According to the Tennessean,

The explosion occurred along the 160 block of the historic Second Avenue North in Nashville's entertainment district, officials said, but the blast was felt from miles away.

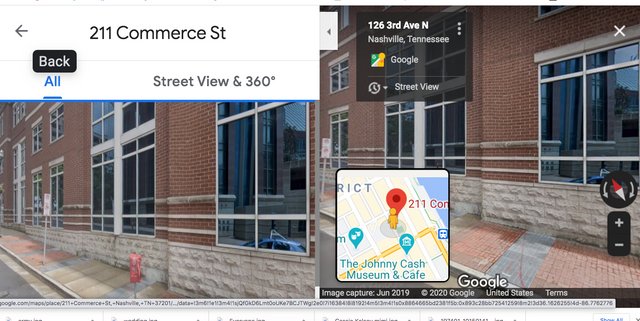

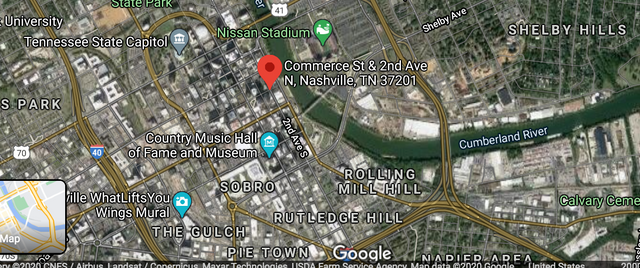

An initial map of google even identified the location.

About 30 minutes prior to the explosion, police responded to reports of shots fired near Second Avenue and Commerce Street. This is where authorities saw a suspicious vehicle parked near the AT&T building.

In the aftermath and recovery process of the explosion, residents who live near the blast location have released security footage showing the extent of damage to their homes.

More tips have poured in as investigators comb through the wreckage and a home is searched at an Antioch address.

Find source link below.

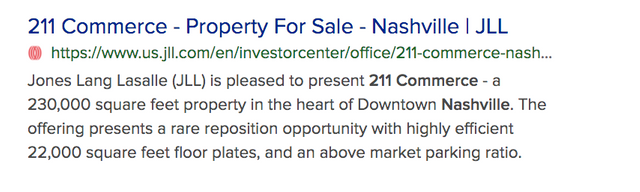

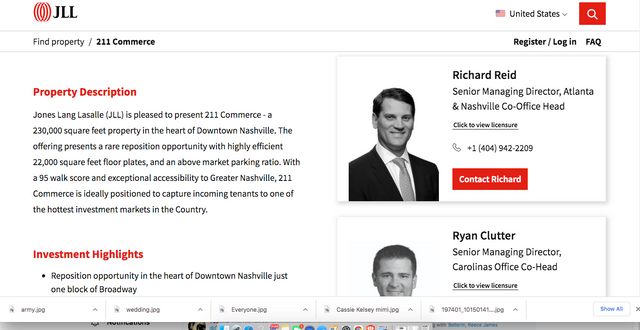

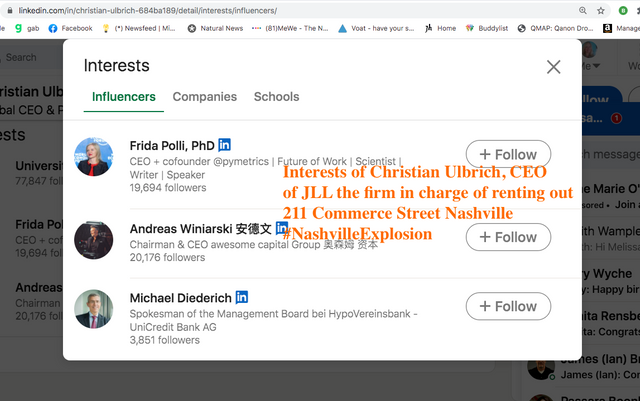

JLL or Jones Lang LaSalle

JLL is headquartered in Chicago, Illinois, and it is the second-largest public brokerage firm in the world. The company has approximately 93,000 employees in 80 countries, as of 2019.

- The company also provides investment management services worldwide, including services to institutional and retail investors, and to high-net-worth individuals.

- JLL had acquired 80 companies and established 100 offices worldwide by 2016.

- The company expanded from commercial real estate services to include property technology or "proptech", with the 2017 launch of its JLL Spark division.

- In early 2018, the division acquired Stessa, a portfolio management company

With Stessa, you can expect to be up and running in 15 mins or less! How Much Does Stessa Cost? Stessa is a free cloud-based software program for rental property owners. You can add an unlimited number of properties, connect as many bank accounts as you like, run endless reports, and freely export your transactions data to Excel at anytime.

- In June 2018, JLL Spark created a $100 million venture fund to invest in real estate start-ups, such as a technology to link office users with co-working spaces.

- JLL announced the acquisition of HFF in a deal worth $2 billion in March 2019.[28] The acquisition was completed in July 2019 and worth $1.8 billion.

So it's just like the song We Built this City states. ..Corporations Always changing Corporation Names!

*Wonder just WHO that benefits?

https://www.gtb.unicredit.eu/global-transaction-banking/groups-home-markets/germany

The following taken from a Deep Dive years ago here,

https://steemit.com/illuminati/@artistiquejewels/ralph-blasey-connected-weakening-of-america-and-the-baal-who-occupies-a-position-in-the-highest-judicial-seat-of-the-eu

Why? Christine Blasey Ford's father, Ralph Blasey Jr. is connected with the owners of this company.

This will cover. . .

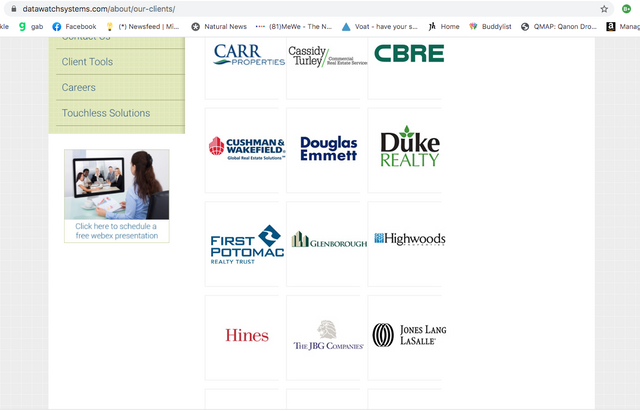

clients of Datawatch.

Why? Christine Blasey Ford's father, Ralph Blasey Jr. is connected with the owners of this company.

What and who is involved with this company.

The fall of Lehman brothers at the time of the rise of Blackstone.

Insider deals that went on

A corrupt judge involved connected to the governor of New York

History of those buying out Lehman brothers

The global industry Datawatch and it's clients are linked to including the UN and the Seat of the European Court of Justice

Link to controllers in history including a close cohort of Rothschild

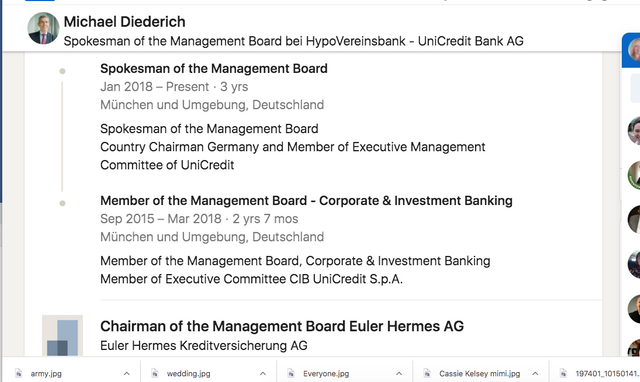

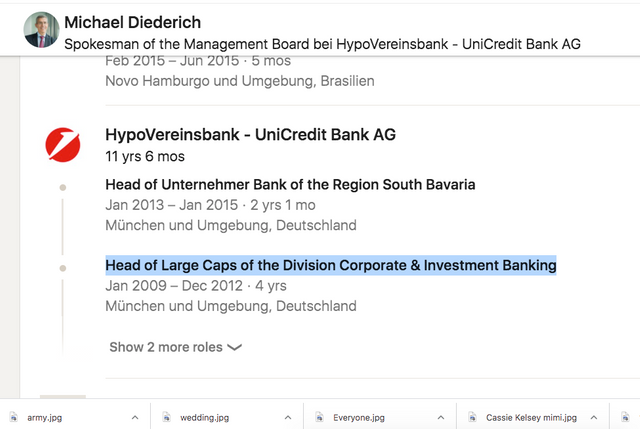

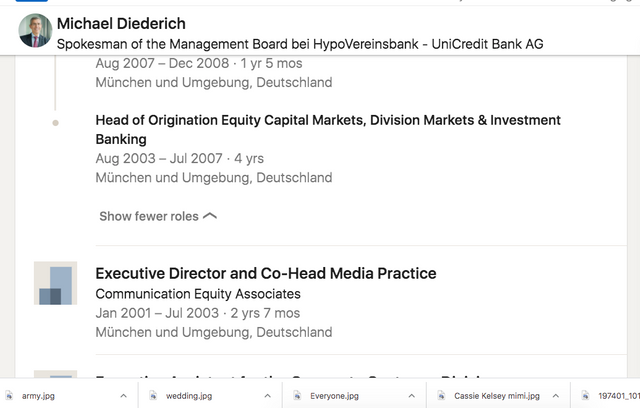

The Baal of International Banking and CEO of banks in the capitol region of the Highest Judicial Court of Justice in the EU

Just who profited from minibonds that became worthless after Lehman brothers went bankrupt. . .Elderly, Students, families were some taken advantage of

A bank that was the German arm of citigroup take over by Daniel Baal's banking industry

A co-worker and Board member of Baal's that is connected to Google Think Performance, Nimbus Ninety, Gartner, NEXT Berlin, Tedx, PayPal, MasterCard, Microsoft, CIO City, SAS, Accenture and Apple

Connected to the European Pharmacopeia Commission involved in * Blood Transfusion

Organ, tissue and cell transplantation

Cosmetics and food contact materials

Another client of Datawatch owned by the co-workers and friends of Ralph Blasey worked on projects called L'Enfant Plaza offices in various locations in D.C.

Connection to a Luminos band that spells out what illuminati stands for

The Big Picture. . .grand scheme of things and how it leads to a globalist agenda connecting to controlling factions making political and financial decisions on a global scale.

Photos of Daniel Baal

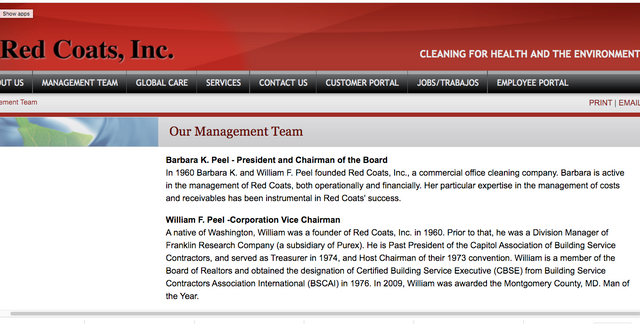

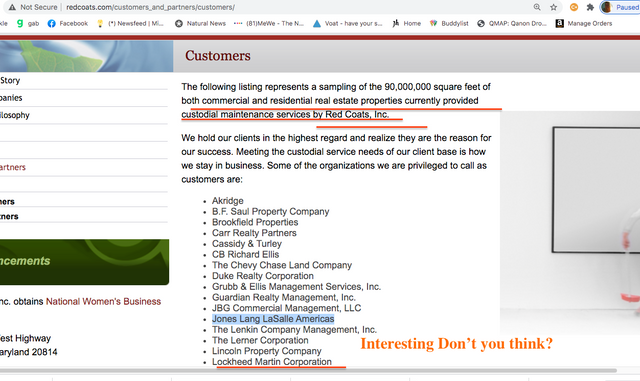

The short of it. . .Barbara Peel is listed on Red Coats site as CEO and is listed as Chairman, President and Co-founder of Red Coats (owner of Datawatch). Since 1960!

Husband, Willam Peel is Vice Chairman of the board for RedCoats and co-owner/founder of Datawatch Systems.

But if you are willing to take the time. . .the trail leads to a diabolical plot!

Why is this important? It shows adherence to the same goals of a particular group and what is being orchestrated right under people's noses.

Here are some of the companies whom Datawatch services,

Let's pull out one

JLL Stands for Jones, Lang Lasalle

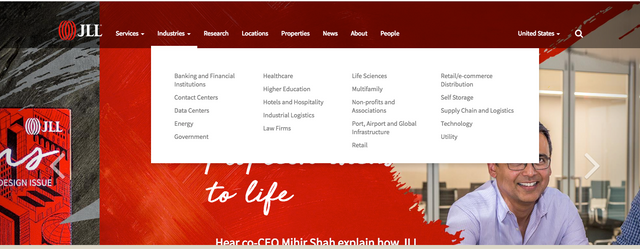

Awe, a Globalists Dream! Look at All the industries they are in

Banking and Financial

Data Centers

Government

Energy

Higher Education

Healthcare

Hotels

Law Firms

Supply Chain

Technology

Port, Airport and Global Infrastructure

Supply Chain

Utility

Pretty much Everything

Don't worry, you won't be left out, you can find a globalist to help you Anywhere!

Locations All Over in the U.S.

Go here to see locations in various countries http://www.jll.com/locations

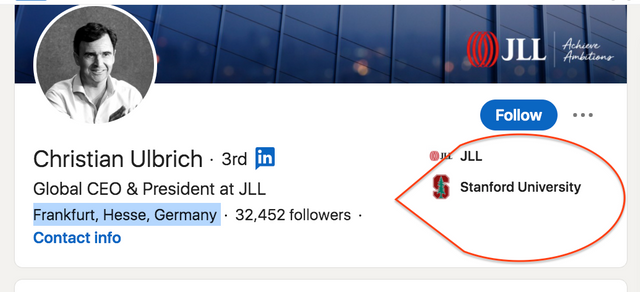

Just some of their CEO, Christian Ulbrich's compensation,

Christian Ulbrich

Executive Compensation

As Chief Executive Officer and President at JONES LANG LASALLE INC, Christian Ulbrich made $9,219,001 in total compensation. Of this total $809,858 was received as a salary, $5,841,000 was received as a bonus

UN ties . Remember, much of what the UN does under the "cloak and cover of goodness" leads to predatory practices as we have found with numerous links of UN soldiers being linked to child sex abuse in Haiti and all over the world.

Considered one of the world’s leading professional services firms, (they CLAIM the following)

JLL is known for its commitment to the highest ethical standards

and to practices that enhance the welfare, safety, and well-being of

our employees and wider communities. A Signatory to the United

Nations Global Compact since 2009, JLL has embraced the U.N.’s

Sustainable Development Goals

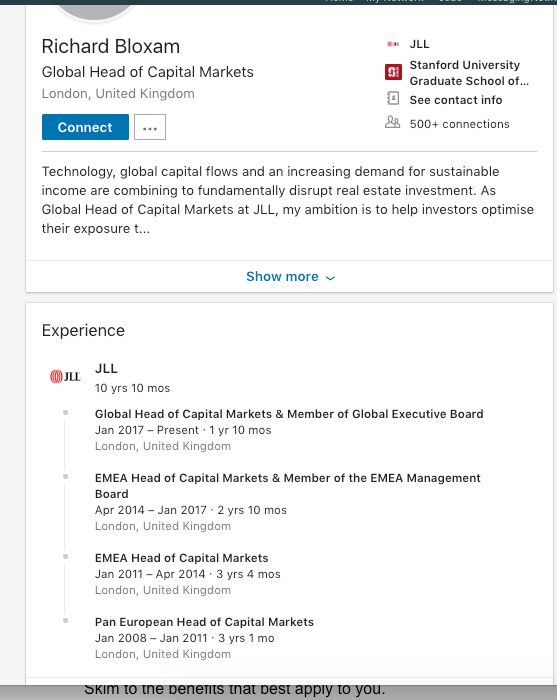

Here is Richard Bloxam, Global Head of Capital Markets,

What a Small world, also a graduate of Stanford,

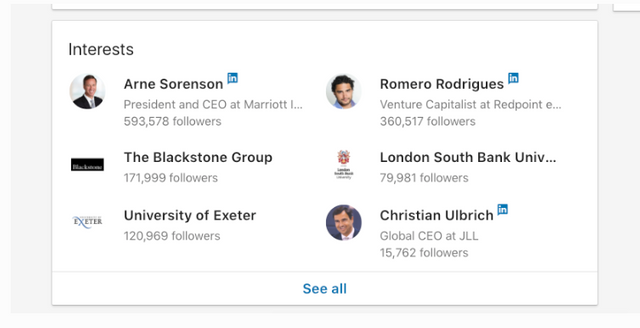

Here are his interests, Note Blackstone Group

See more on this further down.

Interesting info from Liberty Unyielding. . .

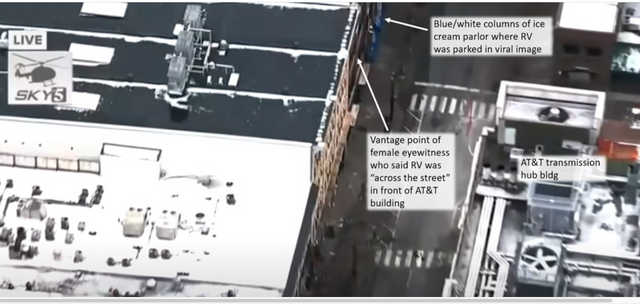

the homely little RV seen in security camera videos, which apparently carried the bomb to the intended location, was parked directly adjacent to a major regional hub facility for AT&T, located in the 100 block of 2nd Avenue North.

At least two eyewitnesses speaking to local media confirmed that the RV sat on the street a few feet from the AT&T building for some time (apparently a minimum of nearly an hour; possibly more) prior to the blast.

However, there appears to be a (possibly minor) discrepancy for which I haven’t yet seen a resolution. The location from which the RV seemed to be broadcasting an audio warning over a loudspeaker, if we go by the viral image seen across American TV screens on Friday, was not the location where it blew up.

It’s not just that an eyewitness interviewed on a local news station described a different location (video below). It’s that there’s no bomb blast where the RV was sitting in that viral image. The bomb blast is visible in post-explosion videos down where the eyewitnesses have said it was just before the explosion. So the RV apparently moved — not just down the street, but across the street — after the Nashville police provided the image that went viral.

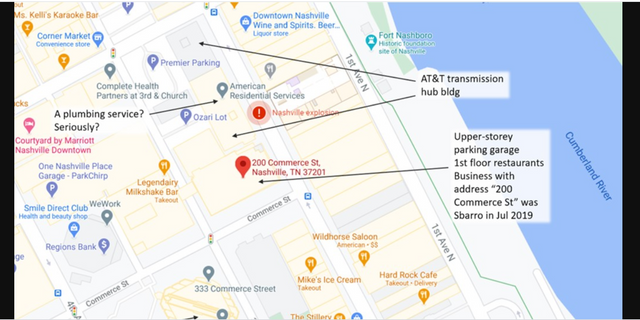

Here is that image. Notice that the RV is in front of a business with blue and white painted storefront columns. (It’s not clear if it is in motion here.)

Here’s the video with a female eyewitness describing where she saw the RV around 6 AM: “across the street,” right in front of the AT&T building (the tall building with the reddish exterior, and the light-colored extension from it at one end, form the AT&T transmission hub building).

Here’s a video screen grab showing the blue and white columns of the business (an ice cream parlor), the vantage point of the eyewitness (next to the ice cream parlor, above the Melting Pot Restaurant), and the damage in the street in front of the AT&T building. It’s clear there’s no bomb blast in front of the ice cream parlor with the blue and white columns. The bomb blast damage is down the street in front of the AT&T building. So the RV had to move after the viral image was taken.

These images show where the RV was said to be in relation to the AT&T building, and what the area looked like (before being blown to smithereens) from street level. First, an orientation map.

The vantage point of the female eyewitness was across the street (to the viewer’s right) from the AT&T hub building, in the building just under the words “Nashville explosion.” Google map; author annotation

View up 2nd Avenue toward the AT&T building.

View from across the street of the location described for the RV before it blew up.

the seeming gunshots that preceded it – at least one witness recounted hearing two series of 5-6 “gunshots” at a time; and the facts that the police were on scene quite early in the event, well before the detonation, and the RV that blew up was reportedly broadcasting a recorded message that warned people within earshot in the buildings to evacuate, for as much as 30-45 minutes before the blast.

One witness (video above) who gave that detail said that the blast didn’t occur at the time that countdown would have indicated, but rather some minutes later than that.

These security camera videos show the blast as it happened.

https://twitter.com/i/status/1342519192180969473

Nashville Explosion Caught on Tape

Some reports speculate whether the “gunshots” may not have been gunshots – witness accounts and recordings of them seem to suggest they were less sharp and more guttural than a gunshot would be – and may have been smaller charges going off prior to the main blast. On that point, we’ll just have to wait and see what the authorities say as they reconstruct the event.

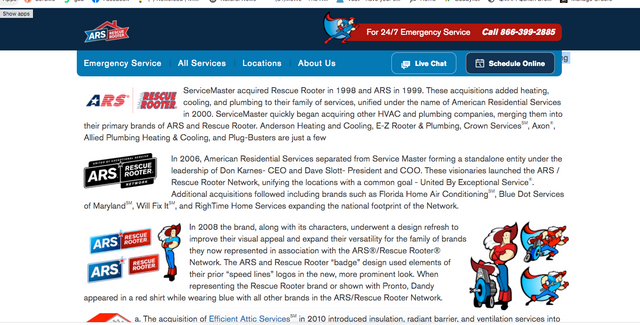

From my prior dig on Ralph Blasey and his connection to all kinds of services including utility, janitorial and maintenance, it makes one wonder about American Residential Services as stated they provide Maintenance Services.

One of the advantages of maintenance is. . .well, Access.

Also access to buildings at odd hours due to their emergency services.

People are saying they are a plumber, but they are Far More than plumbers. There services are vast and extensive.

JLL. . .a client of Datawatch Systems. . .Owned by the CEO and Vice Chairman of Red Coats. . . Barbara and William Peel

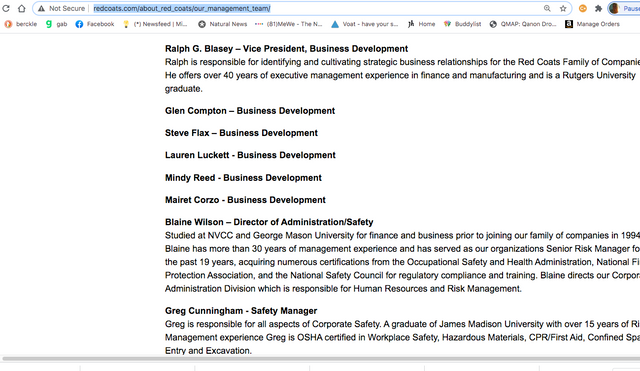

Ralph Blasey works for Red Coats. . .Verified

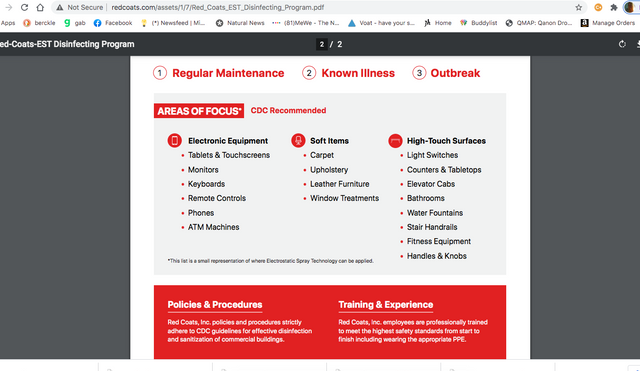

Who would also stand to benefit from a pandemic that needs clean services. Just pointing out the obvious of "services."

What all was being cleaned off Everywhere from the initial panic of this pandemic. . .which BTW was signaled in World War Z?

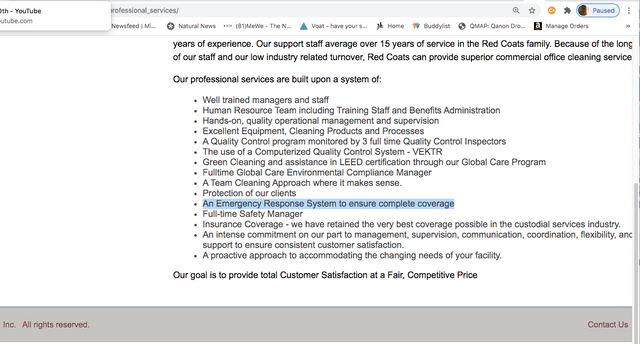

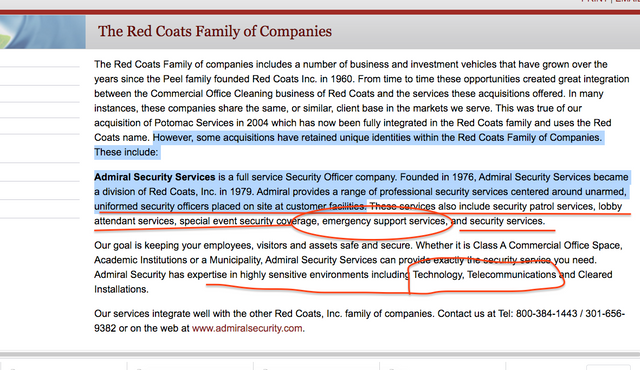

If you check out About US then Family of Companies on the Red Coats page

However, some acquisitions have retained unique identities within the Red Coats Family of Companies. These include:

Admiral Security Services is a full service Security Officer company. Founded in 1976, Admiral Security Services became a division of Red Coats, Inc. in 1979. Admiral provides a range of professional security services centered around unarmed, uniformed security officers placed on site at customer facilities.

This is on Red Coats page,

Go to About Us

Then go to Customers and Partners

The Blackstone Group

an American multinational private equity, alternative asset management and financial services firm based in New York City. As the largest alternative investment firm in the world, Blackstone specializes in private equity, credit and hedge fund investment strategies. As of December 31, 2017, Blackstone had $434 billion under management.

Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last decade, while its real estate business has actively acquired commercial real estate. Since its inception, Blackstone has invested in such notable companies as Hilton Worldwide, Merlin Entertainments Group, Performance Food Group, Equity Office Properties, Republic Services, AlliedBarton, United Biscuits, Freescale Semiconductor, Vivint, and Travelport.

Why is this IMPORTANT?

Blackstone was founded as a mergers and acquisitions boutique by Peter G. Peterson and Stephen A. Schwarzman, who had previously worked together at Lehman Brothers, Kuhn, Loeb Inc..

Yes, you Have to follow me down the rabbit hole, because if we ignore this connections. . .well, let's just say they are KEY!

Remember I said, many times these companies sell off debt, liquidate or as in this case take out Bankruptcy.

I can hear an sleeping person's question from here? So? Big deal, many companies take out bankruptcy, just how it is.

This was a BIG One! Whether it affected you directly or not, I assure you it Affected our Country!

Notice Blackstone, founded in 1985 Blackstone has become one of the world's largest private equity investment firms. In 2007, Blackstone became a public company via a $4 billion initial public offering to become one of the first major private equity firms to list shares in its management company on the public stock market.

Interesting as Lehman Brothers was a Global Financial Firm and they ended up filing for bankruptcy guess when? 2008.

Can anyone say weakening of the American economy and livlihood? .

A description follows, but Biggest Take Away. . .

Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), doing business in investment banking, equity and fixed-income sales and trading (especially U.S. Treasury securities), research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.**

Barclays announced its agreement to purchase, subject to regulatory approval, Lehman's North American investment-banking and trading divisions along with its New York headquarters building.

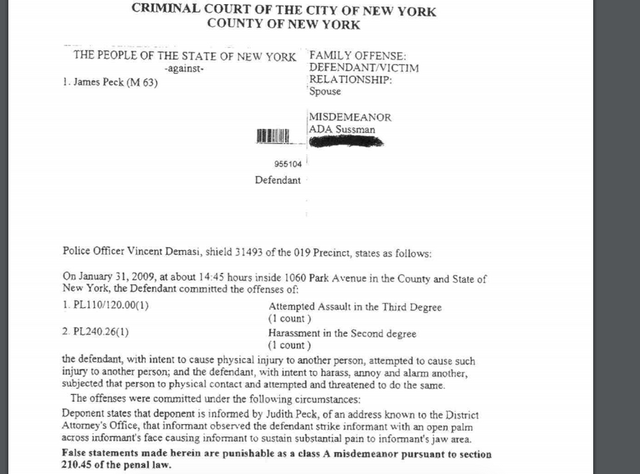

They had a Very special judge for this who was on Board for their Buy out! He is a judge who has been in trouble with the law himself, let off the hook by a certain Governor of New York who worked for the Clintons and under Obama.

On September 20, 2008, a revised version of that agreement was approved by U.S. Bankruptcy Judge James M. Peck. The next week, Nomura Holdings announced that it would acquire Lehman Brothers' franchise in the Asia-Pacific region, including Japan, Hong Kong and Australia, as well as Lehman Brothers' investment banking and equities businesses in Europe and the Middle East. The deal became effective on October 13, 2008

Look at Barclays,

Products Retail banking

Commercial banking

Investment banking

Wealth Management

Revenue Decrease £21.076 billion (2017)

Operating income

Increase £3.541 billion (2017)

Net income

Increase £(0.894) billion (2017)

Total assets Increase £1.133 trillion (2017)

Total equity Increase £66.016 billion (2017)

Number of employees

79,900 (2018)[2]

Divisions Barclaycard

Barclays Investment Bank

Barclays Wealth

Barclays plc (/ˈbɑːrkliz, -leɪz/) is a British multinational investment bank and financial services company headquartered in London. Apart from investment banking, Barclays is organized into four core businesses: personal banking, corporate banking, wealth management, and investment management.

Barclays traces its origins to a goldsmith banking business established in the City of London in 1690.

Over the following decades Barclays expanded to become a nationwide bank. In 1967, Barclays deployed the world's first cash dispenser. Barclays has made numerous corporate acquisitions, including of London, Provincial and South Western Bank in 1918, British Linen Bank in 1919, Mercantile Credit in 1975, the Woolwich in 2000 and the North American operations of Lehman Brothers in 2008.

Guess who the largest shareholder is? Qatar Holdings, an investment vehicle of the State of Qatar.

Once again, Why is this important?

Clinton's charity confirms Qatar's $1 million gift while she was at State Dept.

https://www.reuters.com/article/us-usa-election-foundation-idUSKBN12Z2SL

According to a 2011 paper by Vitali et al., Barclays was the most powerful transnational corporation in terms of ownership and thus corporate control over global financial stability and market competition.

In 1925 the Colonial Bank, National Bank of South Africa and the Anglo-Egyptian Bank were amalgamated and Barclays operated its overseas operations under the name Barclays Bank (Dominion, Colonial and Overseas) – Barclays DCO. In 1938 Barclays acquired the first Indian exchange bank, the Central Exchange Bank of India, which had opened in London in 1936 with the sponsorship of Central Bank of India.

In 1965, Barclays established a US affiliate, Barclays Bank of California in San Francisco.

In 1980, Barclays Bank International expanded its business to include commercial credit and took over American Credit Corporation, renaming it Barclays American Corporation.

In 1999, in an unusual move as part of the trend at the time for free ISPs, Barclays launched an internet service called Barclays.net: this entity was acquired by British Telecom in 2001.

In July 2008, Barclays attempted to raise £4.5 billion through a non-traditional rights issue to shore up its weakened Tier 1 capital ratio, which involved a rights offer to existing shareholders and the sale of a stake to Sumitomo Mitsui Banking Corporation. Only 19% of shareholders took up their rights leaving investors China Development Bank and Qatar Investment Authority with increased holdings in the bank.

This is also Very Interesting!

In 2008, Barclays bought the credit card brand Goldfish for US$70 million gaining 1.7 million customers, and US$3.9 billion in receivables. Barclays also bought a controlling stake in the Russian retail bank Expobank for US$745 million. Later in the year Barclays commenced its Pakistan operations with initial funding of US$100 million.

When Barclay acquired Lehman Brothers,

After a seven-hour hearing, New York bankruptcy court Judge James Peck ruled: "I have to approve this transaction because it is the only available transaction. Lehman Brothers became a victim, in effect the only true icon to fall in a tsunami that has befallen the credit markets. This is the most momentous bankruptcy hearing I've ever sat through. It can never be deemed precedent for future cases. It's hard for me to imagine a similar emergency.

Nomura paid $225 million for the purchase of Lehman's Asian-Pacific unit. Due to large losses with shares dropping to their lowest level in nearly 37 years, Nomura cut around 5 percent of its staff in Europe (as many as 500 people) in mid-September 2011.

In 2011, Trent Martin was hired at Nomura despite having an arrest warrant in the US for alleged insider-trading, securities fraud, and conspiracy to commit securities fraud. Nomura proudly displayed Trent Martin's hire in September on their corporate website.

Trent Martin allegedly involved in an insider trading deal when IBM purchased SPSS Statistics Software

SPSS is a widely used program for statistical analysis in social science. It is also used by market researchers, health researchers, survey companies, government, education researchers, marketing organizations, data miners, and others. The original SPSS manual (Nie, Bent & Hull, 1970) has been described as one of "sociology's most influential books" for allowing ordinary researchers to do their own statistical analysis. In addition to statistical analysis, data management (case selection, file reshaping, creating derived data) and data documentation (a metadata dictionary is stored in the datafile) are features of the base software.

Let's go back to Lehman Brothers

Now let's get back to the Judge in that Lehman case.

Before joining Morrison & Foerster, former Judge Peck served as a United States Bankruptcy Judge for the Southern District of New York from 2006 to 2014. During his judicial service, former Judge Peck presided over the chapter 11 and SIPA cases of Lehman Brothers and its affiliates and a number of other major chapter 11 and chapter 15 cases.

Before his judicial appointment, former Judge Peck was in private practice for over 35 years, concentrating for much of that time on bankruptcy law, business reorganization, (what these elitists are Great at) and creditors’ rights. He was a partner in the reorganization and finance section of Duane Morris LLP.

According to the New York Post "Peck allegedly told police that the blowup began over his wife's late arrival at the house from the Hamptons". Hmmm... Hamptons house, Park Avenue apartment... For anyone not familiar with the New York metropolitan area, please understand that there is no way that an honest federal judge who was not accepting bribes could afford either residence solely from the income of a Federal Judge's salary.

Read it and the articles linked below to see what is obvious and beyond dispute. Then draw your own conclusions about how our Justice system puts criminals in charge of gigantic and recurring re-distributions of wealth. And to be clear, we are not talking about giving money to the poor. We are talking about already rich criminals stealing even more money in the mega case bankruptcies.

In 2009 Andrew Cuomo was then Chief Prosecutor and let Peck off the hook.

Andrew Cuomo, part of the Clinton Administration and as luck would have it,

In 2006, Cuomo was elected Attorney General of New York.

Same judge who granted this Bankruptcy and Approved the buyers.

Lehman Brothers Holdings Inc.

Lehman Brothers

Trading name

Lehman Brothers

Former type

Public

Traded as NYSE: LEH

Founded 1850; 168 years ago

Montgomery, Alabama, U.S.

Founders Henry, Emanuel, and Mayer Lehman

Defunct 2008; 10 years ago

Headquarters New York City, New York, United States

Area served

Worldwide

Key people

Robert Lehman

Pete Peterson

Richard Fuld

Products

Financial services

Investment banking

Investment management

Subsidiaries Lehman Brothers Inc., Neuberger Berman Inc., Aurora Loan Services, LLC, SIB Mortgage Corporation, Lehman Brothers Bank, FSB, Eagle Energy Partners, and the Crossroads Group

Website Barclays Group Archives: Lehman Brothers

Lehman Brothers Holdings Inc. (/ˈliːmən/) was a global financial services firm. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States** (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), doing business in investment banking, equity and fixed-income sales and trading (especially U.S. Treasury securities), research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

On September 15, 2008, the firm filed for Chapter 11 bankruptcy protection following the massive exodus of most of its clients, drastic losses in its stock, and devaluation of assets by credit rating agencies, largely sparked by Lehman's involvement in the subprime mortgage crisis, and its exposure to less liquid assets. Lehman's bankruptcy filing is the largest in US history, and is thought to have played a major role in the unfolding of the late-2000s global financial crisis. The market collapse also gave support to the "Too Big To Fail" doctrine.

The last Lehman,

Robert Lehman died in 1969 after 44 years as the patriarch of the firm, leaving no member of the Lehman family actively involved with the partnership. Robert's death, coupled with a lack of a clear successor from within the Lehman family, left a void in the company. At the same time, Lehman was facing strong headwinds amidst the difficult economic environment of the early 1970s. By 1972, the firm was facing hard times and in 1973, Pete Peterson, chairman and chief executive officer of the Bell & Howell Corporation, was brought in to save the firm.

Under Peterson's leadership as chairman and CEO, the firm acquired Abraham & Co. in 1975, and two years later merged with the venerable, but struggling, Kuhn, Loeb & Co., to form Lehman Brothers, Kuhn, Loeb Inc., the country's fourth-largest investment bank, behind Salomon Brothers, Goldman Sachs and First Boston. Peterson led the firm from significant operating losses to five consecutive years of record profits with a return on equity among the highest in the investment-banking industry.

Kuhn, Loeb & Co

Kuhn, Loeb & Co. logo.jpg

Type

Partnership

Industry Investment services

Fate Merged with Lehman Brothers in 1977

Founded 1867; 151 years ago

Headquarters New York City, United States

Key people

John M. Schiff

Chairman

Harvey M. Krueger

President and CEO

Products Financial Services

Investment Banking

Investment Management

Number of employees

550 (1977)

Website www.kuhnloeb.com

Kuhn, Loeb & Co. was a bulge bracket investment bank founded in 1867 by Abraham Kuhn1 and his brother-in-law Solomon Loeb. Under the leadership of Jacob H. Schiff, Loeb's son-in-law, it grew to be one of the most influential investment banks in the late 19th and early 20th centuries, financing America's expanding railways and growth companies, including Western Union and Westinghouse, and thereby becoming the principal rival of J.P. Morgan & Co.

The German-Jewish banker Jacob H. Schiff was the Rothschild syndicate's most prominent representative in their genocidal war on the Russian People. Schiff implemented the Rothschild's plan to genocide the Russian People and steal the wealth of the Russian nation.

You will recall the revenge a Rothschild sought upon the Czar who ratted him out at the

"The Rothschilds order the execution by the Bolsheviks they control, of Tsar Nicholas II and his entire family in Russia, even though the Tsar had already abdicated on March 2.

This was both to get control of the country and an act of revenge for Tsar Alexander I blocking their world government plan in 1815 at the Congress Of Vienna, and Tsar Alexander II siding with President Abraham Lincoln in 1864.

See more of their story here

https://steemit.com/illuminati/@artistiquejewels/story-of-the-rothschilds-their-history-and-connections

It is described by others as,

The German-Jewish banker Jacob H. Schiff was the Rothschild syndicate's most prominent representative in their genocidal war on the Russian People. Schiff implemented the Rothschild's plan to genocide the Russian People and steal the wealth of the Russian nation.

It is also said Schiff with others was integral in supporting communist leaders and ushering it into Russia.

At one point even a merger with American Express in the 1980's.

In 1993, under newly appointed CEO, Harvey Golub, American Express began to divest itself of its banking and brokerage operations. It sold its retail brokerage and asset management operations to Primerica and in 1994 it spun off Lehman Brothers Kuhn Loeb in an initial public offering, as Lehman Brothers Holdings, Inc.

As investor confidence continued to erode by Sept. 9, 2008 as Lehman's stock lost roughly half its value and pushed the S&P 500 down 3.4% on September 9. The Dow Jones lost 300 points the same day on investors' concerns about the security of the bank.

The next day, Lehman announced a loss of $3.9 billion and its intent to sell off a majority stake in its investment-management business, which includes Neuberger Berman.

Just before the collapse of Lehman Brothers, executives at Neuberger Berman sent e-mail memos suggesting, among other things, that the Lehman Brothers' top people forgo multimillion-dollar bonuses to "send a strong message to both employees and investors that management is not shirking accountability for recent performance."

The person who rejected this idea was George Herbert WalkerIV , chairman and CEO of Neuberger Berman, one of the largest independent, employee-owned investment management firms.

A great aunt in the Walker family had married Senator Prescott Bush, father of U.S. President George Herbert Walker Bush and grandfather of U.S. President George Walker Bush.

So back to the fall of Lehman Brothers and the Rise of Blackstone

Blackstone employs approximately 120 private equity investment employees in New York City; London; Menlo Park, California; Mumbai; Hong Kong; and Beijing.

Blackstone has primarily relied on private equity funds, pools of committed capital from pension funds, insurance companies, endowments, fund of funds, high-net-worth individuals, sovereign wealth funds, and other institutional investors. As of the end of 2008 Blackstone had completed fundraising for six funds with total investor commitments of over $36 billion, including five traditional private equity fund and a separate fund focusing on telecommunications investments

This is what ensued after Lehman's bankruptcy,

Immediately following the bankruptcy filing, an already distressed financial market began a period of extreme volatility, during which the Dow experienced its largest one day point loss, largest intra-day range (more than 1,000 points) and largest daily point gain. What followed was what many have called the "perfect storm" of economic distress factors and eventually a $700bn bailout package (Troubled Asset Relief Program) prepared by Henry Paulson, Secretary of the Treasury, and approved by Congress.

Now to here to see more and what happened in Europe,

https://steemit.com/illuminati/@artistiquejewels/ralph-blasey-connected-weakening-of-america-and-the-baal-who-occupies-a-position-in-the-highest-judicial-seat-of-the-eu

You can verify Ralph Blasey works for Red Coats.

Link and information here, scroll down a ways, as my reports are in depth and involve a great deal. Just zone in on the info about her father.

So consider the same family that started Red Coats owns Datatwatch Systems

According to the Datawatch Systems site,

In 1981, the Peel family, which, under the leadership of Barbara and William Peel, owned a number of companies in the building management sector, recognized the opportunity to expand their facility services offerings and purchased The Morrison Group, a small access control firm with only a handful of client buildings. The name was soon changed to Datawatch Systems, reflecting a modern, more technical focus. Datawatch Systems targeted the commercial real estate market within the Washington, D.C. metropolitan area, seeking out new and better ways to manage access control for their clients and their facilities. Since those early years, Datawatch Systems has acquired an international client base that encompasses 10,000 entities, including global real estate investment trusts (REITs), property management firms, Fortune 500 companies, government agencies, and top nonprofit organizations and other non-governmental organizations.

According to Red Coats site

Barbara K. Peel - President and Chairman of the Board

In 1960 Barbara K. and William F. Peel founded Red Coats, Inc., a commercial office cleaning company. Barbara is active in the management of Red Coats, both operationally and financially. Her particular expertise in the management of costs and receivables has been instrumental in Red Coats' success.

William F. Peel -Corporation Vice Chairman

A native of Washington, William was a founder of Red Coats, Inc. in 1960. Prior to that, he was a Division Manager of Franklin Research Company (a subsidiary of Purex). He is Past President of the Capitol Association of Building Service Contractors, and served as Treasurer in 1974, and Host Chairman of their 1973 convention. William is a member of the Board of Realtors and obtained the designation of Certified Building Service Executive (CBSE) from Building Service Contractors Association International (BSCAI) in 1976. In 2009, William was awarded the Montgomery County, MD. Man of the Year.

Every second of every day, Datawatch Systems remotely monitors more than 100,000 doors to ensure the safety of the people passing through them. Building owners, property managers, and tenants trust us, as an industry leader, to protect their most valuable assets – their employees, residents, and visitors – in more than 4,000 buildings throughout the United States and Canada. At any given time, more than 2,000,000 credentials issued by Datawatch Systems are in use, with that number constantly increasing as the company meets the expanding demands of world-class businesses and organizations.

Their Datawatch Systems also states,

From perimeter and interior door entry systems employing multiple technologies, to intelligent elevator control modules, to lobby and suite solutions and intrusion detection with video event recording, to comprehensive video management systems design and coverage, Datawatch Systems offers the best solution at the best value.

https://www.datawatchsystems.com/hosted-video

Remember the El Paso Shooting and how no one EVER saw the FOOTAGE of the shooter, yet people who lived there said there were multiple shooters. Eye Witness accounts from the hispanic population that lives there.

Do you know who was in charge of their

Information on how Walmart built their own cloud services to compete with Amazon and who they partnered with.

information on how and when Walmart partnered with DHS and under his guidance

Others involved in Walmart and how their history goes back decades

According to Microsoft News Center,

Walmart establishes strategic partnership with Microsoft to further accelerate digital innovation in retail

So That's interesting considering Bill Gates started Microsoft.

Walmart establishes strategic partnership with Microsoft to further accelerate digital innovation in retail

See more information here,

Since we're talking about 211. ..as the controllers/globalists/cabal/elitist families. ..whatever you wish to call them, talk in code using numbers, it's interesting when you look at the transcript from Songbird Movie Trailer what is said at time 2:11 and WHY?

Why did they map out covid 23? Where are they headed?

Coming back in. Have to upload now

Sources

https://support.stessa.com/en/articles/2680071-stessa-new-customer-faq

https://www.ars.com/about-us/history

http://www.redcoats.com/our_management_team/

https://www.datawatchsystems.com/about/company-overview/

https://steemit.com/elpasoshooting/@artistiquejewels/el-paso-shooter-photos-on-news-do-not-match-including-multiple-shooters-witnessed-how-the-father-of-patrick-crusius-is-a

https://www.tennessean.com/story/news/crime/2020/12/26/nashville-bombing-address-location-map-businesses-affected/4047904001/

https://www.tennessean.com/story/news/crime/2020/12/26/nashville-explosion-downtown-rv-christmas-things-to-know/4046727001/