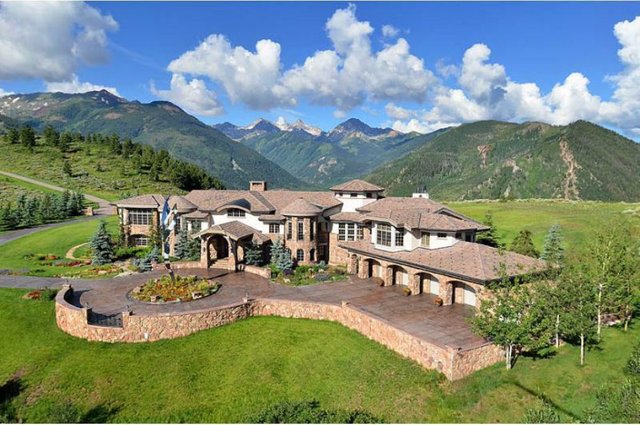

Luxury house sales that fuel Aspen’s real estate market are disappearing, pushing Pitkin County’s sales volume down 42% in H1 2016 vs 2015. Experts question: "Why??...Even when economy collapsed in '08-'09 Aspen slid, but not too much, and then it rebounded quickly ..."

Now, according to data, the market is just simply FROZEN. Single-family home sales are down 62% and houses over $10 million are down 62%!

"Aspen has never experienced such a sudden and precipitous drop in real estate sales." - the Denver Post says.

And the worst thing that worries all the real estate brokers is not just a decline in number of houses purchase, but CONSTANTLY dropping prices. This is particularly bad because Aspen was always viewed as a safe heaven for investors.

What is the most impressive is the speed of the collapse...

Until the start of this year market was growing at the exceptional rates. Pitkin County (the USA, Colorado) real estate market jumped to $2 billion, +33% annual growth in 2015 vs 2014. This was mainly driven by sales in Aspen with medium house price of $7.7 million.

However, a general slowdown in January 2016 just became a free fall of the cliff.

Sales volumes in Pitkin County decline 42% with inventory of unsold houses in the market at its highest levels since 2009 recession.

“People are worried about all kinds of stuff these days,” says longtime Aspen broker Bob Ritchie. “I’ve never seen anything like this before.”

In H1 2016 Aspen average price per square foot decreased by -22% from $1,338 last year to $1,095 as of June 2016.

All the brokers are now hoping for recovery but there is no single sign of it - the similar situation can be observed in other luxury places:

The number of sales closed sales in Miami crashed by -44% vs last year.

Sales in East Hampton, New York fell -54% with average price per house dropped by -53%

In Southampton, total sales fell 48% from the second quarter of 2015 to $45.3 million, with the median sale price falling 21% to $1.65 million - source quoted.

House in Miami

Why is This Happening to Us???

The economists, experts, brokers, and real estate reports are giving all sort of answers - you can pick whichever you like: Presidential Elections. Trump fear. Central Bank policy uncertainty. Brexit. Global economy weak growth. China uncertainty. Russia threat. Zika Virus.

However, as I already explained in my article on the Current state of the World situation there are absolutely OBJECTIVE economic reason behind this decline - it was all based on constant expansionary monetary policy.

And this is now coming to an end!

Frankly speaking, I cannot say that this came across as a surprise for me: I live in London and put my flat for sale earlier this year. I went through pretty tough times with buyers calling me half way through the process knocking down 15 - 20% of the price we agreed.

Guys - please be prepared!

Please feel free to leave your comments / questions and follow me if you liked this and want to read more: @conspi-theorist

For more details please read the Original Source

About me:

In my Blog I write about Politics and Economics, analyse the News, and give advice where to invest. I studied economics and finance in Russia, UK and Italy and worked in Banking, Consulting, and Investment firms. If you follow me I will be able to provide view with lots of arguments and very balanced view.

PS. Maybe a bit empty right now, but more to come!

From Colorado here, and we are seeing stable growth due to scarcity in the 300-400K range but luxury homes along the front range are also stagnant. China owns a lot of property at the ski resorts, well just about any RE safe haven from the past.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wonder if wealthy people are selling these assets to preserve capital elsewhere as they see the writing on the wall.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jasonstaggers - typically people who have demand are high net worth individuals from China, Middle East and Russia... countries that export.... with price of oil declining from $120 to $30-40 no wonder they can't buy it anymore. And China has its own issues with economy, anti bribes policy etc

The thing is that's how it starts and then it will drag down the rest of the property market....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Follow up:

Purchases of new U.S. homes dropped in August at 7.6% to a 609,000 annualized pace, from a revised 659,000 rate in the prior month.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is about time to try out "Freegans".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit