocking, confirmation of the validity of the funds received from the sale of cryptocurrency and its further use. Some of the fascinating features of MyCryptoBank will include online banking and mobile cryptobank in order for companies to pay for goods to companies and online services, crypto acquiring bank deposits, consulting services, money transfer, forex trading, multi-currency exchange or conversion of cryptocurrency (including cryptocurrencies like Bitcoin, Etherium, Litecoin, Dashcoin, Zcash, MyCryptoBank), receiving of loans and P2P loans, ATM infrastructure, Virtual card, Debit card or payment Ring, multi-digital card. The multi-digital cards especially offers a full tariff replacement for plain plastic cards, because they allow individuals to connect multiple cards at once: debits, credits, discounts, gift cards or even cards of fitness clubs, etc. in other words, they can connect to cards that have a default BARCode or EMV chip. They can also be used for cash withdrawals as with traditional cards. The payment rings are integrated in the bank payment system, once the user brings the ring to the payment terminal, the necessary amount will be written off. It saves time since it does not require users to have a card or mobile phone. The wallet gives possibility to send cryptocurrencies and fiat money to other users or send it to a debit card account. P2P loans combines both loaners and creditors, the loans are given out to any user with interest that are to be paid back in MCB tokens. However, the amount of the first loan would not exceed the amount of frozen tokens, and the creditors can choose to credit the borrower or not after perusing his credit history. If a borrower does not pay back, his frozen tokens will be used to cover the creditor’s losses and the borrower will lose his/her P2P crediting rights. Moreover,users will be able get direct access to Forex, where they can perform transactions bypassing any intermediaries through use of high technology methods of order processing and its output to the market.

These services will be available for users through the mobile bank App. Prospectively, MyCryptoBank will become a fully digital bank that will be accessible worldwide and at all times. It will perform all functions of a typical bank but without the bank department and front office, butmaximumly relying on new digital technology. Furthermore, this will allow MyCrytoBank to become one of the least expensive banks in the world with a very lucrative cost-benefit ratio.

The cryptocurrency can be acquired by stores, through withdrawal of other cryptocurrencies, fiat currencies, for their client’s. Even if the bank provides the payment in form of cryptocurrency, the seller can be able to receive traditional money.

POSSIBLE PROBLEMS

Most countries have a problem with cryptocurrency, feeling that it is a threat to their economy. And this issue will not only affect the cryptocommunity from being able to buy or sell cryptocurrencies, it will also hinder acceptance or transfer of funds in fiat money. Most banks have refused to open accounts with cryptocurrency platform who intend performing an ICO.

SOLUTION

However, MyCryptoBank will resolve this by assisting clients to send funds in both cryptocurrencies and fiat money, customers will be able to create deposits, receive loans and credits. Clients will be given bank cards to make withdrawal with any ATM worldwide, and also pay in shops and restaurants. Furthermore, there will be ATM for both local currency and cryptocurrency.The percentage of individuals making use of FinTech products shows that the project will accrue more users over time since it is embedded with all the attributes of a normal bank. In order to experience growth, young companies will come to see that Fintech is inevitable. Likewise industries, information technologies, social network and mass medium will intensively develop in the direction of FinTech technologies. All this affirms the fact that MyCryptoBank is highly demanded by the present FinTech market.

The banking platform will work in conjunction with Viplat, which is known to possess up to 5000 payment terminals, with plans to set up payment terminals for crypto all over the world. And Viplat receives applications for development of new type of equipment capable of robotizing any specific task. Experienced traders in stock market have developed this platform,collaborated with the largest liquidity suppliers and purchased trading platforms so as to avoid additional fees incurred in the market, and also a direct access to interbank trading with the intent of giving favorable prices to customers.

BENEFITS OF USING MYCRYPTOBANK

Developers of the platform have acquired license receipt for work with cryptocurrency in the Euro-zone, and that has made it possible for the bank to work legally with both fiat money and cryptocurrencies.

MyCryptoBank gives its users access to all the banking services available.

MCBtoken will be listed on the main cryptocurrency exchange list, since it leverages exchange of a virtual currency against a fiat currency.

MCBtoken is a rapidly growing cryptocurrency, allowing users to make payments, both instant and worldwide remittances.

Below is a table that gives a clear distinction between MyCryptoBank and other traditional banks:

Traditional bank MyCryptoBank

Business Geography Depends on legislation of country of residence No limits for business

Client quantity Limited No limits

Development Expensive and slow Fast and relatively not expensive

International transfers Limited by territory high fee No territory limits, low fee

Transfer price Commission up to 9% Commission up to 0.1%

Transfer speed Some days Some minutes

Large sum withdrawal Some days Some minutes

Control Centralization Decentralized

Currency exchange Commission up to 8% Commission up to 0.1%

Security Centralization of checking system Decentralized account

Work hours Depends on labor legislation 24/365

Offices Necessary for business development Not required

This analysis proves beyond reasonable doubt that MyCryptoBank is the online bank for the cryptocurrency business.

BENEFITS OF ACQUIRING THE MCB TOKEN

The platforms token is more like a central element and a utility token that can be used for the internal functioning of the platform, and it gives access to defined services, depending on the number of tokens possessed by the user. However, it does not provide profit when distributed amongst users. Every token will be burned on completion of the ICO. Each token held by a user leverages certain advantages to the individual at each stage of the project implementation, depending on the number of tokens owned by the user. Any client not in possession of the token will be rendered services based on standard conditions. Each investor might attain different statuses (Standard, Gold, Silver, Platinum), based on their investments, and the higher the status the higher the accessibility of the user to new services with lower transaction/exchange fees. The highest status will be given special accessories for transactions purposes. The increase in the number of users on the platform will increase the price of each token, and the number of services. Further benefits include speed of processing transaction, scalability with respect to increase to number of users, close to zero cost of transactions, updateability of smart contracts and the application, parallel tasking, possibility to create smart contracts, minimum time for confirmation of transaction and possible interoperation with different blockchain assets.

Furthermore, with the application of blockchain technology to the platform solutions will be given to issues related to cryptocurrency settlements, together with low cost for transaction with transparency and a secured distributed ledger. All records will be immutable. There are plans already set in motion to increase revenue and ensure higher availability and lower cost of products and services. Certain funds raised from investors through ICO will be allocated to reserves in order to ensure liquidity of MyCryptoBank at the first development stages.

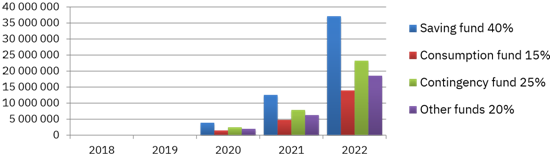

PROFIT DISTRIBUTION

The profit distribution will made across dedicated funds that will enable the major part of the profit to remain within the business ecosystem, since this will act as a funding source for the development of the project. The graph below shows that much profit will be allocated to saving fund during the project development stage which is about 40%, while about 15% will be allocated to consumption fund which will be used to give incentives and aid advancement of the project. Also 25% of the profit will be given to contingency fund to aid the liquidity of MyCryptobank, while 20% will be allocated to miscellaneous activities.

ROADMAP

Stage 0 (2006) = Viplat company foundation

Stage 0.1 (2014) = Purchase of Forex trade terminal

Stage 0.2 (2015) = 5000 payment terminals installed. Contract with liquidity provider signed for direct access to interbank market.

Stage 0.3 (2016) = Commissioning of own payment system. Development of software – informational complex for payment processing, with capacity of 20 thousand payment processing per minute.

Stage 1 (July 2017) = MCB project concept developed

Stage 2 (Nov. 2017) = 1BIT OU Company registered

Stage 2.1 (April 2018) = Start of trader personal account development. Documents submitted for license for turnover and storage of cryptocurrencies and cyber values.

Stage 3 (May 2018) = License for turnover and storage of cryptocurrencies and cyber values granted for being a providing services for cyber values exchange to monetary (fiduciary) assets and provider of services for cyber values wallet. Completed development and launch of own crypto-exchange 1bit online.

Stage 3.1 (July 2018) = Arrangement of Pre-ICO

Stage 4 (August 2018) = MVP MyCryptoBank Wallet (mobile crypto bank). Implementation of crypto-exchange MyCryptoBank service.

Stage 5 (Sept. 2018) = Arrangement of ICO

Stage 6 (Nov. 2018) = Start of MCB trading in exchanges.

Stage 7 (Dec. 2018) = Obtain payment license. EMI license obtained (license for e-money emission). Merchant billing system implemented

Stage 8 (Q1 2019) = Developed technology of users identification by biometrics data. MCB payment rings production. Start of MCB bank cards issue with the partner-banks. Implementation of crypto-terminals with function of fiduciary money intake and exchange of crypto currencies; implementation of payment multi cards with optional use as cold crypto currency wallet.

Stage 9 (Q2 2019) = Company partnership in SWIFT. Implementation of EPC Rulebook for financial operations in Euro zone. Implementation of technology for user’s identification by biometrics data. Broker license obtained. Launch of currency, indexes and futures trading in Forex market.

Stage 10 (Q3 2019) = International banking license of B type obtained in Cayman Islands. Implementation of MCB crypto-ATM for withdrawal and depositing of fiduciary assets. Launch of crypto-currency acquiring service.

Stage 11 (Q4 2019) = Launch of P2P-loan system in MCB mobile bank. Receipt of additional license for banking operations with crypto currencies. Implementation of MCB users crediting in crypto currencies. Expansion of crypto ATM network. Implementation of consultancy and legal service rendering, including taxation. Start of bank deposits service rendering.

TOKEN DISTRIBUTION

ICO participants = 65%

Project team = 10%

Development of bounty campaign = 3%

Partners and Experts = 7%

Reserve fund = 15%

Soft Cap = 3,000,000 USD

Hard Cap = 100,000,000 USD

Accept = ETH, BTC, LTC, FIAT, BCH, EOS

ICO Funds Distribution

Development and Integration of Blockchain platform = 30%

Marketing and Partner network Development = 20%

Development of Innovative products = 10%

Infrastructure development = 10%

Obtaining of licenses and maintaining the bank liquidity = 20%

Development of crypto ATM network with fingerprint identification and face recognition function. = 10%

CONCLUSION

In our modern world, the demand for digital money is very high, but traditional banks cannot meet this demand since their services are limited and centralized. Moreover, FinTech has the highest use activity in fund transfer and a good number of companies have started offering services online, while others are steering towards that direction too. Therefore, the need arises for an online banking system which will meet their needs and leverage many other outstanding features to its clients. MyCryptoBank will become the world’s first fully equipped banking system that will aid users in making transactions with the use of digital currencies and traditional currencies simultaneously. Other primary services will include exchange of crypto-currency with its likes or fiat currencies, wallet (mobile cryptobank), bank card and payment rings, money transfer all over the world, financing and loans P2P, cryptocurrency acquiring, Forex trading, deposit percents, Crypto-ATM and cryptomachines, consulting and legal services, including taxes. MyCryptoBank surpasses other traditional banks in so many ways that will ensure comfort, transparency, speed and safety. The MCB token is rapidly growing, allowing to make payments, making instant worldwide remittances, and grants its owner access to all banking services. The MCB token will be used only within the ecosystem of the platform. Licenses have been purchased by the developers of the platform to ensure reduced cost and freedom, while performing trading and other activities in the system. As the number of users increase in the platform the price of each token will rise exponentially and give profits to its owners. MyCryptoBank has the objective of solving problems in the current economic situation of the global financial market. For more information visit:

Website: https://mycryptobank.io/

Whitepaper: https://mycryptobank.io/docs/MyCryptoBank-white-paper.pdf

Twitter: https://twitter.com/MyCryptoBank

Facebook: https://web.facebook.com/Mycryptobank?_rdc=1&_rdr

Telegram: https://t.me/MyCryptoBank

Reddit: https://www.reddit.com/user/MyCryptoBank

Bitcoin profile: https://bitcointalk.org/index.php?action=profile;u=1860734

EOS Account Name: cryptolighte