Bitcoin choices are shutting the hole with the market pioneer after names like stellar and cardano wound up noticeably scorching as 2017 was shutting.

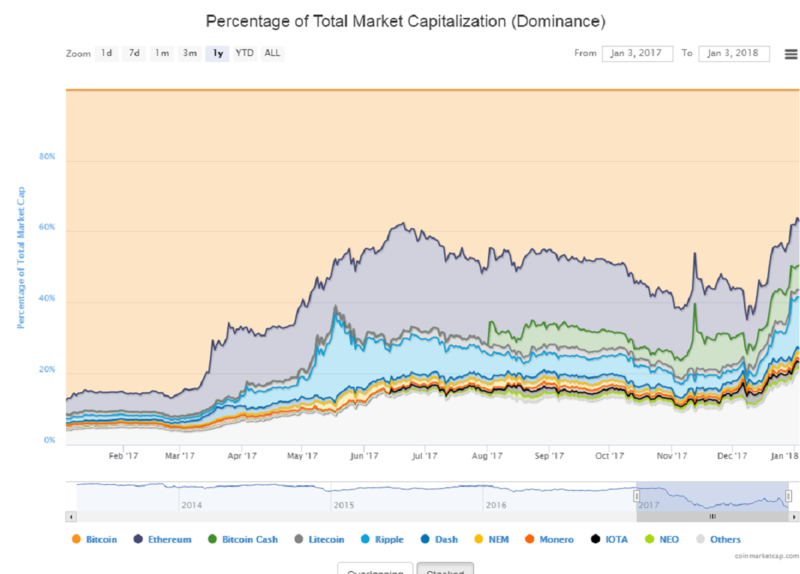

The greatest digital currency's offer of market esteem has tumbled to a record 36 percent from 56 percent a month back, as indicated by CoinMarketCap costs for coins and tokens. Stellar, intended for cross-outskirt installments, has dramatically increased in the principal exchanging days of this current year, accomplishing a record advertise top of more than $13 billion.

That sort of move brings up issues with reference to whether examiners will drive up second-level computerized coins to the detriment of bitcoin, despite the fact that they have diverse purposes. The paper estimation of all digital forms of money joined has dramatically increased to nearly $700 billion in the previous month.

"The altcoins today, in substantial part, are not endeavoring to be bitcoin contenders," said Lex Sokolin, worldwide chief of fintech procedure at Autonomous Research LLP in London. "They are accomplishing something unique totally - ethereum as a brilliant contracts stage, particle as a machine-economy token, swell for interbank installments, et cetera." How each is utilized "ought to wind up plainly progressively significant as the oddity of crypto wears off."

Relative execution is presently a multibillion-dollar question as expert financial specialists scan for approaches to esteem advanced resources that appear to resist customary strategies, for example, benefit and profit potential for values, or modern request standpoints for products. Relationship, for instance, is one of numerous specialized investigation apparatuses utilized crosswise over resource classes in anticipating, and altcoins verifiably have moved generally in venture with bitcoin.

While there were numerous times of uniqueness, on adjust the gathering rose or fell together, a Bloomberg study of more than 5,000 information focuses appear from CoinMarketCap and CoinCap costs. With bitcoin equals now making greater additions, it is important more whether the gathering keeps moving generally in a state of harmony - as they to a great extent have done as far back as the good 'ol days when fans were for the most part PC developers and libertarians.

While naysayers demand the crypto showcase has many indications of an air pocket, guessing has been promising for some, who purchased second-level coins. Ethereum, the second-biggest by showcase esteem, has generally tripled over the most recent two months. Cardano is up more than 40-overlap in the period. That contrasts and an inexact multiplying for bitcoin, which went more standard in December by donning its first U.S. prospects contracts. Bitcoin rose 2 percent Wednesday.

The specialized weaknesses of bitcoin flag its benchmark status might be taken away sometime by a moment age match, as indicated by Mike McGlone, a ware strategist at Bloomberg Industries who compares the market to web based organizations a couple of decades back.

For a gander at utilizing Bloomberg capacities to contrast and website bubble, click here.

"At the point when the craze dies down, 2Gs should keep on gaining on bitcoin, which has imperfections and where prospects can be shorted," McGlone wrote in a note a week ago. "Ethereum seems prime to expect benchmark status, however bitcoin forks swell and litecoin are the essential cutting-edge contenders."

With a $216 billion market an incentive on Dec. 31, bitcoin was frequently the primary stop - and perhaps the last - for speculators who at that point possibly fiddled with littler, more unstable tokens. A surge in financial specialist premium regularly benefits the littlest all the more, basically in light of the fact that they have littler market esteems, said Spencer Bogart, an accomplice at Blockchain Capital LLC in San Francisco.

"This goes the two headings however: frequently when crypto markets are falling you see a turn out of the long-tail of crypto resources and into bitcoin, the 'lord of crypto,' which is legitimately seen to have the most backbone in the biological system," Bogart said.

Crypto Party

As the crypto party became greater, the crashers - blue-suited financial specialists and speculative stock investments - have acquired for the most part bitcoin, and they have distinctive purchasing criteria than early changes over who may have proceeded onward to less-fluid units like dash or monero, as per industry eyewitnesses. The weakened financial specialist base may debilitate the burden to bitcoin, the greatest by showcase esteem, they say.

"The capital base of these business sectors is developing quickly," said Kyle Samani, overseeing accomplice of Multicoin Capital, a computerized resource support investments in Texas. "Prior to the current bitcoin bull run, the financial specialist base in crypto was generally architects, geeks, and libertarians. "

In the U.S., Samani of Multicoin Capital says he sees a division between what's on offer at the well known Coinbase trade, and everything else.

"Most retail financial specialists are just purchasing resources accessible on Coinbase," he said. "We should keep on seeing a decoupling between what's on Coinbase versus different altcoins."

{ #Note :- Picture Source : All Picture Is collected From Internet.

&

Reference Link :