Awesome right???

This is what I mean when I say there are two narratives. On one hand the stock market makes new highs. On the other, the market is preparing itself for the worst crash in history while we are simultaneously sleep walking into World War 3.

Let's start off with TSLA. We've repeatedly said that Tesla is the poster child for this false economy. TSLA trendline resistance (broken support) is holding today. The daily 50 period moving average is also below the 200 period moving average (cyan/magenta lines) creating a "death cross" once again.

In previous updates, we've warned that TSLA would be sued by multiple parties for multiple reasons. Now it looks like that is happening. The Department of Justice (DOJ) is now involved along with the SEC with regard to "funding secured" statements to take the company private. It looks like this statement was false and was used as a means to manipulate the markets (fraud) and stick it to those who are shorting the stock. The class action lawsuits are coming in now as well on this matter.

As if that weren't enough, Musk is also being sued by the scuba diver who rescued the stranded cave dwellers for libel and slander when Musk called him a "pedo" after Elon's submarine was not used and then Musk doubled down on such statements days later. Now the onus is on Must to prove that he has proof that this man was a pedo or he might have to pay up.

TSLA is in trouble. They really need to deliver some solid numbers in the next couple quarters as well as hit targets but how is this possible with so many high level executives departing the company?

https://www.zerohedge.com/news/2018-07-05/why-tesla-executives-are-fleeing

TSLA had an opportunity to corner the electric car market but now it looks as though that window is closing quickly as large auto makers are offering more electric vehicles to compete with them.

But the DOW made new highs today, right? Am I just being a Debbie Downer?

It wouldn't be the first time I've been called that.

Let me state what most people don't realize about the DOW. First, the DOW is comprised of only 30 stocks. That's not a diverse enough representation of the overall market. It's not even statistically significant. Further, the DOW stocks change over time so the index itself is not consistent. It's a headline index - nothing more.

For a more PRECISE representation of the market I recommend looking at VT (total global market). This index is NOT making new highs. In addition, it's getting overbought again. This is happening at the same time that BONDS look like they MIGHT try to bounce (usually this happens with flight to safety as equities sell off).

I believe that the market could turn lower from here. VT is probably setting up to be a pivot point. In the next couple weeks, we should witness a break back below the daily 8 period moving average. If not, then a new breakout is occurring and we could see new highs on VT. However, the likelihood of this is very low and the downside potential is YUGE to say the least.

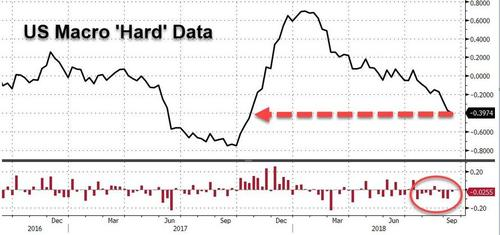

The MACRO DATA continues to move lower this year. The system is ripe for a major meltdown - in SPITE of the Central Banks. They have only made the problem worse and now there is more systemic risk out there than ever.

Let me say it again. The only thing propping these markets up is 1) Central Banking stimulus via the BOJ, ECB, and SNB and 2) record setting corporate stock buybacks. That's it. It's not rocket science although it should be considered unethical and illegal. Now there is more risk in the markets than prior to 2008. We have credit bubbles everywhere. And the real economic data is signalling a weakening across the board (see our blog feed for details).

We cannot close without saying something about Syria. All I can say is that the situation in the Middle-East is steadily deteriorating and the Western powers (specifically the USA, France, UK, Israel and Saudi Arabia) are chomping at the bit for a larger war. Israel continues to provoke a larger escalation with regular attacks on Syria. The US and it's allies are now protecting Al-Qaeda terrorists in Idlib and there are numerous reports from Russia that the "White Helmets" are actively preparing for another false flag chemical attack in order to justify more US involvement (and yes, they really do think you are that stupid). This situation is truly the backdrop for a larger escalation with Russia and Iran and it will likely be waged under false pretense which puts us on the wrong side of this war.

As the DOW makes new highs and Wall St. execs pad their wallets with easy money courtesy of the central banks, we know better. This is what irrational exuberance looks like. Take a snapshot of the market, and let us come back to revisit the situation in a couple weeks (maybe sooner).

The situation is not at all what the headlines would have you believe.

Act accordingly,

The Market Vigilante