Exactly where is the digital money story going?

In the event that YOU'VE known about SpankChain, odds are you are an eager devotee of cryptographic money patterns or a sharp supporter of the grown-up industry. SpankChain - a blockchain-based administration worked to furnish grown-up performers with the foundation to make and run their own spilling or substance circulation destinations - is a piece of the most recent fever of grown-up wanders propelling their own particular starting coin offerings (ICOs). What's more, a considerable lot of them aren't doing half terrible. SpankChain's token, Spank, was exchanging at some US$0.40 on Friday, almost 10 times its cost since the organization's ICO in December.

Cryptographic money (crypto for short) is obviously all the vogue now - heaps of organizations have begun to dispatch ICOs, through which they issue their own particular advanced tokens that can be purchased by patrons utilizing crypto. Such tokens qualifies supporters for money related or non-financial prizes. For the unacquainted, crypto is advanced cash, (for example, Ethereum) that is utilized as a methods for trade, and can be exchanged between peers without a go between, for example, a bank. It is decentralized: controlled not by a focal government but rather by clients and a calculation. Exchanges are recorded on a computerized record, called a blockchain. However, even as crypto contributing and ICOs pick up footing, there remain extremist doubters. The Business Times assembled six people to banter about all things crypto. Whoever you concur with, 2018 will be the Year of the Crypto.

ROUNDTABLE PARTICIPANTS

Anson Zeall, director of the Association of Cryptocurrency Enterprises and Startups, Singapore (Access)

Darren Chua, fellow benefactor of fintech venture and counseling organization, Fairway Resources

Questioning Thomas, a mysterious male who works in fund and a general doubter of crypto

Dustin Lau, boss experience officer at Kommerce, a stage that utilizations blockchain to lead exchange fund in Africa

Jamie Lee, fellow benefactor of Viola.AI, a Lunch Actually dating stage based on the Ethereum blockchain

Kenneth Tan, fellow benefactor of crypto crowdfunding stage, Fund Yourself Now

Kenneth: Yes, 2018 is certainly the year where everything goes crypto. Since it's significantly less demanding today to make coins: we are seeing all kind of coins, extending from genuine ones, for example, Bitcoin Cash, which is a fork of Bitcoin, to amusing ones, for example, Useless Ethereum Token (UET). As of late, somebody purchased a computerized feline in light of the Ethereum blockchain (CryptoKitties) for over US$100,000.

DT: I'm impartial on this. I presume a tremendous piece of crypto's ascent in 2017 is because of modest liquidity in the market and financial specialists' fixation on the scan for yield. In the event that the worldwide economy keeps on reinforcing and the real national banks continue on their fixing way, the crush in liquidity and accessibility of other more secure speculations which give sufficient returns will cause the crypto fever to fade away a bit.

I compare crypto contributing to funding (VC) contributing. At the point when value returns are average, financial specialists have less impetus to go up against more hazardous wagers, since they would as of now have met their required returns. This is likewise the motivation behind why VC and private value valuations have turned out to be extended. The contrary will be valid if the real national banks keep down on their fiscal arrangement fixing.

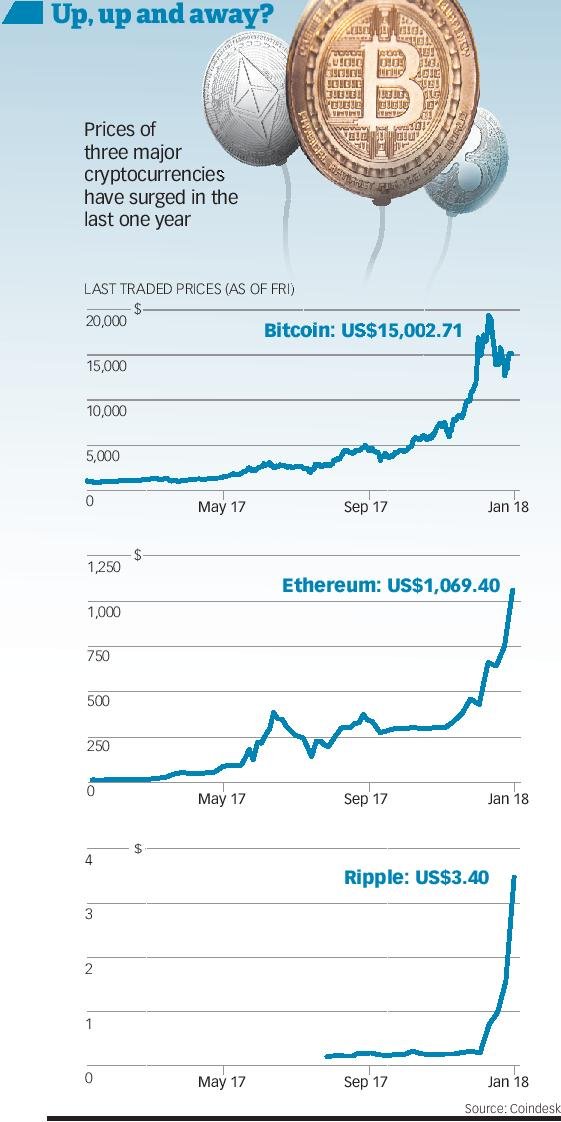

Kenneth: That's a substantial perspective. Because of the zero for every penny loan cost, there has been a great deal of hot cash since the last monetary emergency. That is the manner by which the value and property markets got so hot - all the shabby cash was put into the framework. So, I question any benefit class approaches crypto. Bitcoin gave a 13x return a year ago. Value gave no less than 20 for each penny returns a year ago, yet even its great execution didn't prevent Bitcoin from detonating. The profits on the other resource classes need to go up by a great deal for the crypto market to chill off.

Darren: Actually, the crypto drift began in mid-2017. We are as of now observing cryptocoins for a plenty of items and administrations. Lately, I have been to Fintech Week (in Hong Kong), Fintech Festival 2017 (Singapore) and BlockShow 2017 (Singapore). While simply strolling energetically through the occasion lobbies, I could see more than 100 Initial Coin Offerings (ICOs) and fintech firms pitching their coins and thoughts. The organizations' vitality and energy, and their thoughts, are incredible. I see 2018 being the year that ICOs will move more into the standard.

Anson: As speaking to the head of Access (the Association of Cryptocurrency Enterprises and Startups, Singapore), we don't theorize on cost, consequently we don't know whether it's a fever or not. All we know is that our individuals are putting in tremendous endeavors in the development space with blockchain innovation.

Jamie: The industry is by all accounts developing exponentially and spreading to numerous new ventures and producing numerous new advancements and thoughts. It feels fundamentally the same as website's initial days, however I don't know whether 2018 will be the pinnacle or simply the center of the crypto story or pattern.

Introductory Coin Offerings (ICOs): Innovation or trick?

Anson: Before anybody puts resources into an ICO, they ought to in any event realize what blockchain is, before taking a gander at the cost or returns. The distinction is when close relatives and uncles begin touching this. More training is required. Access is working with NTUC to hold classes on the nuts and bolts of crypto.

Ken: From the business person's perspective, ICOs are a development apparatus. It is a procedure that out of the blue, enables organizations to connect with a worldwide pool of financial specialists effortlessly.

This is in respect to bank credits, distributed loaning and pitching value to VCs - which are all very costly methods for raising assets.

Darren: Compared to IPOs (Initial Public Offerings), ICOs are a more agile approach to fund-raise. The time and measure of planning required for an ICO is considerably less than that for an IPO, which is a long-drawn process that can take 1.5 years and cost a ton of cash. ICOs are a great deal less expensive, and they don't weaken shareholding. You will require a strategy for success, a whitepaper that is ideally bolstered by attorneys, and some showcasing.

Kenneth: Think of ICOs as a kind of prepaid administration. You get clients ahead of schedule to finance your venture, and they receive an item or administration consequently. As an organization, you are hence really getting clients, not simply pledge drives. ICOs, as a development, will drive business.

Jamie: Yes, consider ICOs likened to Kickstarter. I'm a colossal Kickstarter fan, having bolstered 170 activities, just two of which have fizzled. In the ICO space, the disappointment rate will be higher than two out of 170. However, notwithstanding when ventures come up short, I have taken the cash and accomplished brief comment the biological system. I put stock in the energy of crowdfunding, regardless of whether it is a gift with no plan of action. For what reason should enterprise be in the hands of so few? Honestly, it ought to be in the hands of society.

DT: Honestly, I don't see the purpose of ICOs. Financial specialists of ICOs need to comprehend that the essentials of the organization at present have a low relationship with the cost of the organization's ICO. For the relationship to be high, organizations that issue ICOs need to guarantee that the administrations or products conveyed by them are paid for just by the organization's own particular tokens. That, in my view, wouldn't occur at any point in the near future. Unless the organization has an exceptionally convincing item, I wouldn't experience the problem of obtaining the organization's tokens just to pay for their thing.

Kenneth: actually, we are as of now doing that consistently. We purchase WeChat credits to give as hong baos. We purchase virtual endowments to provide for live-streamers. Virtual cash is only an expansion of e-cash. Organizations can likewise, to some degree, manage buyer conduct.

On the off chance that it is useful for the organization to issue and utilize their own particular tokens, and they have a decent item, I don't perceive any reason why they can't manage to clients to utilize their tokens.

DT: Also, with crypto costs being so unstable, how are the organizations going to value their administration or item? In the event that they value it at one token now, and that esteem vacillates such a great amount for the duration of the day, how are they going to do their bookkeeping?

Kenneth: Service costs are generally named in the US dollar comparable, so regardless of whether token costs vary, this is a non-issue.

How might we tell the great ICO ventures from the awful?

Anson: The ICO space typically includes little, imaginative organizations. The great tokens are venture vehicles, as well as instruments to make things. To decide whether a venture merits putting resources into, take a gander at the organizers and check whether they can execute. At last, the thing to ask is: Are they taking care of an issue?

Darren: The Big Boys - recorded organizations among them - are presently additionally taking a gander at ICOs as an elective method for gathering pledges, however some simply out of the "dread of passing up a great opportunity" (FOMO). How might we separate FOMO from the extremely creative organizations? Take a gander at the organizers, resources strategy for success and whitepaper. In the event that it's an expansive organization, take a gander at who are driving the undertaking. Toward the day's end, despite everything we require a dependable backer.

Kenneth: I can state what not to put resources into: ICOs that guarantee 100x returns, with originators whose profiles can't be checked on LinkedIn, or who are all from that one same nation. A decent thing to ask is: Are the authors being excessively avaricious? Returns are at last attached to how covetous your originators are.

Will Bitcoin supplant an extensive part of fiat cash? Will the interest for Bitcoin one day have an indistinguishable speed from that for cash?

DT: No. It isn't a steady store of significant worth right now and there are no hidden basics.

Kenneth: Naysayers will state that the genuine estimation of Bitcoin is zero. Allows simply say that when enough individuals have faith in something, it turns out to be genuine. Bitcoin's cost could go to zero or really turn out to be genuine. It's difficult to tell.

Anson: Just like how they say retail will be killed by web based business, the cycle will require significant investment. I believe it's more critical that the group in the crypto space discovers chances to make the present society more equivalent and proficient in all perspectives - that is more essential than talking about if Bitcoin will supplant ordinary cash. In any case, now, it's unrealistic.

Jamie: It's my unassuming perspective that Bitcoin appears to have a "bearing issue". This, alongside a huge trouble in scaling it, should be overcome definitively before Bitcoin can be a feasible test to regular cash. Kenneth: Whether Bitcoin will supplant a substantial division of customary cash will generally rely upon government approaches. In nations where the cash is firmly controlled and the managing an account framework is all around created, there is an immense obstacle to overcome before Bitcoin or other crypto will supplant customary cash. Close-by nations, for example, Indonesia, Vietnam and China have restricted Bitcoin as a type of installments for administrations.

Be that as it may, in different spots like Japan, where they are more open to new advancements, Bitcoin is broadly acknowledged and is growly quickly, with Japan representing 50 for each penny of the worldwide Bitcoin exchange volume day by day. In creating nations, for example, Zimbabwe, where the managing an account framework is feeble and monetary standards are experiencing hyperinflation, we are seeing an extensive number of individuals embracing Bitcoin rather than their national monetary standards.

Dustin: Bitcoin is yet one cryptographic money. It is still too soon to advise to what degree Bitcoin can supplant regular cash, however it's much more probable that there will be an assortment of cryptographic forms of money, each with various properties and filling diverse needs. For instance, in customary markets, we have an assortment of items, for example, platinum cards, Mastercards, explorer's checks, carrier securities, Paypal, GrabPay, Nets, blessing vouchers and so on. We trust that an assorted variety of items will serve the crypto space. Truth be told, later on, it is impossible that we will make a refinement amongst customary and blockchain offerings.

Darren: I think Bitcoin - cryptographic forms of money besides - wouldn't supplant fiat monetary forms, at any rate in the close to mid-term. Once more, Bitcoin isn't the main digital currency. As of Dec 20, 2017, Bitcoin took up just 47.6 for every penny of the general estimation of the digital money showcase.

I think at the appropriate time, digital forms of money will work as a decently generally acknowledged elective type of cash, however we require the wallet framework to enhance and the managing an account framework to acknowledge these also. There are hoarders of Bitcoin - most mineworkers and dealers I know are accumulating their coins. Bitcoin has a breaking point of 21 million coins. At the rate its cost is rising, it wouldn't be an astonishment for it to break US$100,000 per coin. Individuals used to state it's insane when Bitcoin went past US$100, at that point US$1,000 then US$10,000. I would compare Bitcoin to precious stones, and maybe Ethereum to gold or silver.

Blockchain: What are a few illustrations where it is having a material effect in individuals' lives?

Dustin: There are many convincing stories of certifiable employments of blockchain, for example, how exile camps are utilizing blockchain and biometric sensors to convey sustenance stipends, anticipate kid trafficking, handle bondage in supply chains, and enable little hold agriculturists to get paid a reasonable cost for their products.

DT: While I don't have confidence in crypto, I have faith in blockchain. The innovation is valuable and as registering power increments and record-keeping winds up noticeably less expensive, this innovation will turn out to be much more practical. With blockchain, there will never again be a requirement for an outsider to check the credibility of exchanges and records, for example, a legal official mark or exchanging records among banks. It's critical to take note of that despite the fact that cryptographic forms of money use on blockchain, the expanded consideration given to and the selection of blockchain ought not really mean an expansion in the utilization of digital currencies.

Anson: A considerable measure of blockchain's utilization cases are exceptionally modern. From money related consideration to wares, blockchain is about decentralization and giving influence and opportunity back to the general population.

Jamie: Blockchain is in the development arrange now. Notwithstanding the energy, there wouldn't be such a large number of thinking of new thoughts. The most intriguing cases I've seen are in power and power.

'Crypto specialists': Do they exist and would they say they are risky?

DT: How would anyone be able to call themselves a specialist in a space that can't be clarified by essentials and in which conduct is unreasonable? These self-declared specialists could have earned their bucks since they were fortunate to ride the wave and profited from contributing early. Be that as it may, are past encounters demonstrative of what's going to occur in future?

Anson: There is no master and there shouldn't be. I'm as yet an understudy in this space. Be careful with those self-broadcasted specialists, a significant number of whom have all of a sudden all flew out in the most recent year. Some are notwithstanding arranging classes on the best way to put resources into digital forms of money and ICOs.

Darren: These "specialists" are charging S$3,888 for an intense training on the most proficient method to spot cryptographic forms of money. What's more, Fomo has prompted these classes being exceptionally generally welcomed. Yet, a fraction of the time, individuals who go to the classes don't comprehend what they are purchasing. It's anything but difficult to go after them, in light of the fact that the profits look so great and cryptographic forms of money make amazing news. My recommendation is, whether somebody says he's a specialist, keep a separation from him.

Kenneth: These classes are a hazard to the environment. Controllers should come in and avert tricks. In the event that the coach has profited from crypto contributing, why run a course? Is it accurate to say that he is running a ponzi conspire?

Anson:That stated, we ought to likewise be cautious that controllers don't regard cryptographic forms of money as licensed speculator just items. The majority will pass up a major opportunity.

Jamie: Get-rich workshops have dependably been around. They have been held for some, extraordinary resource classes, for example, offers and property, and keep running via mentors who claim to be specialists. Crypto is only the most recent prevailing fashion.

Kenneth: In my conclusion, crypto began to truly take off a year ago. Toward the start of 2017, the crypto advertise top was US$15 billion with just a modest bunch of understood coins. Toward the finish of 2017, there were more than 1,500 coins, with a joined market top of US$600 billion. A decent method to tell whether a man is a "crypto master" is to perceive the amount he thinks about digital forms of money as a rule and on the off chance that he can clarify the tech and basics behind it. The ones you ought to evade are those that simply indicate you graphs and instruct you to purchase on the grounds that the cost is expanding quick.

Jamie: There is a connection with the cost of key digital forms of money and the premium level in the business. In the wild years where costs were declining and stuck at the lower levels, many individuals in the businesses in reality left or moved to different things. Digital forms of money took off a year ago halfway due to the ICO blast which uncovered to organizations and general society another utilization for blockchain past only installments for merchandise and enterprises. In my view, the ones who really stuck it out in the early and wild years and kept on contributing reliably to its advancements will make believable specialists.

What components will influence the execution of crypto in 2018?

Jamie: The execution and manageability of a significant number of the activities and ICOs, and whether the utility of the key coins keeps on satisfying desires, will influence crypto's execution. In the event that desires are not met, an amendment is inescapable. In the event that enough key activities and measurements are hit or conveyed, at that point the development will proceed. Much the same as some other market, crypto will see good and bad times. It's just market conduct. In any case, even after the website crash, a more develop website rose up out of it. We are seeing a similar dynamism today.

Kenneth: temporarily, crypto costs are driven by theoretical enthusiasm for the coins. With the current opening of the CME Group Bitcoin Futures advertise, institutional financial specialists are presently ready to put resources into Bitcoin as an advantage class, which ought to be sure for the general crypto showcase. 2018 is likewise the year where we are probably going to see many decentralized applications running on the Ethereum blockchain come into this present reality. Many organizations that finished their ICO in 2016 and 2017 are as of now in the last phases of testing their item and propelling it to the world. This spreads almost all ventures, for example, installments and keeping money, gaming and vitality. The present restricting variable for mass appropriation is the exchange speed of the blockchain. Both the Bitcoin and Ethereum systems will see overhauls that intend to build speeds by 10 to 100 times in 2018.

Darren: Definitely, the greatest calculate lies government and administrative oversight. We have seen the rehashed notices and alerts from the Monetary Authority of Singapore. We have seen the prohibition on ICOs in China. An extensive number of national banks and Wall Street fat cats have sounded the alert. In the meantime, we have seen Bitcoin fates take off on the Chicago Board Options Exchange and CME. In this manner, as a major picture check, it will be a tussle amongst government and national bank directions versus business endeavors to carry cryptographic forms of money into the standard.

{ #Note :- Picture Source : All Picture Is collected From Internet.

&

Reference Link :