I wanted to give an update on one of my favorite plays in the Marijuana space. I talked about Innovative Industrial Properties three months ago,

Innovative Industrial Properties…An Interesting Play In The Marijuana Sector

but a lot has happen since then. Again, Innovative Industrial is a marijuana-based REIT that acquires cannabis-related properties. Innovative Industrial went public in 2016. The company has made eight quarterly dividend payments since July 2017, with three separate $0.10/quarter increases over that span. And on July 15th, the company paid a quarterly dividend of $0.60 per share, representing an increase of 33% from the previous quarter.

But also In July, the company issued 1,495,000 shares of common stock. Typically when a company issues more stock, where they dilute the earnings/share which is frown upon on Wall Street. This is probably why the stock fell in mid-July.

Now in my eyes, they raised more cash to buy more properties...which is a good thing. In recent months, the company has acquired the following properties: six in California, two in Pennsylvania, two in Michigan and one each in Ohio, Nevada and Massachusetts. But get this, all the properties have occupants that have signed on to long-term leases.

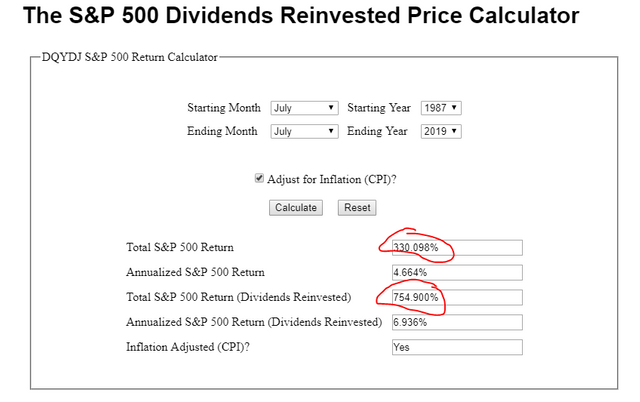

There reason why I love Innovative Industrial Properties so much is because you have an opportunity to get onboard a growing company, in one of the hottest growing secular trends, that’s paying shareholders dividends that grow almost every quarter. Why are dividends such a big due, look at the returns of the S&P 500 and the S&P 500 with reinvested dividends.

I’m personally looking to buy if price gets to the $64 level, so if price breaches the daily demand at $95 price has a shot of getting through the mess in white and to the $64 level.

This level also represent a fib retracement of 61.8%, for all the folks out there that use fibonacci in their trading.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Interesting play with an opportunity worth watching out for as it gets impacted by the volatility of the market.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definite worth keeping an eye on.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been tracking them on my watchlist myself! Definitely a trailblazer in the REIT category. I've been waiting on a buy in opportunity under $100 so I think I'll start dollar averaging in

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not a bad plan, im a bit cheap and waiting for price to get lower.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad I read your perspective on it though. Just reaffirmed the idea that it could go a lot lower based on the environment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit