The potential of DeFi has been formed. Although the ups and downs of DeFi are inevitable, as a deterministic trend, it has risen.

DeFi spread from Ethereum

DeFi first came to fruition on Ethereum. From the stablecoin practice of MakerDAO, the trading practice of Uniswap’s AMM, the practice of Compound lending, to the practice of Synthetix’s derivatives, and the practice of YFI’s aggregator, DeFi users have never To 200,000 people, it has grown to more than 400,000 people. The amount of assets locked in DeFi has gone from less than US$1 billion at the beginning of the year to more than US$8 billion today. This speed is rapid.

In addition, since Compound and Balancer launched liquidity mining in June this year, YFI launched a token distribution mechanism without pre-mining, and then SushiSwap and YAM's fork of Uniswap and AMPL, the DeFi fire has been raging on Ethereum.

Of course, the high fees, slow speeds, and low throughput on Ethereum also show deficiencies. For now, Ethereum cannot carry all DeFi. Other public chains have gradually gained opportunities to participate in DeFi.

Flamingo by Neo

The scalability of the Ethereum public chain leaves a lot of room for the DeFi development of other public chains. Recently Neo's Flamingo has also come.

What is Neo's Flamingo? It is a full-stack open financial protocol based on the Neo public chain. In simple words, it is the basic protocol of the DeFi ecosystem on Neo. Why is it a basic protocol or a full-stack protocol? Because it integrates asset cross-chain, AMM model DEX, synthetic stable currency, AMM model perpetual contract transaction, etc.

From this perspective, Flamingo is the DeFi infrastructure of the Neo ecosystem. In the future, Neo's DeFi will be built on Flamingo.

Behind Neo's Flamingo

Neo's Flamingo is based on the Neo public chain. Neo itself has made some basic preparations for the new features of DeFi. These include Neo officially supporting State Root and asset cross-chain. Poly Network is a cross-chain interoperability protocol jointly issued by members of Neo, Ontology, and Switcheo Foundation. At present, Poly Network has been interconnected with Ethereum, Neo, Ontology, and Cosmos-SDK-based. Poly Network can realize cross-chain and interoperability of assets in heterogeneous public chains. Neo supports interoperability with Bitcoin, Ethereum and Cosmos-SDK.

Neo's exploration on DeFi, especially the exploration of DEX ecology, started with Switcheo. Currently, Switcheo's cross-chain TradeHub has already supported Poly Network-based cross-chain asset transactions, which has generated a certain scale of transaction volume. These are the basic supports behind Neo Flamingo.

Flamingo and Neo's DeFi puzzle

DeFi is essentially an open financial facility built on the basis of a public chain. MakerDAO, Uniswap, Compound, and Synthetix have left active explorations for the development of DeFi by building a liquidity, fee incentive, and token incentive system that the community can participate in.

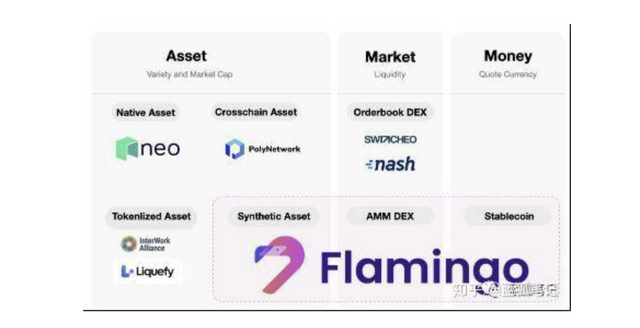

From the practice of these pioneers, we can see that DeFi presents some obvious characteristics: permissionless, composability, non-tamperable, programmable, open and transparent. These are new features that are different from traditional financial models. As DeFi, it is essentially a digital native financial paradigm, and it is still inseparable from assets, markets, and stablecoins.

Assets refer to the scale of assets that are flowing or locked on DeFi. The market is a trading market with sufficient depth and low slippage on DeFi. Stable currency is the value carrier of stable currency as the medium of exchange. These three are indispensable. They operate on the new agreement and eventually form a new digitally native financial paradigm. This is the source of DeFi's greatest imagination.

Specific to Neo's DeFi, its assets include the native token asset Neo/GAS, and the cross-chain contract asset NEP-5. Currently, Neo can support the asset interoperability of Ethereum, Bitcoin, and Cosmos-SDK. In other words, in the DeFi ecosystem of Neo's Flamingo, in addition to its native Neo assets, Ethereum, Bitcoin, and Cosmos-SDK-based assets all have the opportunity to circulate in Neo's DeFi ecosystem.

At the market level, the Neo public chain currently supports DEX in the order book model, such as Nash. Only by forming an exchange with sufficient depth and liquidity in the AMM model can Neo's Flamingo's DeFi ecosystem be considered complete, which is also one of Neo's Flamingo's focus.

Finally, there is the stable currency level. This is also one of the foundations of Neo's Flamingo DeFi Lego bricks.

Neo's Flamingo tries to perfect its Lego bricks

From this perspective, Neo's Flamingo is precisely the construction of its DeFi infrastructure. It is complementing its puzzles in the AMM model of DEX, stablecoins, synthetic assets, etc., and tries to form a complete DeFi puzzle in the end. Flamingo is perfecting Neo's DeFi puzzle.

Neo's new exploration of Flamingo

Flamingo is a full-stack DeFi protocol, Neo's DeFi infrastructure, and an important puzzle of its DeFi ecology. So, what new exploration does it have compared to the DeFi ecology of other public chains?

The exploration of cross-chain DeFi

At present, DeFi has no large-scale application in cross-chain. Except for the liquidity mining on Curve and other Ethereum DeFi, such as wBTC and renBTC, there is no large-scale application of DeFi cross-chain. At present, the cross-chain of DeFi is still in a very early stage. Flamingo can use Poly Network's cross-chain protocol to support financial protocols for cross-chain transactions in the DeFi ecosystem.

If low-wear and atomic cross-chain interoperability can be achieved, the circulation of assets in different chains can be accelerated, and the market size and processing capabilities of DeFi can be improved. Assuming that many new users cannot participate in DeFi due to congestion, high fees and other reasons on Ethereum, then other public chains have the opportunity to attract assets to run on DeFi on other chains. At present, ERC20 stablecoins have also begun to be diverted to other chains other than Ethereum for transfer.

Open up AMM's liquidity pool and synthetic mortgage asset pool

Currently, loans on DeFi are basically completed based on over-collateralization, which is not conducive to the improvement of capital utilization. At the same time, the current liquidity pool of the AMM model is also under-exploited. If the AMM liquidity pool and the synthetic mortgage asset pool are opened up, the utilization rate of funds will be improved, and liquidity will also be improved. This is a new exploration on DeFi.

Incentive mechanism based on contribution allocation

The current level of incentive system design on DeFi is uneven, and some have relatively mature and long-term token economic mechanism design, but due to the early fundraising of institutional funds, the space for community participation in the later period is reduced. Some economic mechanism designs only consider short-term behavior. For example, the 10% of the original Sushiswap development team incentives did not have an unlocking period at all. Later, the founder's sell-off caused panic in the community. This is obviously not a token mechanism design suitable for long-term sustainability. Sushiswap is currently designing a new incentive mechanism.

Neo's Flamingo tries to change this situation. It proposes a distribution mechanism based on the contributions of project participants, which links the long-term benefits of the project's sustainable development with the contributions of contributors, and gradually explores its governance tokens in the process The value of FLM.

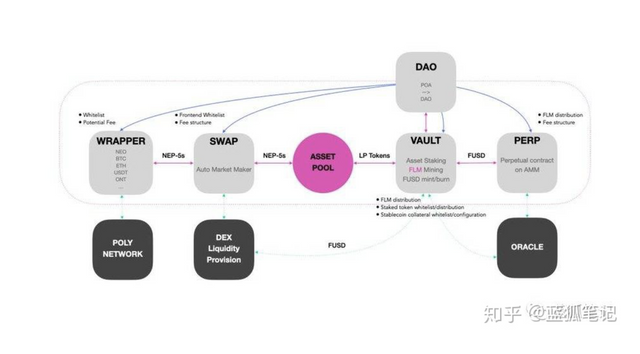

In terms of specific components, Neo's Flamingo's DeFi exploration includes WRAPPER, SWAP, VAULT, PERP, and DAO. Among them, WRAPPER is a multi-asset cross-chain gateway, SWAP is an on-chain liquidity trading market, VAULT is a protocol for generating stable coins and platform tokens, PERP is an on-chain perpetual contract trading platform based on the AMM model, and DAO gives Flamingo’s community Governance. From Neo's plan, cross-chain asset transfer, pledged asset mining, DEX trading, stable coin generation, and perpetual contract DEX will be gradually launched.

Neo's DeFi components

From the perspective of Neo's planning, these components of Flamingo are not only independent, but also mutually composable. The functional modules can be highly coupled to facilitate the flowability of different component products. Similar to the DeFi of the Ethereum ecosystem, MakerDAO is one of the most important basic components (to generate DAI). Flamingo's Vault is also the core component of its basic assets. It provides basic liquidity for DEX and pledge tokens. It can realize intercommunication between the liquidity pools of different components, thereby breaking the state of separation between different liquidity pools and improving the utilization of funds. .

In addition to the interoperability of the liquidity pool, Flamingo also supports platform token FLM and mainstream asset LP tokens (liquidity pool equity tokens) as pledge assets, and also supports LP tokens to be traded in DEX or provide liquidity.

Flamingo based on community governance

The governance token of Neo's Flamingo is FLM, and its issuance mechanism chooses the mode of distribution based on contribution. 100% of the tokens are distributed to the participants of the project. In other words, there is no institutional private equity and no founder distribution.

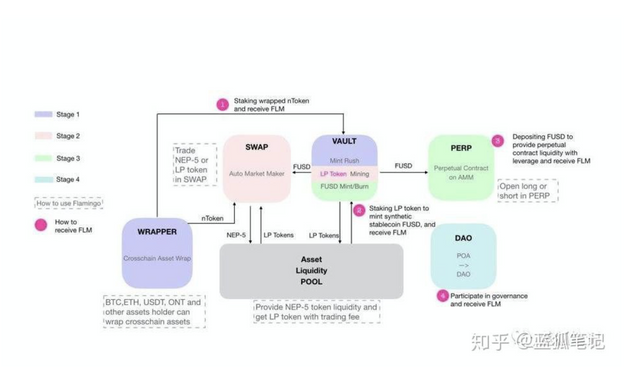

So, specifically, who are the participants of the project? What percentage of FLM tokens will they receive? For the DeFi protocol, the core of its operation is the provider of assets. Therefore, Neo's Flamingo's native token FLM is mainly distributed to participants who provide assets. These include:

Cross-chain assets

For example, pledged assets from other chains (such as Ethereum) can be rewarded with FLM tokens. The pledge of cross-chain assets provides liquidity for cross-chain asset transactions. This incentive time is limited to the one-week Mint-Rush in the first phase.

Provide liquidity to obtain LP tokens and pledge

LP tokens are equity tokens that prove their liquidity provision. For example, by providing liquidity on DEX, you can get incentives from FLM tokens.

Generate stablecoin

Liquidity providers can generate stablecoins FUSD by staking the native token FLM or other mainstream assets.

In addition to providing assets to participate in Flamingo's DeFi ecosystem to obtain rewards, you can also obtain FLM token rewards through active participation in governance.

The distribution of FLM tokens and the main components of Flamingo

How is FLM distributed?

All FLM tokens are issued through the VAULT module. We also mentioned above that FLM does not have team allocation and private placement. From the beginning, Flamingo has conducted Mint-Rush for a week. During this period, 50 million FLM tokens will be used to incentivize cross-chain asset traders who start the project.

Specifically, first, users transfer assets across the chain through the Poly Network, deposit different chain assets (such as ETH and BTC), and can use Wrapper to generate tokenized assets that meet the Neo standard (similar to wBTC and renBTC, which are on Ethereum). Bitcoin tokenized assets in circulation). Then, deposit these tokenized assets that meet the Neo standard into VAULT for pledge, and you can get FLM rewards.

The one-week cross-chain asset mining will include Bitcoin, Ethereum, ONT, USDT and other assets. These assets will provide basic liquidity assets for Flamingo's DeFi ecosystem in the future. In essence, Neo's Flamingo attracts high-quality assets from other public chains through the token incentive mechanism, thereby forming its own DeFi ecosystem, which can reduce the high cost and congestion of DeFi on different chains, so as to gain from the great development of DeFi Own place.

In addition to pledging mainstream assets and providing liquidity to obtain FLM token incentives, participating in the governance of Flamingo can also be rewarded. FLM itself carries the value of cross-chain assets, DEX, synthetic assets, lending and other protocols, and it also serves the governance of this full-stack protocol. Therefore, it is the native value carrier in Neo's Flamingo's DeFi ecosystem, which can capture the cost, governance and other values of its full-stack protocol.

This is one of the big differences from the current Ethereum DeFi ecosystem. On Ethereum, the MakerDAO protocol is governed by MKR holders, Compound is governed by COMP token holders, and Synthetix is governed by SNX holders. Each of its tokens captures the value of its own agreement. Flamingo is a full-stack financial protocol, which captures the governance and cost of stablecoins, lending, DEX, derivatives and other protocols.

In addition, since its distribution is 100% community participation in distribution, it can be followed by community governance to set its iterative development direction. For example, its product iteration direction, agreement fee capture, governance proposal mechanism, specific design of token distribution, etc.

There is a positive relationship here. As FLM captures the value of its Flamingo full-stack protocol, the enthusiasm of community participation will increase. Increased enthusiasm for community participation will in turn facilitate the capture of its FLM value.

Ultimately, how high Flamingo can develop depends mainly on the depth and scale of its community participation, such as the introduction of new protocols or products in the community, and the combination of new things. At the same time, it is also necessary to rely on the community to introduce more high-quality assets from other public chains to participate in the construction of Flamingo's DeFi.

No matter how many ups and downs there will be, as more and more public chains participate in the exploration of DeFi, the overall potential of DeFi will become stronger and stronger!