Investors sentiment is 1.03 in 2017 Q3. Its the same as in 2017Q2. It is flat, as 52 investors sold Intel Corporation shares while 663 reduced holdings. only 127 funds opened positions while 608 raised stakes. 3.05 billion shares or 0.19% more from 3.05 billion shares in 2017Q2 were reported.

Hsbc Public Limited Com owns 5.63 million shares. Perkins Coie Co stated it has 60,051 shares. Dupont Capital Management Corporation has 0.18% invested in Intel Corporation (NASDAQ:INTC) for 210,467 shares. Perkins Mgmt Inc holds 0.24% or 6,100 shares. Franklin Res has 21.80M shares. California-based Gemmer Asset Mgmt has invested 0.19% in Intel Corporation (NASDAQ:INTC). Metropolitan Life Insur New York, a New York-based fund reported 2.22M shares. Adams Asset Ltd Liability holds 1.02% or 196,395 shares. Stock Yards Commercial Bank, a Kentucky-based fund reported 77,968 shares. Signature accumulated 0.19% or 18,202 shares. Hightower Advsrs Limited Liability Corp stated it has 2.15 million shares or 0.7% of all its holdings. Butensky And Cohen Security has 2.19% invested in Intel Corporation (NASDAQ:INTC) for 64,921 shares. Contravisory Inv Management Inc has 0.01% invested in Intel Corporation (NASDAQ:INTC). Gfs Limited Liability Company invested in 112,937 shares or 0.97% of the stock. Truepoint has 545,536 shares for 0.05% of their portfolio.

Since July 31, 2017, it had 0 insider purchases, and 10 selling transactions for $31.43 million activity. Krzanich Brian M sold 61,860 shares worth $2.40 million. BRYANT ANDY D sold $3.99 million worth of stock. Shares for $87,011 were sold by Bryant Diane M. On Monday, July 31 the insider RENDUCHINTALA VENKATA S M sold $496,438. Shares for $1.35 million were sold by YOFFIE DAVID B.

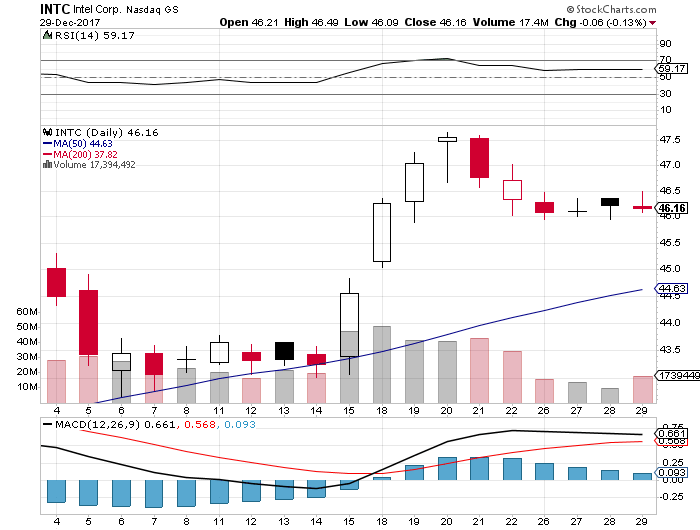

Analysts expect Intel Corporation (NASDAQ:INTC) to report $0.86 EPS on January, 25.They anticipate $0.07 EPS change or 8.86 % from last quarter’s $0.79 EPS. INTC’s profit would be $4.02 billion giving it 13.62 P/E if the $0.86 EPS is correct. After having $1.01 EPS previously, Intel Corporation’s analysts see -14.85 % EPS growth. The stock increased 1.49% or $0.69 during the last trading session, reaching $46.85. About 23.37 million shares traded. Intel Corporation (NASDAQ:INTC) has risen 19.47% since January 3, 2017 and is uptrending. It has outperformed by 2.77% the S&P500.

Intel Corporation (NASDAQ:INTC) Ratings Coverage

Among 54 analysts covering Intel Corporation (NASDAQ:INTC), 33 have Buy rating, 5 Sell and 16 Hold. Therefore 61% are positive. Intel Corporation had 200 analyst reports since August 7, 2015 according to SRatingsIntel. TH Capital maintained Intel Corporation (NASDAQ:INTC) on Friday, January 15 with “Buy” rating. The rating was maintained by Canaccord Genuity on Tuesday, September 20 with “Buy”. The stock of Intel Corporation (NASDAQ:INTC) has “Hold” rating given on Friday, September 8 by Canaccord Genuity. Jefferies maintained Intel Corporation (NASDAQ:INTC) rating on Thursday, August 31. Jefferies has “Sell” rating and $30.0 target. The rating was initiated by CLSA on Tuesday, May 17 with “Underperform”. On Wednesday, October 19 the stock rating was maintained by Brean Capital with “Buy”. The rating was maintained by Morgan Stanley on Thursday, July 21 with “Underweight”. The firm has “Neutral” rating by UBS given on Tuesday, January 5. As per Thursday, January 14, the company rating was initiated by Suntrust Robinson. The stock has “Buy” rating by UBS on Monday, September 19.

Intel Corporation designs, manufactures, and sells computer, networking, and communications platforms worldwide. The company has market cap of $219.26 billion. The firm operates through Client Computing Group, Data Center Group, Internet of Things Group, Non-Volatile Memory Solutions Group, Intel Security Group, Programmable Solutions Group, and All Other divisions. It has a 16.44 P/E ratio. The Company’s platforms are used in notebooks, 2 in 1 systems, desktops, servers, tablets, smartphones, wireless and wired connectivity products, and mobile communication components; enterprise, cloud, and communication infrastructure; and retail, transportation, industrial, video, buildings, and other market divisions.

More notable recent Intel Corporation (NASDAQ:INTC) news were published by: Fool.com which released: “Intel Corp. Needs Better Manufacturing Leadership” on December 12, 2017, also Seekingalpha.com with their article: “Intel And AMD: Teaming Of The Rivals” published on December 26, 2017, Seekingalpha.com published: “Intel: The 15+ Year Breakout” on December 06, 2017. More interesting news about Intel Corporation (NASDAQ:INTC) were released by: Seekingalpha.com and their article: “Intel Now A Short Target?” published on December 28, 2017 as well as Investorplace.com‘s news article titled: “3 Things to Watch with Intel Corporation Stock in 2018” with publication date: December 27, 2017.

Source. https://bzweekly.com/intel-corporation-intc-analysts-see-0-86-eps-2/