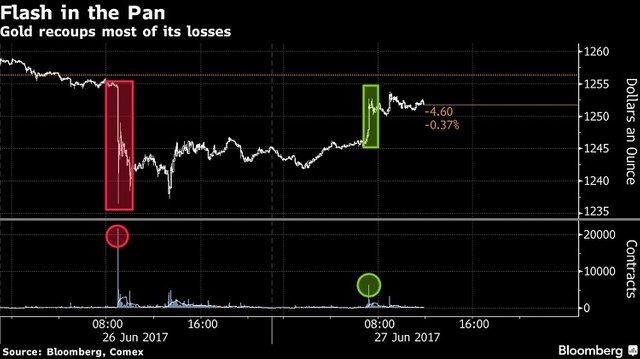

If you noticed something strange recently in gold prices, you're not alone. The yellow metal suffered its worst single-day collapse today, dropping nearly 2% against last Friday's session. But the real story was a much smaller magnitude decline on June 26.

(This article originally appeared on Crush The Street -- https://crushthestreet.com/articles/breaking-news/bloomberg-confirms-gold-manipulation-stunner)

The CrushTheStreet Staff Is Consistently Researching The Most Important Investment Research. Our Goal Is To Magnify Your Financial Education At These Critical Times. Gain Immediate Access To Our Wide-Range of Top-Conviction Reports HERE!

On that day, gold prices closed down about 1%. But within the session itself, gold bullion lost 1.7%, just a tenth of a percent shy of today's massive selloff. The question, though, was why. Over the years, gold volatility has substantially let off, despite the fact that intense geopolitical tensions and economic concerns were rippling throughout the markets.

Precious metals typically do well under periods of unease or uncertainty. Gold markets especially represent a safe haven from foreign currency fluctuations and unexpected dynamics within the traditional equity indices.

Was this a trading mistake by a junior broker, or are gold prices finally reacting to the fundamentals?

The Fat Finger

Bloomberg Markets first reported rumors that traders were spreading about a "fat finger" incident, or an erroneous order. The rumor had substantial weight, considering that "Trading jumped to 1.8 million ounces of gold in just a minute, an amount that’s bigger than the gold reserves of Finland."

Bloomberg further reported confusion among analysts to come up with any other reasonable answer. “'No one has a clue, apart from the unfortunate individual that pressed the wrong button,' David Govett, head of precious metals trading at Marex Spectron Group in London, said of the spike in volume. Thin activity and automated trading may exacerbate such moves, he said."

Although that a fat finger incident has sparked other flash crashes before, it's unlikely that a junior broker would have access to make such colossal trades on his or her own. Given the oversight that the broader financial industry has suffered, any small mistake could have severe consequences for the guilty firm.

Fundamental Drivers?

Perhaps it wasn't a mistake at all, but a foreboding reflection of the times. According to several foreign policy experts, U.S.-Russia relations are at an all-time low. Terrorism is spreading across the globe like wildfire. The Middle East is completely out of control. To top it all off, North Korea seems hell-bent on sparking an unprecedented Asia-Pacific warfare.

Gold prices certainly respond to such international incidents and dynamics. The problem is that given the ugliness of geopolitics, gold and the entire precious metals complex should be moving higher, not lower. Indeed, investors are more encouraged than ever to seek viable safe haven assets. Since gold has been the absolute standard for a fungible store of wealth, the yellow metal should be a logical choice.

The bearish trading firmly indicates that this is not the case. And if this wasn't a fat finger incident, a trader is deliberately betting against the psychological consensus of the markets. This then brings us to the next possible source of the mysterious gold collapse.

Gold Manipulation Confirmed

Bloomberg Businessweek dropped a stunner when it reported that gold manipulation could be the culprit. With the complexity of modern markets, it's quite feasible that an entity carrying enough leverage could sway gold prices in its favor. Such accusations have been forwarded by the alternative media, but have been quickly derided by the mainstream.

Not any longer. In Bloomberg's article, "Gold Gets Its Own Flash Crash," authors Susanne Barton and Eddie van der Walt wrote the following:

Other theories circulated. Was a short seller trying to manipulate the gold options market? Options were set to expire on June 27, and pushing the price of gold down to $1,200, a key technical level, would fuel more selling and potentially bolster the value of expiring options. With Italy mired in a banking crisis, one trader suggested a troubled financial institution needing to raise cash might have sold bullion to shore up its balance sheet.

Shockingly, you will not find this story anywhere on Bloomberg's website (at least as of the time of writing). Instead, you must be a subscriber to their print magazine catalog to read it. Not only that, the story was stuffed somewhere near the middle of the magazine, ensuring that only a few interested people will have access to this critical information.

My Personal Request

What I will encourage you to do right now is to bookmark this article for your own posterity. Then, share this with your family, friends, and concerned associates.

This is the first time I personally have seen where the mainstream media was forced to acknowledge the reality of gold manipulation. Prior to that, manipulation in the precious metals markets were forwarded mostly by "YouTube gurus" or people with questionable credentials or agendas. It was also an idea mocked by mainstream business media.

Now, the concept and controversy of manipulating gold prices for financial gain is out in the open. Yet as I mentioned earlier, this story is only limited to print media. Not coincidentally, print media is a dying industry.

Again, for your own posterity and to provide strong evidence to bolster your own defense of gold investments, please bookmark this article. With your help, we will ensure that the truth will remain free.

This is on the blockchain now. Shouldn't be possible to erase

STEEM On!!

Dave

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's true...but do people know it's on the blockchain? That's the philosophical question, and I just want to make sure that people are getting access to the truth.

Because I guarantee this ... someone who is very concerned about metals manipulation will read this article, forget to bookmark, and then desperately search for it months later, and never find it!

This is especially crucial because, again, the news is not on digital media, it's deliberately distributed on dying print media for a reason!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're onto it! I reckon the FED is the main culprit.

The best article I read about this was a few years ago by a bloke called Paul Craig Roberts. Very sobering read. I found the link again if you're interested. Keep up the good work!!

http://www.paulcraigroberts.org/2014/01/17/hows-whys-gold-price-manipulation/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Will do, thank you sir!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Since we're talking about gold market manipulation, you might be interested in this: I wrote a letter to the DOJ highlighting my own findings on extraordinarily unusual statistical variances in gold and silver bullion prices.

Of course, it went nowhere, but here it is for posterity's sake -- https://steemit.com/gold/@bullishmoney/my-letter-to-the-department-of-justice-urging-investigation-of-gold-silver-market-manipulation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like how you think! Thank you for keeping us, your fellow Steemians, updated!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's what I do! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well of course it's manipulated! It's a high value commodity! Good post nonetheless.

I mean, what truly isn't manipulated, either in nefarious way or more behavior based manners?

Take TSLA stock for example? MarketWatch and Barron's are running article after article trying to lower the value of it. And yes, over the last week I lost quite a bit of value and I am long--in full disclosure, but overall glad I got in when I did on it. At least they are more 'honest' about it running hitpieces, whereas...who truly knows with the gold?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Right, but the point isn't about stating what gold advocates believe is patently obvious...it's that the mainstream media finally admitted to gold manipulation, which was considered a tin-foil hat conspiracy theory not too long ago!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

another question to ask is "what next?!"... mainstream media has covered numerous manipulation scandals and what got done? the funny thing is it was never a theory.. or at least not for long. The facts where all there and numbers as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

While the numbers and data points were available via the COMEX reports and other sources, the problem was the lack of concrete data tying unusual trading dynamics to off-market activities. Without this connection, analysts were forced to call it a theory.

Now, the mainstream media is normalizing the idea (or at least crystallizing) of gold market manipulation. However, they're still playing games by only providing the pertinent information on print media, not digital media. Therefore, only a small number of people are getting access to this critical admission by the mainstream.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

To your point, I actually wrote a letter to the DOJ Antitrust Division regarding my findings on suspected gold, silver market manipulation -- https://steemit.com/gold/@bullishmoney/my-letter-to-the-department-of-justice-urging-investigation-of-gold-silver-market-manipulation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing this! I just upvoted you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot! I appreciate it! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just posted a new article about gold market manipulation. This is a letter to the DOJ Antitrust Division that I sent during the height of the LIBOR scandal -- https://steemit.com/gold/@bullishmoney/my-letter-to-the-department-of-justice-urging-investigation-of-gold-silver-market-manipulation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this. Upvoted and resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just put up a new article. This is from 2015, when I sent a letter to the DOJ urging them to look into my findings on suspected gold, silver market manipulation. Check it out if you have a spare minute -- https://steemit.com/gold/@bullishmoney/my-letter-to-the-department-of-justice-urging-investigation-of-gold-silver-market-manipulation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit