This article was written by Co-founder & CEO of Holyheld, Anton Mozgovoy:

"It’s hard to believe how much has changed in the past four months. Not only in the crypto world but everywhere. We’ve witnessed historical changes in politics and geopolitics, in human pandemics and our response, in crypto derivatives trading ban and OCC approval on stablecoins. The year-end was rich in events, and we’ve been busy building on our vision.

In this first of many articles this year, we want to address every member of our fantastic community. Without you, there is no Holyheld; without you, there is no DeFi. DeFi is built by crazy people, so has always been the case with human-kind history. We have a mission, and with everything going on in the last four months — we are just getting started. We don’t know where DeFi will end up being, but we believe in our mission, and we believe in you. Thank you for believing in us.

Enough lyrics. If you are reading this article, it means that the time has come.

This article covers the following:

-LP Program closure & results

-New app and starting functionality

-Holyheld Infrastructure

-HOLY migration to HH

-Next on the plan (the concept of the fluid roadmap)

LP Program closure & results:

We now mark the successful end of the pre-launch phase. The HolyKnight LP Contract has stopped accruing rewards, and we have disabled deposits into the contract.

As you know, security has always been our priority: it was then, it is now, and will always be. It was four rough months in DeFi. Exploits, hacks, scams, and arbitrage opportunities across the board have exposed the complexity and difficulty of creating a safe decentralized finance ecosystem.

And thus, we will be able to safely wind down the program when the last deposit leaves the contract. Until then, let’s take a quick look at the LP program highlights.

Just look at that harvest transactions count. Someone clearly likes to harvest their rewards. Which is interesting, because when it comes to the deposit times, we have the longest and the shortest stake times:

When we first announced our long-term support program, we clearly didn’t expect such a result. Which is, quite actually, remarkable:

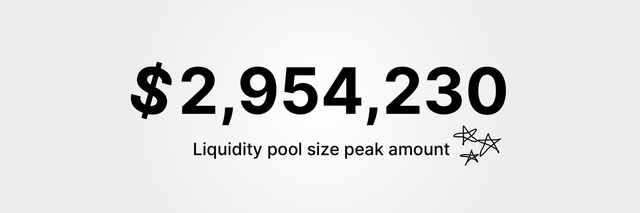

With all your support HolyKnight V1 LP contract has reached an astonishing figure when it comes to the TVL highs. TVL stands for the Total Value Locked, and represents the dollar value of all assets that our users have staked to generate rewards:

Let’s not forget, that throughout this time we have developed a very interesting set of services, that actually helped us gather this on-chain analytics. Probably, the one that is indeed interesting among others is the largest single deposit size. You know, those guys — 🐋.

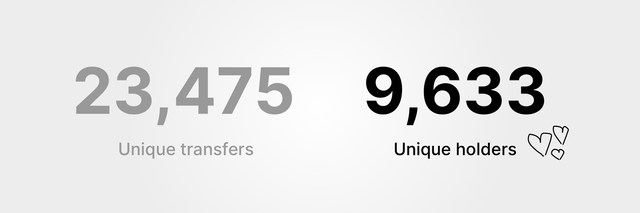

What about unique holders and wallets interacting with the $HOLY? Well, we must say that this number is slightly lower than the 1.8M ETH addresses, but we are getting there. It’s a solid start, and there is only one way forward — ☝️.

Finally, some stats on the UNI V2 liquidity pool. Our experimental fair-launch model, where everyone staking assets can generate rewards — can be announced as successful. There are well over 1,000+ LP program participants (1,095 unique addresses to be exact), and over 900+ current holders. Strong beginning of our community, and the number keeps growing! So did the liquidity pool. Just take a look at this staggering number:

New app and starting functionality:

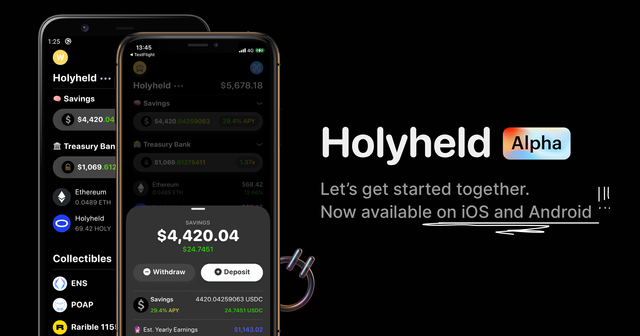

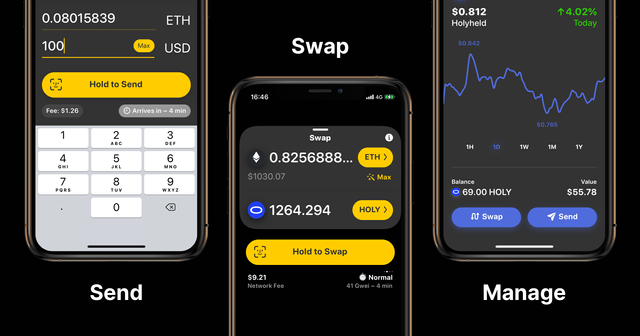

Please welcome the Alpha version of the Holyheld app.

It is a fully non-custodial wallet based on one of the best Ethereum wallets ever existed — Rainbow. We are deep fans of the Rainbow and $SOCKS, so we decided to continue the great work done by the team.

What can you do in the app?

We’ll start with something you can’t do right now. We’ve limited the two main aspects of the application:

-debit card applications

-in-app chat support

And we have also limited:

-maximum deposit size per wallet

Why did we do that? As mentioned earlier, our key priority is security and safety, thus, as we test and iterate more, we will start rolling out additional features and functionality on a rolling basis.

So what can you do in the app?

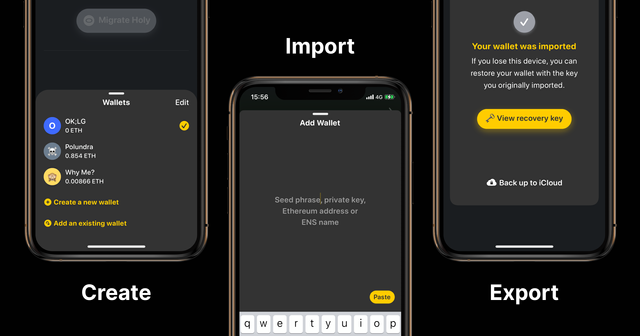

-You can create, import, and export non-custodial wallets. It means that only you have access to your keys. Back up your keys manually or using the cloud.

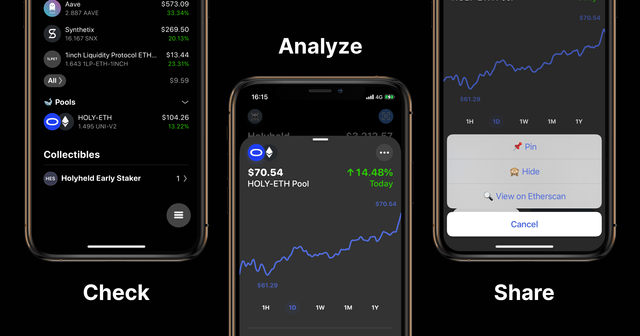

-You can send, receive, or swap any Ethereum tokens. If you have access to the yield treasury, you will automatically get gas costs deducted or fully covered (depends on the size of your share).

Please note that the Yield Treasury will be activated shortly after the launch of the bonus multiplier tokens unlock.

-You can migrate your $HOLY to $HH. The app also shows how much more $HOLY you need to migrate to access the full bonus amount (if applicable).

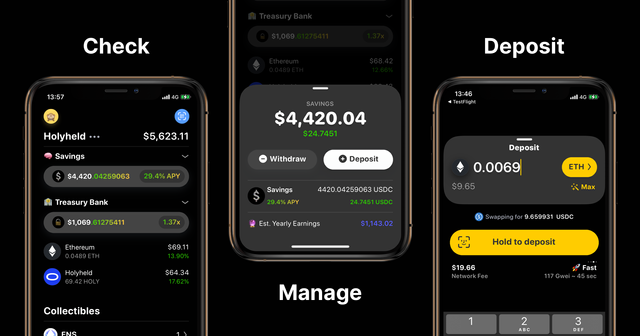

-You can deposit into the Holyheld vault and start generating safe interest. The app safely converts any deposit into the stablecoin USDC and deposits into the strategy (to make your money work). You can check how your deposit grows in real-time.

-You can access and claim your bonus multiplier tokens (if applicable).

-You can view and claim your Yield Treasury part.

-You can also perform claim & burn to burn all your $HH tokens and receive your share of the Yield Treasury with a multiplier.

Please note, once you access Claim & Burn feature, your tokens will be burned forever decreasing the total supply for $HH, while receiving a one-time bonus pay-out.

-Check your liquidity pool positions.

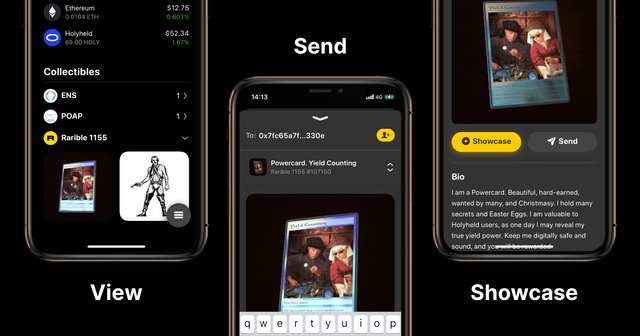

-You can access NFTs in your wallet. No further explanation is needed: observe the beauty.

Speaking of NFTs, what about the “Yield Counting”?:

Patience. Great secrets are revealed to those who HODL. We haven’t forgotten about the card.

As the card states: who knows what kind of power it has, or when it will appear itself?

Remember, all the clues are hidden in plain sight. Check the fresco out here, and maybe you’ll find the answer first.

Also, if you are the owner of the card and want to know how to import the card into your app wallet, check out this guide.

Holyheld Infrastructure:

Where should we start? Not so while ago, there was a great article in Financial Times about “self-driving” banks. Well, we’re calling Holyheld in simpler terms: just the future of finance. But thanks, FT. Anyways, we are very excited to start sharing with you our infrastructure details. It is just the beginning, and we have so much more that we want to share, but Anton M is boring and doesn’t allow it just yet.

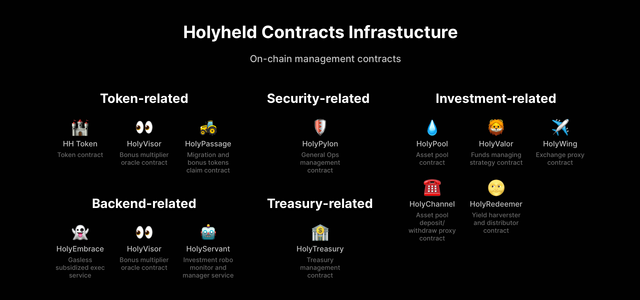

So where should we start? We’ll start with the basics: we’ve been working on a sophisticated infrastructure that will ensure safe and easy ops now or in the future. This infrastructure follows the best space-driven software: better to have an extra fail check safe of a fail check safe, rather than to be sorry later. Here is a short glimpse of the largest smart contracts:

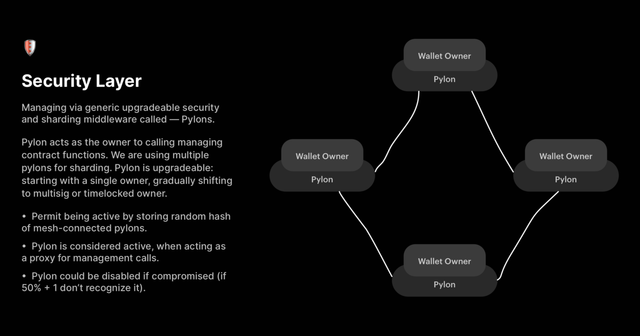

Speaking of security, it’s never enough to speak about security. We’ve designed a specialized sharded generalized security contracts called “Pylons”, that will ensure that the system can never lose all funds should the worst-case scenario come. Every other day, they make sure that funds remain safe and sound.

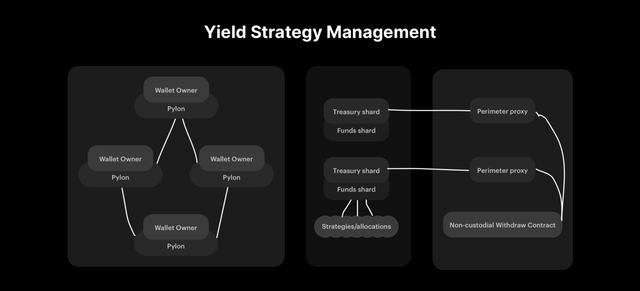

Security is great, no, it’s amazing! But yield is even better. Thus, the bigger investment image looks more like this:

And if we break it further down into the four key parts:

-Deposit

-Withdraw

-Treasury operations

-Subsidized transactions

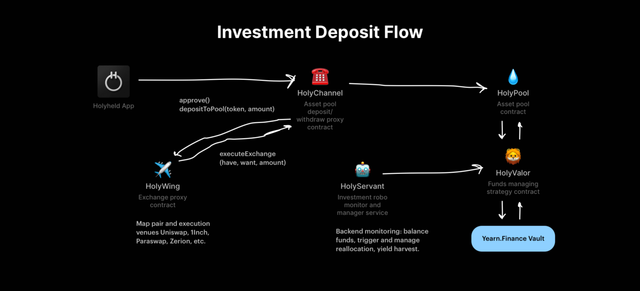

Deposit flow works as follows:

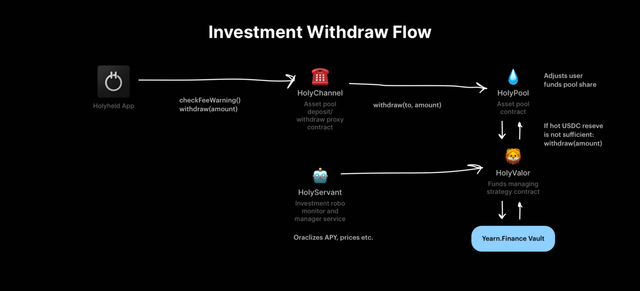

Withdraw flow, accordingly:

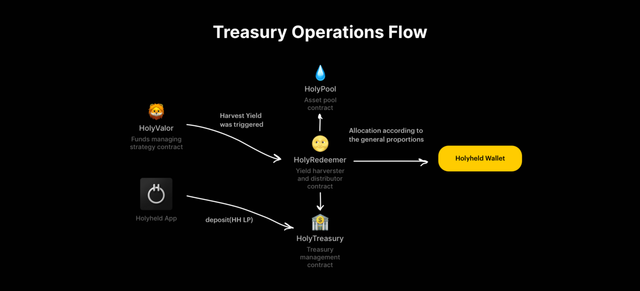

When it comes to the treasury operations, it has one simple mission: to control the flow of the yield distributions according to the general proportions. It also controls the outflow of funds, for easy management.

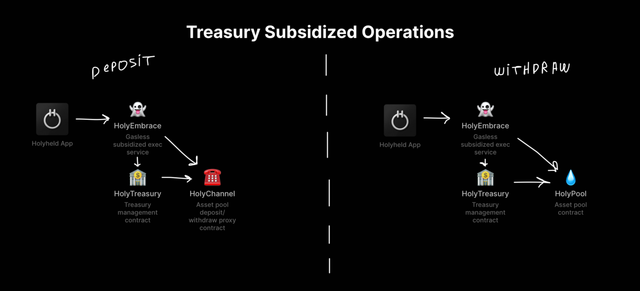

And finally, subsidized transactions. Whenever someone asks: what makes Holyheld unique? What’s the key point here? Well, besides millions of other points, it is right here: the system subsidizes every user and covers their fees when overperforming. Sounds like some black magic, but it’s not. Instead of printing infinite tokens as user cashback, we are optimizing funds flow to cover expenses in stablecoins, preserving the dollar value.

There is a lot more than just a short glimpse of what we cover in this article, and throughout this year, we will continue releasing more of our work, live integrations with our partners, and R&D developments.

HOLY migration to HH:

The migration is the next evolutionary stage of Holyheld, and it is now open. As the project matured, so did the token, and thus, we are happy to present $HH.

The new token contract is more robust, more secure and ready for the DeFi exploratory nature. The token contract can be found here. All of the questions about the token and migration have been answered when we first announced $HH back in December in the article here.

So, as a recap.

Where to migrate?

There are two options: Web and Mobile. To use the web option head to the Staking Portal and proceed to migration (use this option if you have been using Ledger or other cold wallet storages to stake in the LP program), or if you are very eager to migrate immediately! [migration section will appear shortly after the release of this article.]

Alternatively, you can migrate tokens conveniently in our app. To use the mobile option, feel free to download Android or iOS Alpha releases here [if there is no link here, it means that the app is not yet released to public, but it will be in the next days or hours.]

What is the migration rate?

1:1. You will get 1 $HH per every 1 migrated $HOLY.

Migration period:

$HH migration is now open and will end on February 28th. It means that if you do not migrate your $HOLY during the migration period, it will be lost forever.

Bonus multiplier unlock and requirements:

For a detailed explanation of the unlock process and requirements to obtain bonus multiplier tokens, read the full article here .

Next on the plan (the concept of the fluid roadmap):

Why do most blockchain projects strive to have a perfect roadmap per month, quarter, year, decade? Because we want others to believe in our commitment to the future outputs. Then we can set clear expectations with our stakeholders without asking ourselves a question: do we even need things defined in the roadmap? Will those features be used? What do our users need now? We forget about those questions, and instead focus on one: wouldn’t it be ideal for delivering everything on time as we planned?

The perfect plan creates an illusion that makes us forget how complex reality is. Planning upfront doesn’t work in a dynamic environment. Once we insist on an ideal plan upfront, we might not be able to react fast to the inevitable changes. There are many technics used in modern product-driven teams now, but none of them has a valid definition of the roadmap.

The Scrum Guide doesn’t have a single mention of the word roadmap. But it does say what the Product Backlog is:

The Product Backlog is dynamic; it constantly changes to identify what the product needs to be appropriate, competitive, and useful.

— The Scrum Guide, November 2017

With that being said, what is next on the roadmap? Since we don’t believe in the exact roadmaps, we do believe in fluid roadmaps. It’s a concept where we define the key targets in different focus areas. The main key target remains intact for most cases, and all minor things in between are fluid and can change.

The first two targets seem obvious and easy, but let’s take a closer look.

Release of the debit card:

In the past four months, there were numerous critical changes in the financial heart of Europe — the UK. We’ve undergone Brexit, the ban on crypto derivatives sales, and many more. Yet, we’ve been consistent on our mission, and the debit card release is the next thing coming. It is that simple.

Full app release:

There is a lot that is hidden and not accessible in the app right now. Features that are developed and prepared but removed from the alpha build on purpose. We will roll them out gradually to provide a smooth and joyful experience, especially during the high-load times of 2021.

In short:

-In-app live customer support

-Fiat on/off-ramp

-Virtual and physical debit card issuance and management

-Portfolio concierge

-Smart suggestions

-Multichain support

and much more…

Become the number one DeFi banking solution:

This one, on the other side, is tricky. There are so many great projects and so many fantastic builders. What can we do to secure leadership positions? Is it even possible?

Everything is possible, and we are very well-positioned to work our asses off and make it happen. So it makes more sense to phrase the question as: what should we do to make that happen?

Firstly, our team has been in the DeFi market from the very beginning — December 2017. At that time it wasn’t even called that way. We studied the market behavior and actively participated in the market itself in building a $25 billion niche that grows 90% CAGR. According to all the data, the growth will only accelerate. But the new financial system must serve everyone, not only the already crypto-initiated. Data from within the market is an important benefit when modeling future patterns.

Secondly, the business models of most distributed companies in the digital financial sector are much more complex than interface applications for fiat licensed banks. Our experience in building complicated complex IT systems shows that we have already begun to move away from the Uberization model, which means we have something to share, and something to lean on.

Thirdly, being in the fastest-growing segment of the market, we had the opportunity to work together and learn from many leading companies. Most of which were already fully distributed even before the onset of ubiquitous lockdowns during the global pandemic. We were able to accumulate important experience of how companies of the future will work several years ago.

Fourth, as in our previous projects, as it is now, 100% of all employees are millennials (Y) and zoomers (Generation Z). A fully remote team even before the global pandemic of 2020. The main principle of innovation inherent in the company was based on a simple idea: you are a user of your product. And this experience in the approach of building business models from the inside out is the central part of the whole thesis.

Lastly, it is no secret that emerging markets are the next Blue Ocean, in other words, the next billion users. And since more than 80% of all users are representatives of generations Y and Z, we had the opportunity to accumulate vast amounts of on-chain depersonalized data, which opens a look at the future of consumer finance."