I normally don't chart stocks cause I trade crypto, but this is for anyone that might be interested.

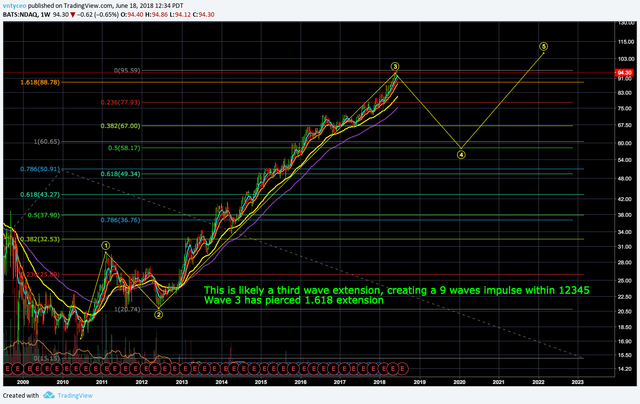

NDAQ has been on it's way up since 2012 without any significant correction.

Since wave 2 retraced a lot, we expect wave 4 retracement to be smaller.

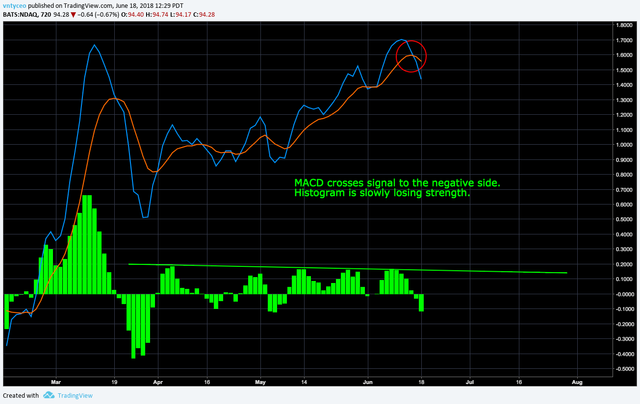

On 4 hr and 12 hr chart, I am seeing series of rejections on RSI.

MACD also crossed over signal to the negative side while histogram shows continuous downward momentum.

I believe we are in short term correction but it is very difficult to assume that we are in wave 4 YET.

If we end up breaking below 78 region in the next few weeks, we can swing it to target $66~58.

This is of course, talking in terms of months!!