Did the Fed cut interest rates useless? Already powerless to save the market?

On March 15, the U.S. stock market opened, and the S & P 500 triggered the third meltdown this month. The three major U.S. stock indexes opened lower. The Dow fell about 2,200 points. The S & P 500 index fell 7%, triggering a third meltdown this month. Trading in U.S. stocks was suspended for 15 minutes. US technology stocks tumbled, and Apple fell more than 12%.

If the Fed ’s last frantic rescue of the market was successful yesterday, global economists would simply come back and rebuild it.

Fortunately, the reality is that no matter how much you resist, the laws of the economy will eventually show its true power and even double back.

At this time, one must be mentioned-former Federal Reserve Chairman Paul Volcker, who died recently at the age of 92 on December 8, 2019.

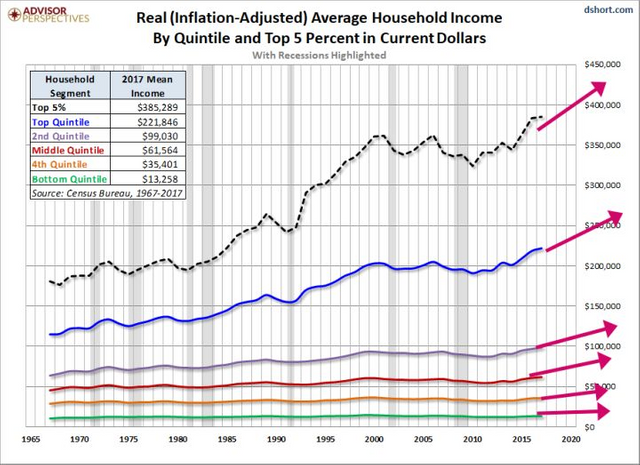

If this old man could live for four more months, he would be able to smile at the embarrassing appearance of Trump, who defied the laws of the economy; but at the same time, he could only regret seeing the operation of the dollar he founded himself. The mechanism failed in two weeks. Paul Volcker served as Deputy Secretary of the Treasury for Financial Affairs in the Nixon Administration from 1969 to 1974. He presided over the US abandoning the gold standard and ending the "Bretton Woods System." This credit is equivalent to recreating the dollar hegemony that the world still respects today. Why was it that Paul Volcker was particularly mentioned during the third consecutive US stock market meltdown, because during his tenure, he vigorously controlled inflation, punctured the economic bubble, and opened up the Fed's new duties. This is something the Fed can't do right now. In the 1970s, the decoupling of the US dollar from gold, the Vietnam War, and other factors led to the excessive overspending of the US dollar. The rapidly developing US economy has already encountered problems. The outside is also facing competition from the resurgence of Japan and Europe, the oil crisis in the Middle East, domestic inflation and unemployment. Are rising. At that time, the Fed tried to control inflation and found that the employment rate was too bad, and then it had to let go again. So by 1979, the annual inflation rate had soared to an unprecedented 13%. That year, US debt also began to exceed the total GDP. At the end of 1980, Paul Volcker, who had just assumed the chairman of the Federal Reserve, raised the federal funds rate to a record 20%, bursting the bubble in one fell swoop. Due to lagging benefits, in March of the same year, the inflation rate reached a peak of 11.6%. The US economy is in a severe recession. Under high-interest rates, the unemployment rate continues to rise, and business activities have encountered liquidity problems. From 1980 to 1982, the various industries in the United States that were punctured by the bubble were extremely dismal. It can be imagined that the Fed led by Paul Volcker was scolded. Farmers gathered at the Federal Reserve headquarters to protest, car sales fell to a 20-year low, and car dealers put the keys in a coffin and sent them to the Federal Reserve. Many also wrote to Volcker, complaining about high mortgage rates. There are also magazines publishing a "Wanted Order" against Volcker, accusing him of "premeditating and cold-blooded killing millions of small businesses" and "hiking the American dream of property owners". Within the government, Reagan, who has not yet become president, has also been heavily criticized for his policies, which was highly respected by Trump. Although this outrageous act ignited the worst economic recession in the United States since the Great Depression from 1982 to 1983, inflation that once rose to double-digits was firmly controlled by the Federal Reserve, laying the foundation for the "Reagan prosperity" of 80 years. Despite the 1987 stock market crash that year after he stepped down, according to ordinary people's understanding, it should not be a very good performance, but Paul Volcker was recognized as the greatest Fed chairman because the irrational market respects the economy Law is the most essential role of the Fed, so as to ensure the stable operation of the dollar system and the US economy, which is decoupled from gold, rather than just blowing bubbles. Raising interest rates and reducing interest rates, seemingly simple decisions are very stressful to implement. The key lies in the independence of the Federal Reserve and its understanding and respect for economic laws. After all, everyone is happy to send money and red envelopes, and it is easy to get support votes. Why not? For example, after Trump took office, the financial policy was basically to send money and then send money, and the rich sent more money. However, it is easy to offend people if they want to raise interest rates and tighten money bags, and they will face huge pressures in various aspects to affect commercial stock market loans. Every economist knows that sending too much money can cause inflation, the gap between the rich and the poor, the financial crisis and even the collapse of society (Lao Jiang's gold coupon), but it is very difficult to do so because no one wants to burst the bubble and change it. Become a sinner who detonated the economic crisis. The chairman of the Federal Reserve is appointed by the President of the United States. The President will certainly not be willing to spend money during his term of office. After all, all the people gathered around the President are capitalists. But Paul Volcker not only did it himself but also allowed the Fed to play this independent role without interference until Trump came to power. Trump first appointed Powell, the first non-financial background Fed chairman, and the Fed gradually became a tool for the president to manipulate the economy. The unprofessional Fed has completely lost its proud independence. Ironically, in order to please the bottom Americans during the Trump campaign, he had talked about punishing Wall Street and moved the bottom voters. As a result, Trump issued a red envelope to the financial market on the massive tax cuts at the beginning of his administration. Instead, he relaxed the supervision of financial institutions. Many financial media interpreted the results of the 2017 US stock market as a bull market, interpreting it as a "Trump deal" in the capital market. In his State of the Union address and various other occasions, Trump himself boasted of the current U.S. economic recovery and the repeated highs of U.S. stock indexes. The credit is due to his policies. He completely forgot to monitor Trump by exerting influence to allow the Fed to The cycle of interest rate hikes has been reversed to cut interest rates, blowing up the economic bubble and the stock market bubble, and reaping a lot of political dividends. Influencing the stock market through Twitter has also become a typical routine of President Trump. Originally in 2018, the U.S. economy should return to a recession cycle through the return of blood through QE, but the Federal Reserve under Trump's intervention was equivalent to forcibly renewing its life for more than two years. There is a question here. Since Paul Volcker controlled inflation in the past, why does the inflation and unemployment rate in the United States not soar now? How can we say that there is a problem with interest rate cuts? In fact, the problem may lie in the statistics of inflation and statistics. Alliance Berstein is one of the world's largest publicly traded global asset management companies. Its former head of economic research, Joseph Carson, believes that due to changes in inflation statistics, the inflation data currently seen by the market is actually problematic. Cost of living. As early as 20 years ago, the United States began to measure the cost of living only in rents and no longer included those who needed to repay their mortgages. The result is that before 2008, US house prices rose by double digits, but core inflation also reached only 2.5%. In the era of Paul Volcker, when US housing prices rose by more than 10%, core US inflation was often twice or even three times higher than later figures. Food, Carson believes that considering statistical methods, food price inflation is also particularly problematic. After comparison, Carson found that the CPI data had a huge error in the statistics of food prices in the United States. The difference between US government prices and actual prices is as low as 14% and as high as 64%. Here the respondent personal analysis and medicine. According to a Congressional report published by the Daily Mail, nearly one-third of the 20 most commonly prescribed medicines for elderly Americans increased their prices by more than 100% between 2012 and 2017. ZeroHedge, a financial blogger, also believes that in recent years people have observed unprecedented increases in drug prices in the "real world". Although this has been a key political topic for many years, somehow it has never triggered any inflation model. The last one is education. The soaring tuition fees of US private universities operating on a profit model have not been reflected in inflation indicators, and student loans of up to $ 1.5 trillion are also hidden under the myth of "low inflation", directly overwhelming the future of the United States. In addition to the problem of inflation, another key factor affecting the Fed's decision is that the unemployment rate also has moisture. For example, people who are unwilling to work are not counted; those who have found a job in the past four weeks but have not found it are counted as unemployed, and long-term unemployed are not counted. As a result, in the United States where odd jobs are common in the service industry, a large number of unemployed migrants or temporary workers are excluded from the unemployment rate. (Note, lest there be a bar, here is not to discuss the issue of unemployment rate standards, but that the current virtual economy accounts for a large portion of the United States unemployment rate, which is too high to reflect the actual employment situation of the people.) This unemployment rate is similar to that of forty years ago. The unemployment rate data faced by Paul Volcker can be said to be completely different. After all, there were still stable jobs in many factories in the United States at that time, and employment was not high. It can be said that the two most important policy reference indicators of the Fed are at least inaccurate. The current chairman, Powell, still uses "low inflation" and "high employment" as the best excuse to cut interest rates and water under the full intervention of Trump. Trump himself also used low inflation in Twitter to refute those who satirically criticized him. The questionable data also flickered with US public opinion to support Trump. Paul Volcker, who has retired for many years, reminded in media interviews in the past two years that the degree of perfection of employment statistics is not enough to reflect the difference between 2%, 1.75%, and 1.5% inflation. It is a silly idea to mistakenly measure that the level of inflation in the economy can reach that precise level. He also indirectly warned the Trump administration that inflation could be too loose and attempts to boost the economy through excessive currency expansion. But suddenly expectations have changed, and people's behaviors have suddenly changed, causing problems.

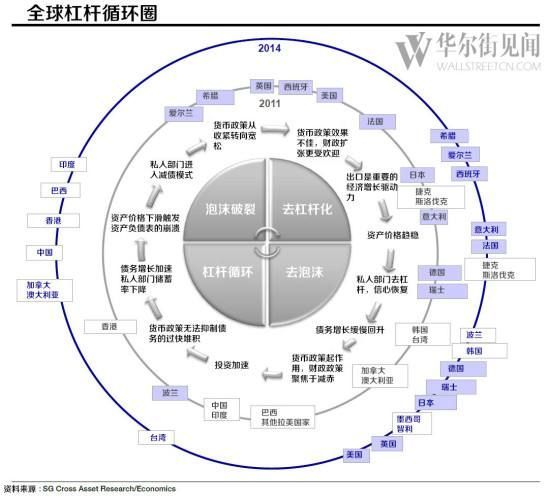

Leverage, foam, crisis, and deleveraging, just like the undulating roads in the mountains, cannot change the inevitable economic laws. Driving on it can only follow the terrain, and you cannot step on the accelerator when you reach the top of the mountain, otherwise, it will usher in a more tragic ending. Entering the 2020s, Paul Volcker is just a retired old man with a wind candle. He can only watch the Fed losing its independence like a truck with a broken speedometer. Under the intervention of an unprofessional driver and a brain that is extremely excited by passengers, Throwing the American throttle and rushing to the cliff. In November 2019, Ray Dario, the founder of the world's largest hedge fund, who has a close relationship with Paul Walker, wrote that the Fed has been providing cheap funds to investors under the title "The world is crazy and the system is collapsing." These investors are pouring money into companies that usually don't generate profits and don't contribute to economic growth. He wrote: "The system that allows capitalism to serve the majority has collapsed." He is not talking about it but based on macro forecasts, betting on tens of billions of dollars in 2018 to be bearish on the U.S. economy, even if it is bullish The worst performance in 2019 has not changed the bearish view. For more than forty years after Paul Volcker stepped down, the United States has gathered an immense asset bubble. The Internet dividend of the 1990s and the collapse of the Soviet Union eased for a while, and finally burst in 2008. But since then, the United States, which is constantly QE releasing water, has not really solved the problem, and Obama has not changed anything. In the end, Trump has turned into a thunderstorm. With the enthusiasm of the financial system and soaring asset prices, the hollowing-out trend of the industry has intensified, and the re-industrialization of the US real economy has long been out of reach. One example is that the Wall Street capital bubble has overflowed. As a result, the only shale gas industry that can give the US economy a lifespan has been thrown away because it can't raise money, and China is still at the bottom.

As early as two years ago, the United States should have fully entered into the rate hike cycle. It can also withstand the consequences of the bubble burst and slowly pull back. But was stopped by Trump, but instead rushed to the highest peak of US stock indexes in 2019, turning into a thunderbolt that the Federal Reserve could not cover the United States.

It is conceivable that the general tragedy of ordinary people is hidden in false indicators. More than 2% of inflation simply cannot explain why 40% of Americans cannot afford the sensational reality of $ 400. (For data, see the U.S. congresswoman angry at the person in charge of cdc.) It is easy to sing a red face, but it is difficult to sing a white face. It is even more difficult to sing the white face of the world ’s largest financial empire. Unfortunately, Paul Volcker did not finally see the tragic status quo of the three meltdowns when the bubble finally burst. But only those who are brave enough to fight pressure and sing face like Paul Volcker and Bridgewater Fund founder Ray Dario can build up the global hegemony of the US dollar, not those who have their brains hot. After the bullets are over, the lunatic with stud. Paul Volcker was born on the eve of the Great Depression of the United States in 1929 and died before the historic "three consecutive blowouts" of the US stock market. In his life, he did not gather much wealth but witnessed the rise of the United States in the crisis. He personally built the US dollar system for more than half a century, and finally closed his eyes in the last carnival of the US economy. In 2020, the American story is almost over. I do n’t know who will be the protagonist in the next Chinese chapter.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit