It's the "ecosystem" that matters.

Looking ahead, this idea is the key to winning eyeballs, customers, and ultimately, dollars...

In China, the growth and widespread adoption of Tencent's WeChat app shocked me. It didn't take long for WeChat to go from nothing to ubiquitous. People in China already can't imagine life without it.

Americans describe WeChat as "Facebook, with PayPal built in." But that's like calling Apple a phone manufacturer or Google just a search engine... See, they're much more than that. These businesses attempt to pull you into their world – their ecosystem – and have you never leave it. (I'm not knocking it – they're good at it!)

While Apple, Google, and Facebook are good at this, Tencent is the best.

People don't use cellphone numbers to call each other anymore in China. They call each other on WeChat. They don't read investment newsletters like this one on separate sites. They read them on their phone on WeChat. They don't hail rides with Uber, because it's outside of WeChat. They would prefer to do everything, if possible, within WeChat's ecosystem.

If you live in China, you live in WeChat. You don't want to leave the app.

It's a battle out there for your screen time. And it's a winner-takes-all type of thing... There is no Pepsi to WeChat's Coke. With these ecosystems, second place is the loser.

There are 2 things in this world that I'm convinced of:

I'd just seen the future of how people interact... For better or worse, it's ecosystem-based. Control the ecosystem, and the dollars will come your way.

Tencent could someday become the world's largest company.

The battle for "controlling the ecosystem" has been going on in the U.S. for years – even if you haven't thought of it that way yet.

Look at it this way... The five largest companies in the world are all ecosystem-based:

Apple

Alphabet (Google)

Microsoft

Facebook

Amazon

All of these companies want you completely immersed in their worlds. Think about it – Apple has best-selling cellphones, operating systems, in-house apps, desktop computers, and tablets, plus software that connects all of these things together. There's no reason to leave Apple's universe.

These five companies are everywhere in the U.S. and Europe. It would be hard to challenge them today... Imagine trying to come up with the Pepsi to Google's Coke to compete in the U.S. or Europe.

And while these companies control the ecosystems in the U.S. and Europe, WeChat absolutely controls the ecosystem in China.

Its upside potential could lead Tencent to become the world's largest company... After all, it is still soaring. Tencent's latest earnings came out this week – up around 57% versus a year ago, and the number of regular WeChat users is now up to 963 million.

But what about the rest of the world?

Are there ecosystems in Russia, for example? What about India? Or South America?

Ah, this is where it gets interesting.

Today, the formerly-unknown Chinese company that Koos Bekker invested in is now the world's eighth-largest company. You may have heard of it – it's called Tencent (OTC: TCEHY). Today, Tencent's stock market value is around $400 billion.

Not many people know it, but Bekker's company actually held onto the stake in Tencent that it bought in 2001... It still owns about $134 billion worth of Tencent stock. That's right – Bekker's stake in Tencent went from $32 million to $134 billion.

The thing is, Tencent isn't all that Bekker's company owns. It actually owns dozens of businesses from all over the globe that could each potentially turn into the next Tencent...

And I don't think it will just be the U.S. names – it will be the names that fit this theme around the globe. It's already happening... China's Tencent is up more than 70% year-to-date.

You see, the secret to Tencent's success is what I call "the ecosystem." Tencent keeps you within its ecosystem better than any company on the globe.

Once you're in the ecosystem that meets your needs, you don't want to find a different one. It would be incredibly hard to start from scratch and build the businesses that Bekker's company already owns.

Bekker has been in a near-desperate race to put together this portfolio of global ecosystem companies before the moment passes.

Investors don't get it. They have become impatient. They want to see a return on their investment – now. Investor frustration has reached an extreme, pushing the company's price down, and that's providing us with an incredible opportunity right now.

Let me explain.

Today, Bekker is the chairman of South Africa's Naspers (OTC: NPSND). And as we said earlier, Naspers owns roughly $134 billion worth of Tencent stock.

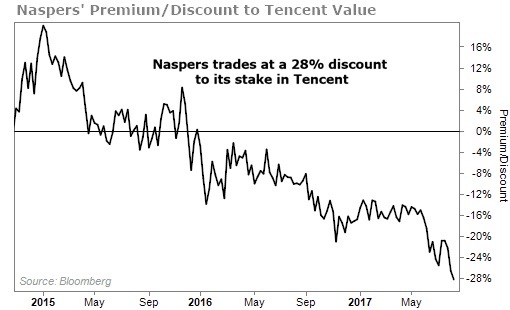

But get this – the stock market value of Naspers stock is only about $96 billion today.

So yes, what you're thinking is true – by buying shares of Naspers today, you are buying Naspers' stake in Tencent at a $38 billion discount. And that doesn't even count the other ecosystems in Naspers' portfolio.

What's more, this is Naspers' largest-ever discount to its holdings in Tencent. It's crazy.

If Naspers stock simply went to "fair value" on its Tencent stake, its shares would rise by almost 40% – from a market value of $96 billion to $134 billion.

But remember, a number of Naspers' other stakes are worth a billion dollars or more, right now (as I explained earlier).

So if the market simply valued Naspers as "Tencent + other stuff," it should easily be worth $150 billion... or over 50% higher than today's value.

That's a 50%-plus gain – and that's also assuming none of those revolutionary companies' valuations go any higher.

Ah, but I see a change in valuations coming...

In the U.S., the "Big Five" stocks keep getting bigger. Outside the U.S., Tencent is the biggest name – and it's already up more than 70% this year.

This is the right moment for Naspers.

It is worth buying shares of Naspers today for their extreme discount to Tencent alone – the largest discount in Naspers' history.

THIS IS THE TIME TO GET IN!

Congratulations @daytrader96! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit